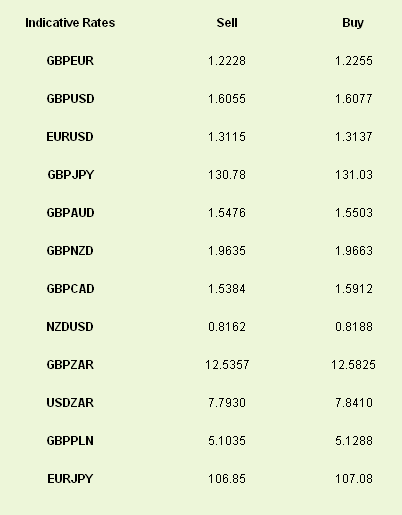

The UK enjoyed mixed emotions this morning as markets opened. Lower than expected unemployment figures and the timely denouncing of further QE by the BoE sent GBPEUR and GBPUSD through the roof. Yesterday’s inflationary hiccup was enough to dismiss the possibility of further stimulus for the time being. Focus quickly changed to the Q1 GDP out next week. With poor construction sector figures expected, analysts haven’t ruled out the possibility of a negative figure for another successive quarter. QE may only be taking a back seat temporarily. Interest rates were unanimously kept at 0.5%.

We saw GBP/EUR trade at very tight bands during the afternoon. Spanish data highlighting huge exposure to bad loans and an Italian revision of growth saw European markets plummet yesterday. The Portuguese PM didn’t rule out the possibility of a 2nd bailout.

The Global Financial Stability Report came a long way to laying the cards on the table for the Eurozone recovery. Clear instruction and strict adherence was doled out by the IMF. The terms of the de-leveraging programme were quantified and deadline targets were set. The key with any kind of restructuring is co-ordination and volume. They must maintain a credit supply to businesses and individuals while at the same time bolstering their capital requirements by namely selling non-core assets and by lending less.

It does however beg the question as to why the struggling economies of Europe under the tutelage of the ECB have been loading their balance sheets (by means of LTRO’s) with sovereign debt that private investors wouldn’t touch with a pole, only to be told now by the IMF that it’s the exact fat they need to trim in order to survive.

With the housing crisis in Spain still ongoing, how is Spain supposed to attempt to organise its banking system when exposure to bad loans is still growing? Further funding from the Eurozone in some shape or form will be needed in the future . There really is no end in sight.

US markets finished the day in the red following their European brethren. The Asian session overnight was calm with no real EURUSD movements.

No real economic data due out today. IMF talks continue today but I reckon we have seen the best of it at this stage. The 2nd Spanish bond auction due this week is occurring this morning, although a successful auction, when you consider the bigger Spanish picture is about as useful long term as putting a plaster on a broken arm.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Construction Figures To Decide UK’s Stand On QE

Published 04/19/2012, 05:08 AM

Updated 07/09/2023, 06:31 AM

Construction Figures To Decide UK’s Stand On QE

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.