The headline said:

In August, consumer credit increased at a seasonally adjusted annual rate of 8 percent. Revolving credit increased at an annual rate of 6 percent, and nonrevolving credit increased at an annual rate of 9 percent.

August 2012 unadjusted consumer credit was 59.1% driven by student loans.

The Econintersect analysis is different than the Fed as follows:

- an effort is made to segregate student loans from consumer credit to see the underlying dynamics;

- the growth is expressed as year-over-year change, not one month’s change being projected as an annual change.

Econintersect does not believe the seasonal adjustment methods used in the headlines are accurately conveying the situation for a variety of reasons. The Econintersect analysis here uses non-adjusted data.

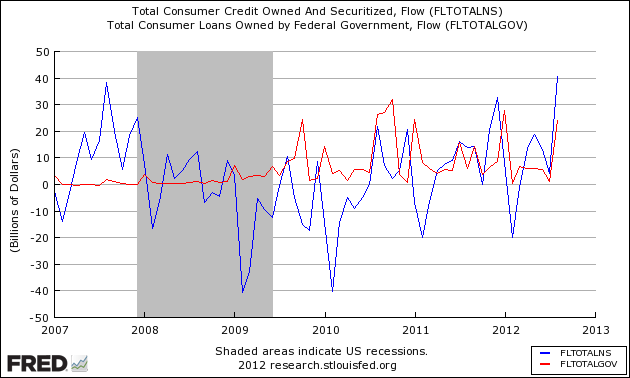

This month, student loans accounted for 59.1% of the total loans issued. Since the Great Recession, much of the increase in consumer credit is from student loans (A good background article was written by Frederick Sheehan). Note: If any reader of this post has issues with payments or default, some of your options available are addressed in this NYT’s article. The following graph shows the flow into consumer credit (including student loans) against the flow into student loans alone. Whenever the red line in the graph below is above the blue line – student loans account for all the credit growth.

Flow of Funds into Consumer Credit – Total Consumer Credit (blue line) vs Student Loans (red line)

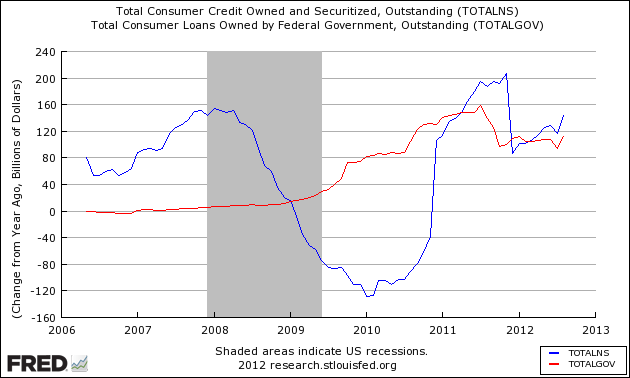

Another way to view the effects of student loans on consumer credit is to view year-over-year growth in $ billions into total consumer credit (including student loans), and student loans alone. In short, student loans accounted for all consumer credit growth from 2009 to late 2011.

Year-over-Year Growth in $ Billions – Total Consumer Credit (blue line) vs Student Loans (red line)

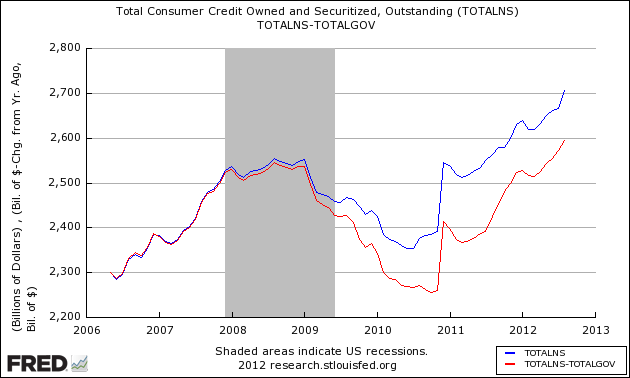

And one final look at total consumer credit and the effect of student loans. The graph below removes student loans from total consumer credit outstanding.

Total Consumer Credit Outstanding – Total Consumer Credit (blue line) vs Total Consumer Credit without Student Loans (red line)

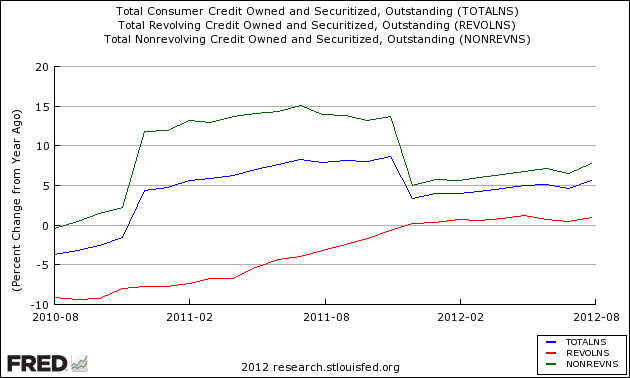

Econintersect spends time on this generally ignored data series because the USA is a consumer driven economy. One New Normal phenomenon has been the consumer shift from a credit towards a cash society – a quantum shift which changes the amount of consumption. Watching consumer credit provides confirmation that this New Normal shift continues.

Year-over-Year Growth of Consumer Credit – Total (blue line), Revolving Credit (red line), and Non-Revolving (green line which includes student loans)

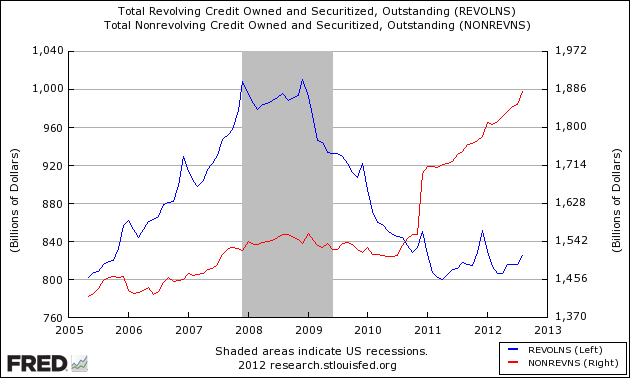

The Federal Reserve reports credit divided between revolving and non-revolving. The majority of revolving credit is from credit cards, while non-revolving credit includes automobile loans, student loans, and all other loans not included in revolving credit, such as loans for mobile homes, boats, trailers, or vacations.

Comparison Revolving Credit Total (blue line) to Revolving Credit Total (red line)

Other Consumer Credit Data from Outside this Report:

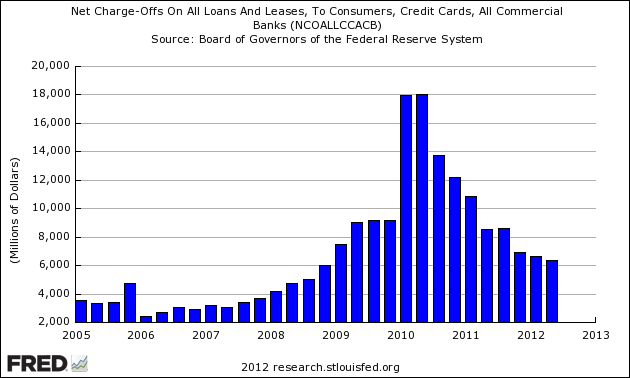

The question remains on the rate of write-downs of consumer loans. The following graph addresses this question:

Net Charge-Offs on Consumer Credit

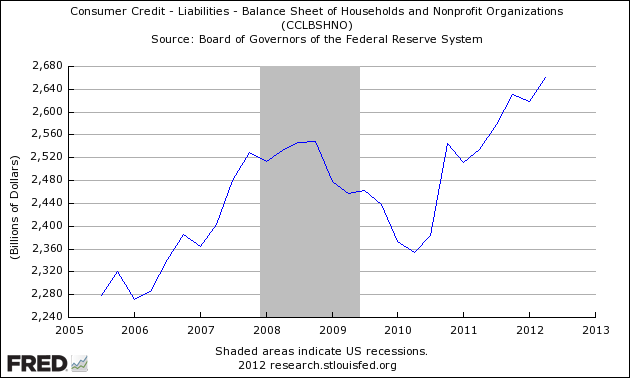

And just to make sure the data in the consumer credit report migrates to other reports, here is a graph from Z.1 Flow of Funds.

Total Consumer Credit Outstanding from Flow of Funds Z.1

Caveats on the Use of Consumer Credit

This data series does not include mortgages, and is not inflation adjusted. This whole series has undergone a major revision with the April 2012 Press Release:

The Federal Reserve Board on Monday announced that it has restructured the G.19 statistical release, Consumer Credit, to reflect regulatory filing changes for U.S.-chartered depository institutions and, in addition to the data currently reported on level of credit outstanding, the release will now report data on the flow of credit. The revised data will be made available with the release of the April report on Thursday, June 7.

Savings institutions now file the same regulatory report as U.S.-chartered commercial banks. The U.S.-chartered commercial banks sector and the savings institution sector, which were previously shown separately, have been combined into a new sector called depository institutions. The previously published series for U.S.-chartered commercial banks and savings institutions will continue to be available as separate series in the Federal Reserve’s Data Download Program (DDP).

The new flow data represent changes in the level of credit due to economic and financial activity, rather than breaks in the data series due to changes in methodology, source data, and other technical aspects of the estimation that affect the level of credit. Access to flow data allows users to calculate a growth rate for consumer credit that excludes such breaks.

These changes will be accompanied by revisions to the estimates of outstanding consumer credit back to January 2006 and reflect improvements in methodology and a comprehensive review of the source data.

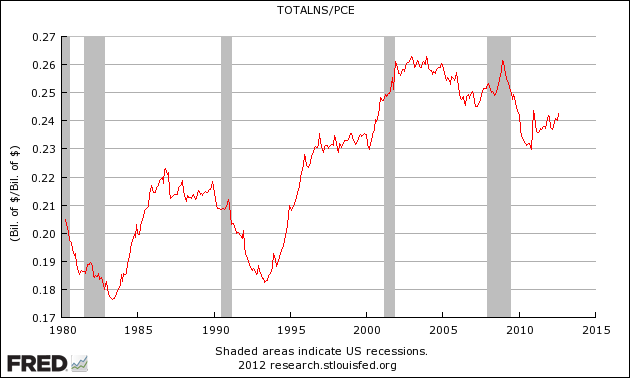

The graph below shows consumer credit outstanding (this data series does not include mortgages) is slightly less than 23% of annualized consumer spending – down from a high of over 26% in the 2000s, but still above the averages before the mid 1990s.

Ratio of Total Consumer Loans Outstanding to Consumer Spending

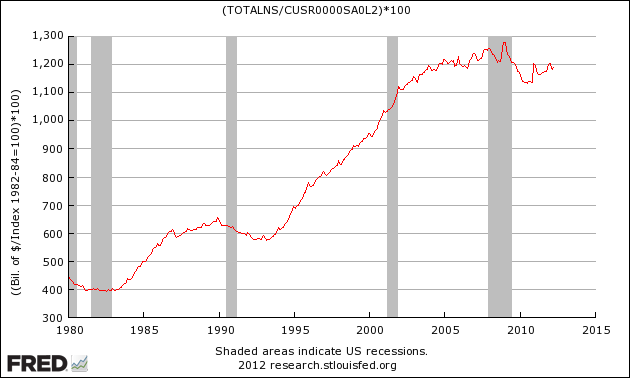

To get a feel of inflation adjusted consumer credit, the following graph is inflation adjusted consumer credit using the CPI-U (less shelter) – this is expressing consumer credit in 1982 dollars. It is evident on an inflation adjusted basis, consumer credit is beginning to grow.

Inflation Adjusted Consumer Credit

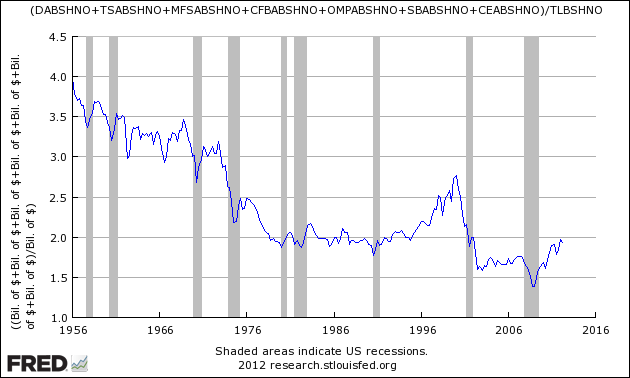

Also, an interesting graphic showing the consumer’s ratio of liquid assets to total liabilities – I am not sure what can be implied except that it is evident that de-leveraging is well underway. As the average Joe Sixpack has little savings or other liquid assets, we can assume this graphic applies to the upper half of the USA population.

Ratio of Consumer Liquid Assets to Total Consumer Liabilities

Econintersect believes consumer credit levels are now in its historical channel from the 1990′s.