Major global exploration and production company ConocoPhillips (NYSE:COP) recently agreed to a proposed settlement of $39 million for groundwater contamination charges brought by the state of New Jersey. The announcement was made by the Attorney General's office.

ConocoPhillips is one of the 50 oil and chemical companies that have been sued in 2007 for contaminating ground water and harming the natural resources by methyl tertiary butyl ether (MTBE), a gasoline additive.

In 2012, as a spin off, some of the assets and liabilities of ConocoPhillips were transferred to Phillips 66 (NYSE:PSX) . Notably, these included the MTBE litigation cases of ConocoPhillips. Phillips 66 has held discussions with the Division of Law and reached mutually acceptable terms for ConocoPhillips through the settlement.

The Division of Law presented the contamination issue to the U.S. District Court in New York on behalf of the Department of Environmental Protection, where a judge approved the amount of the settlement.

Including the lawsuit against ConocoPhillips, the Division of Law has obtained a total of almost $157 million in settlements for the MTBE litigation, from the defendant companies. The Attorney General's office expects this settlement to reinforce its commitment to help the Department of Environmental Protection to safeguard the natural resources from pollution.

About the Company

Houston, TX-based ConocoPhillips is a major global exploration and production company with operations and activities in 21 countries that include the U.S., Canada, the U.K./Norway, China, Australia, offshore Timor-Leste, Indonesia, Libya, Nigeria, Algeria, Russia, and Qatar. The company is involved in operations with crude oil and natural gas worldwide.

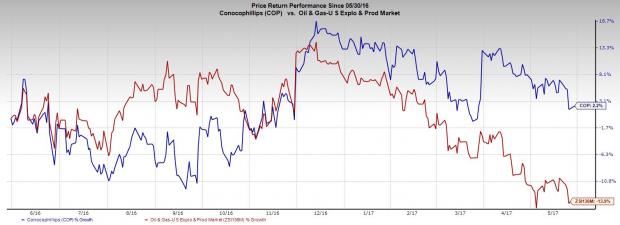

Price Performance

In the last one year, ConocoPhillips’ shares gained 2.28%, outperforming the Zacks categorized Oil and Gas - United States - Exploration and Production industry, which witnessed an 13.90% decrease.

Zacks Rank and Stocks to Consider

ConocoPhillips presently has a Zacks Rank #3 (Hold). Some better-ranked stocks in oil and energy sector include Delek US Holdings, Inc. (NYSE:DK) and Enbridge Energy, L.P. (NYSE:EEP) . Both of these stocks flaunt a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Delek US Holdings’ sales for 2017 are expected to increase 74.02% year over year. The company recorded a positive average earnings surprise of 60.68% in the last four quarters.

Enbridge Energy’s sales for the second quarter of 2017 are expected to increase 13.17% year over year. The partnership recorded a positive earnings surprise of 38.22% in the last four quarters.

Looking for Ideas with Even Greater Upside?

Today's investment ideas are short-term, directly based on our proven 1 to 3 month indicator. In addition, I invite you to consider our long-term opportunities. These rare trades look to start fast with strong Zacks Ranks, but carry through with double and triple-digit profit potential. Starting now, you can look inside our home run, value, and stocks under $10 portfolios, plus more. Click here for a peek at this private information >>

Enbridge Energy, L.P. (EEP): Free Stock Analysis Report

Delek US Holdings, Inc. (DK): Free Stock Analysis Report

Phillips 66 (PSX): Free Stock Analysis Report

ConocoPhillips (COP): Free Stock Analysis Report

Original post

Zacks Investment Research