Finding consistently growing companies has been and continues to be a tough thing with the world’s developed economies barely growing.

From the investor’s perspective, I think consistency, both in terms of corporate financial growth and stock market performance, is absolutely golden. This is especially the case for investors who aren’t actively trading and are perhaps saving for retirement or are in retirement and want some security with their equity holdings.

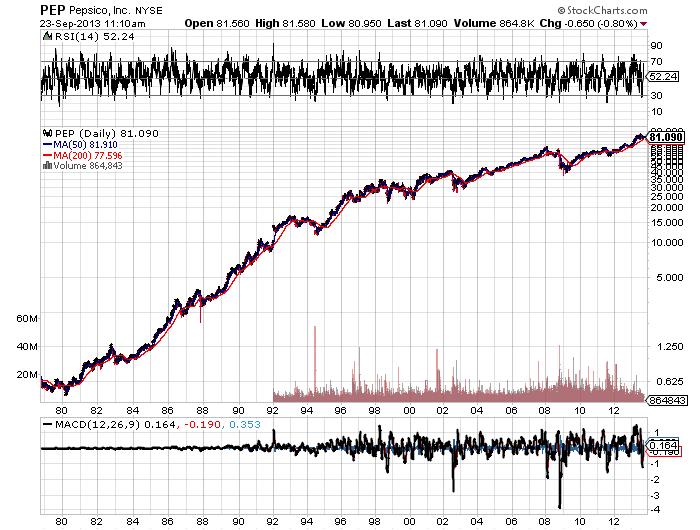

One company that I regularly view as an excellent long-term enterprise for savers is PepsiCo, Inc. (PEP). PepsiCo is a drink and snack business that has consistently delivered on management forecasts. The company has a solid track record of increasing dividends over time, and its long-term performance on the stock market has, to date, offered a stable uptrend. The company’s 35-year stock chart is featured below:

PepsiCo has been a stellar performer on the stock market since the beginning of the year. Like a number of other blue chips that delivered on their promises (Johnson & Johnson [JNJ], for example), the company provided the Street with exactly what it was looking for.

With a current dividend yield just shy of three percent, PepsiCo is a company that a long-term equity investor can build a position in over time and still be able to sleep at night. It’s also an attractive equity investment in which to consider a dividend reinvestment plan. A company that pays rising dividends combined with an investor who reinvests those dividends into new shares compounds wealth. It’s an old-school and simple way to get your money working for you instead of the other way around.

PepsiCo’s largest operating division in terms of revenues is the company’s Americas Beverages business, which includes all North and Latin American beverage sales. This is followed by all beverage and food and snack sales in Europe and South Africa, then its snack and food business in North and Latin America, followed by the rest of the world.

The most profitable operating division in terms of gross dollars is actually the company’s Frito-Lay North America business. In terms of operating profits, PepsiCo’s domestic snack business could actually be considered highly profitable in relation to any mature enterprise.

The company’s Americas Beverages division actually saw a two-percent sales drop in the second quarter of this year, mostly due to volume declines. But even with this slight decline, operating profit in its largest business actually rose five percent to $882 million in the second quarter.

Also notable in the company’s second quarter this year was a huge increase to its cash position, in spite of additional restructuring charges. The company’s cash balance soared to $7.8 billion, up from $6.3 billion in the same quarter last year, including a dividend increase.

One Wall Street firm recently lowered its earnings outlook on PepsiCo for the third quarter, this fiscal year, and next year. But in my view, a missed quarter is an opportunity with this kind of blue chip business.

This is a company that’s worth accumulating when it’s down; and it’s proven over time that it’s never down on the stock market for long.

Disclaimer: There is no magic formula to getting rich. Success in investment vehicles with the best prospects for price appreciation can only be achieved through proper and rigorous research and analysis. The opinions in this e-newsletter are just that, opinions of the authors. Information contained herein, while believed to be correct, is not guaranteed as accurate. Warning: Investing often involves high risks and you can lose a lot of money. Please do not invest with money you cannot afford to lose.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Consistency, Rising Dividends Make This Benchmark A Possible Winner

Published 09/25/2013, 03:15 AM

Updated 07/09/2023, 06:31 AM

Consistency, Rising Dividends Make This Benchmark A Possible Winner

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.