Investing.com’s stocks of the week

This will not be a long post. My bond strategy has always included longer bonds from the iShares iBoxx $ Investible Grade Corporate Bond ETF (LQD), and very long bonds from iShares Barclays 20+ Year Treasury Bond ETF (TLT). They have made money for me and my bond clients.

But now I am thinking of selling them. Why?

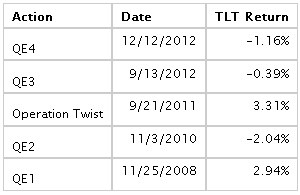

Let’s consider the history of QE:

Now, QE2 was kind of wimpy, and disappointed the markets. All the other actions qualified as bold, but bold actions are not moving the needle at present. Why?

I suspect that bond investors are embedding higher inflation forecasts into their prices, and that the balance has tipped. Inflation is coming, and I am likely to trade away longer nominal bonds for short bonds, and inflation-adjusted bonds.

The market is responding differently to loose monetary policy than it used to respond. Time to adjust; the illusions of the Fed are finally failing, I think, and markets may be about to discipline them with stagflation.

Full disclosure: long TLT and LQD, but might be moving for cover.