Investing.com’s stocks of the week

Delivering on the growth strategy

Consort Medical Plc's, (CSRT) H114 results provided solid evidence of delivery on its three-year strategy for growth. The combination of the strong market position in the development and manufacturing of disposable medical devices, the investment in operational improvements and the ongoing expansion and diversification of its pipeline should translate into sustained solid earnings growth over the medium term.

H114 results highlight solid execution of strategy

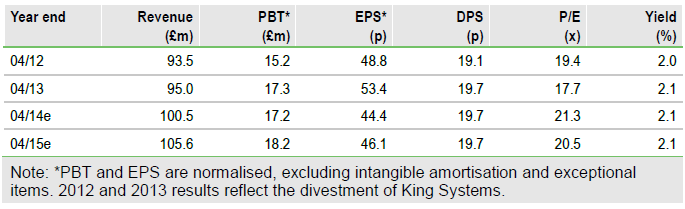

On a like-for-like basis, H114 revenues increased by 6.5% from £48.1m to £51.2m, with operating profit (before special items) rising by 4.8% from £9.1m to £9.6m. Similarly, EBITDA grew by 1.7% from £12.1m to £12.3m, while the improved financials line meant pre-tax profit increased by 12.4% from £8.0m to £8.9m. Adjusted EPS grew by 17.3% from 20.8p to 24.5p. The interim dividend was raised by 5% to 7.35p (H113: 7.0p), in line with the 5% increase in the FY12 final dividend.

Bespak set to deliver solid earnings growth

Consort Medical is targeting double-digit earnings growth over the medium term. The marked transformation in the past three years, as operational efficiencies and investment in innovation and development pay off, suggests this should be achievable via organic growth (new products, diversification and moving up the value chain) in its existing cash-generative Bespak business. Additionally, selective M&A and investment opportunities (such as Atlas Genetics) should be expected.

Earnings visibility is improving

Increasingly, both the near- and medium-term earnings visibility is improving. A total of eight products are due to be launched through to 2015. Timings clearly depend on the regulatory approvals being achieved and, while the commercial potential is difficult to assess (usually neither the product nor the customer company is disclosed until launch), the scope for growth is materially higher than historically.

Valuation: Pipeline not fully reflected in the price

We value Consort Medical using a combination of peer comparables and attribute a value for the development pipeline. The peer group trades on an EV/EBITDA multiples of 9.5x and 7.7x for 2014 and 2015, so using a calendarised EV/EBITDA of 9.0x and 7.5x generates an implied share price of 845-980p. The incremental value, using a simple rNPV, of the Bespak portfolio adds a further 150-180p per share, which gives a conservative valuation range of 995-1,160p per share.

To Read the Entire Report Please Click on the pdf File Below.