Constellation Brands Inc. (NYSE:STZ) , a leading international producer and marketer of beverage alcohol brands, released third-quarter fiscal 2018 results, wherein adjusted earnings of $2.00 per share surpassed the Zacks Consensus Estimate of $1.87. Moreover, the bottom line rose 2% from the year-ago quarter.

Backed by solid growth at its beer business, Constellation Brands raised its fiscal 2018 adjusted earnings forecast to $8.40-$8.50 per share from the previous guidance of $8.25-$8.40. Also, the company raised its GAAP earnings estimate to $8.50-$8.60 per share, compared with $7.90-$8.05 anticipated earlier.

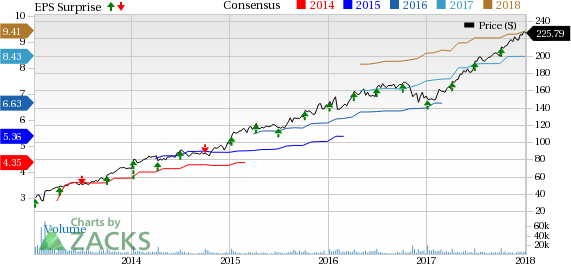

Earnings Estimate Revision: The Zacks Consensus Estimate for fiscal 2018 has remained stable in the last 30 days. However, Constellation Brands’ performance in the trailing four quarters (excluding the quarter under review) gives a positive picture. The company has outperformed the Zacks Consensus Estimate by an average of 13.6% in the trailing four quarters.

Revenues: Constellation Brands generated net sales of $1,799.1 million that dipped 0.6% year over year and also came below the Zacks Consensus Estimate of $1,863 million.

The company reiterated its sales targets for fiscal 2018. It continues to anticipate beer business sales to grow 9-11% in fiscal 2018, while sales for the wine and spirits business is expected to decline 4-6%. These estimates include the expected impact from the divestiture of the Canadian wine business and the benefits from High West, Charles Smith and Prisoner acquisitions.

Zacks Rank: Currently, Constellation Brands carries a Zacks Rank #2 (Buy), which is subject to change following the earnings announcement. You can see the the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Stock Movement: Constellation Brands’ shares are down 2.2% in the pre-market trading hours.

Check back later for our full write up on Constellation Brands’ earnings report!

Zacks Editor-in-Chief Goes "All In" on This Stock

Full disclosure, Kevin Matras now has more of his own money in one particular stock than in any other. He believes in its short-term profit potential and also in its prospects to more than double by 2019. Today he reveals and explains his surprising move in a new Special Report.

Download it free >>

Constellation Brands Inc (STZ): Free Stock Analysis Report

Original post