MarketWatch: U.S. consumers increased their debt in April by a seasonally adjusted $6.5 billion, the smallest increase since last October, the Federal Reserve reported Thursday. This is the eighth-straight monthly gain in consumer borrowing. The increase in April was just more than half of the roughly $11 billion gain expected by Wall Street economists. The report also includes revisions to reflect improvement in methodology and a review of the source data, according to the Fed.

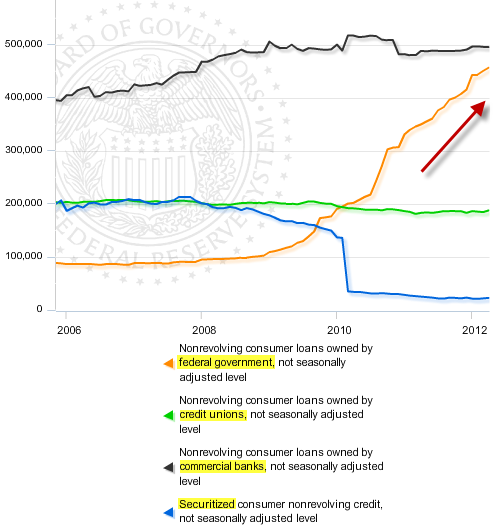

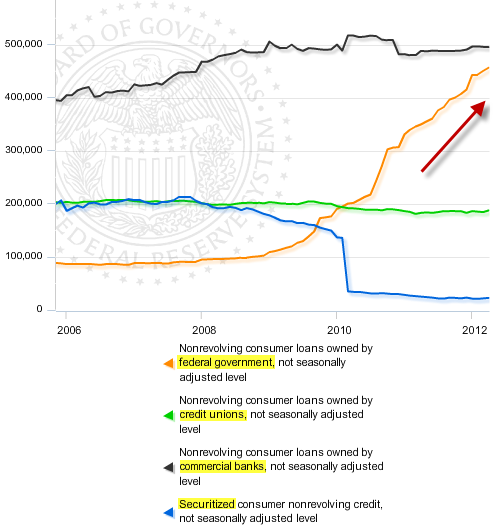

Credit growth in March was revised to a gain of $12.4 billion, compared with the initial estimate of $21.3 billion. All of the increase in April came from nonrevolving debt such as auto loans, personal loans and student loans - with these three categories combined for a $10 billion jump. Credit-card debt fell by $3.4 billion in the month after a $3.7 billion increase in March. Once again reporters fail to point out what types of nonrevolving credit caused this increase. The chart below shows the major owners of non-revolving consumer debt in the US. Auto loans would be bank owned or securitized. Personal loans would be provided by banks or credit unions. When it comes to consumer credit, the federal government only owns student loans - and they own a great deal of them. In fact that's where the $10bn increase is coming from (orange line below).

The Obama Administration is clearly trying to head off this issue in the press as concerns mount. Here are a couple of Twitter posts from the White House (both from Friday):

Credit growth in March was revised to a gain of $12.4 billion, compared with the initial estimate of $21.3 billion. All of the increase in April came from nonrevolving debt such as auto loans, personal loans and student loans - with these three categories combined for a $10 billion jump. Credit-card debt fell by $3.4 billion in the month after a $3.7 billion increase in March. Once again reporters fail to point out what types of nonrevolving credit caused this increase. The chart below shows the major owners of non-revolving consumer debt in the US. Auto loans would be bank owned or securitized. Personal loans would be provided by banks or credit unions. When it comes to consumer credit, the federal government only owns student loans - and they own a great deal of them. In fact that's where the $10bn increase is coming from (orange line below).

The Obama Administration is clearly trying to head off this issue in the press as concerns mount. Here are a couple of Twitter posts from the White House (both from Friday):