Thank goodness it’s Friday in the Wall Street Daily Nation!

On Fridays, I abandon long-winded analysis in favor of carefully selected graphics.

Sometimes charts can say things that words cannot.

But don’t let my brevity fool you.

Your feedback says that Friday’s edition is our must useful column of the week.

So yes, picture books can be educational for adults, too!

And here’s the latest proof…

Massive One-Day Gains Dead Ahead

Is the Deep State active in European affairs, too?

Here’s what we know…

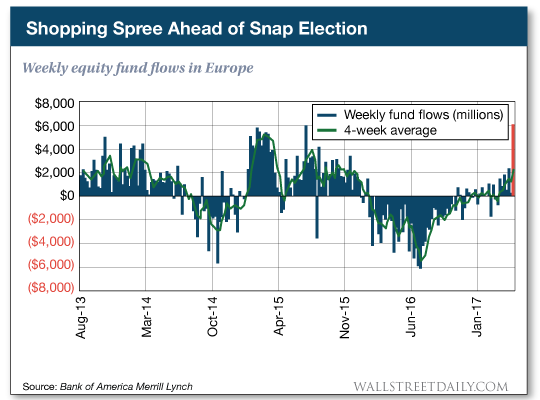

A wave of fresh capital is flooding into Europe ahead of Britain’s Snap Election on June 8.

Some believe that the Deep State wants to kill Brexit.

I’ll concede that an “emergency election” is extremely odd.

Either way, the Snap Election is ready to decide Brexit’s fate.

But the results could also trigger a massive one-day gain using “Churchill’s Ladder.”

According to data from Bank of America Merrill Lynch, investors poured $6 billion into European stocks last week.

That’s a record amount!

It’s not just stocks that are getting gobbled up. Data shows a healthy appetite for investment grade bonds, high-yield bonds and fixed-income funds, as evidenced by an eighth consecutive week of inflows.

So will Brexit die or not?

That question sets the stage for two outcomes on June 8…

Outcome #1 — Brexit is dead, and the market crashes and burns.

Outcome #2 — Brexit lives, sparking a huge rally heading into the summer.

But since Churchill’s Ladder extends in both directions, you could win either way.

The last time this happened — the day Fed Chairman Yellen announced the first rate-hike in nearly 10 years — Churchill’s Ladder put 436% gains on the table.

I’m projecting gains as high as 1,000% on the Snap Election.

Volatility Returns with a Vengeance

We hate to say we told you so… but, we told you so!

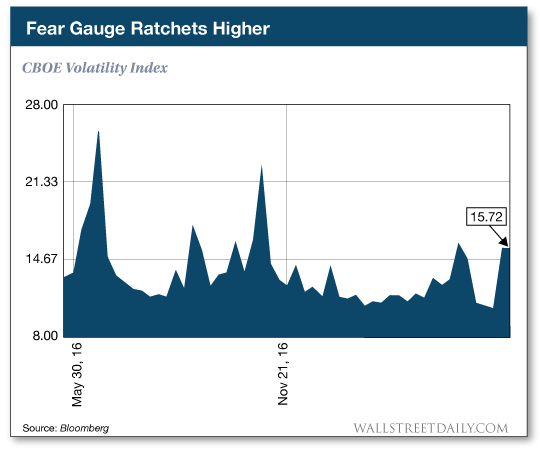

Last week, we noted the ridiculously low level of volatility in the market. You’ll recall, the so called “fear gauge” – the CBOE Volatility Index or VIX – dropped within spitting distance of its lowest level on record.

I warned, “It’s only a matter of time before volatility returns.” And it already did!

The VIX soared 46% in a single day this week. It’s up over 60% since the May 9 low. And yet, we’re still not back to elevated levels (above 20).

Clearly, investors are on edge again. But our advice remains the same: Don’t join the panic.

Instead, speculators should consider going long the VIX. (Those who did last week are sitting on tidy profits already).

Everyone else needs to make sure you have trailing stops in place to protect your profits and principal.

Bitcoin Boom… And Bust?

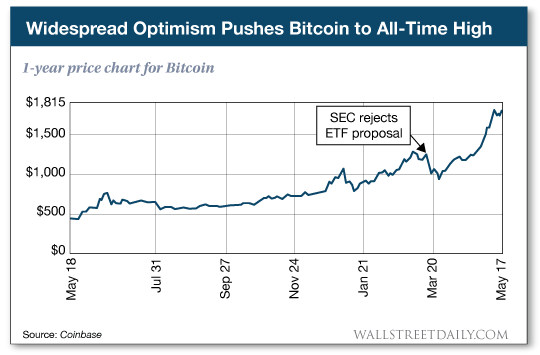

The world’s most popular cryptocurrency is gaining ground quickly.

Bitcoin hit a fresh all-time high yesterday on hopes the SEC will reverse its previous decision to reject the first bitcoin exchange-traded fund.

Documents in support of the ETF were due on Monday. So the SEC’s latest ruling on the issue can hit any day now.

According to a recent poll, 65% of investors expect the agency to uphold its initial rejection. But we’ve learned from the Presidential Election not to put too much hope and trust in poll data.

In the end, this is a classic binary event – like Churchill’s Ladder opportunity I mentioned above.

A favorable ruling promises to send Bitcoin to new highs, whereas an unfavorable one promises to send the cryptocurrency crashing and burning.

That’s precisely what happened in March when the SEC issued its first ruling. Prices plunged 15% in a blink.