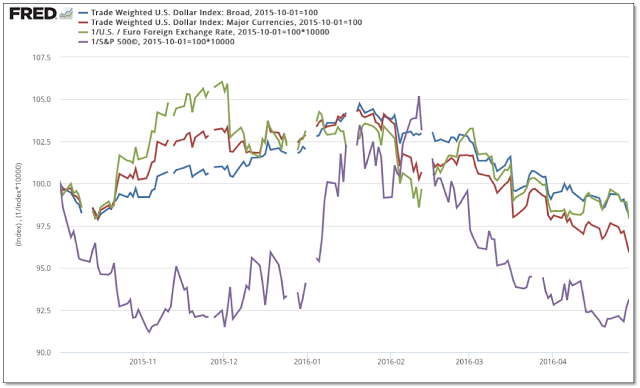

After treading water through much of April, the US dollar index took another step lower last week, after the BOJ declined to fire another salvo of stimulus at the markets – rocketing the yen higher by over 5 percent for the week. Taking their cue from the currency markets, hard commodities also rallied sharply to new highs for the year, with gold, silver and oil each tacking on ~ 5 percent for the week.

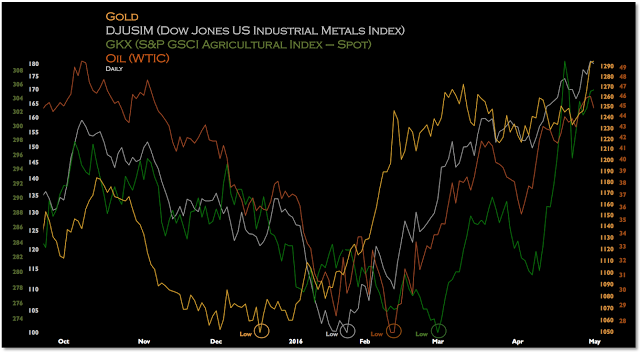

Doing what they do best, markets successfully cut against the grain of the now apparent consensus expectation that the reflationary rally was due for a pause. Nonetheless, the rising tide that had lifted most boats since mid February did begin to recede, namely, in the equity markets which enjoyed a wider breadth of performance since the commodity markets found what we believe was a cyclical low.

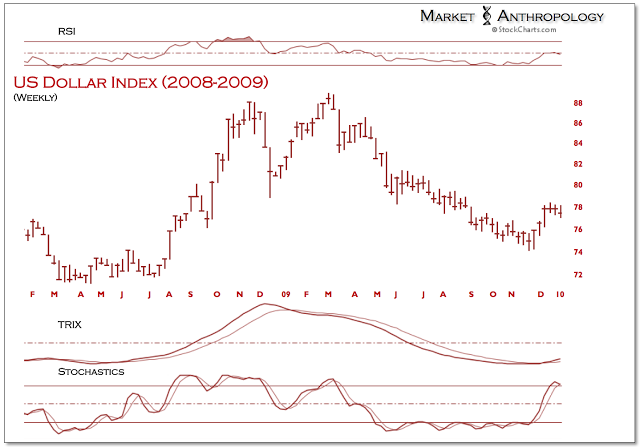

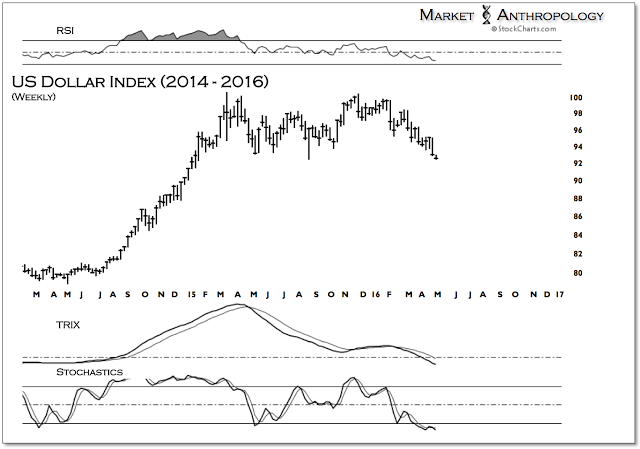

US Dollar

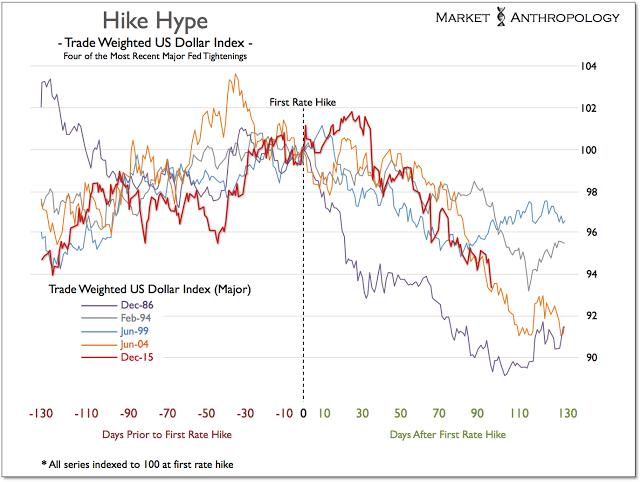

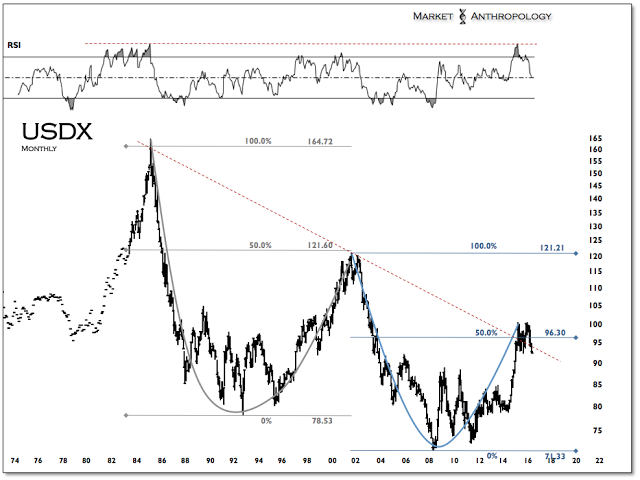

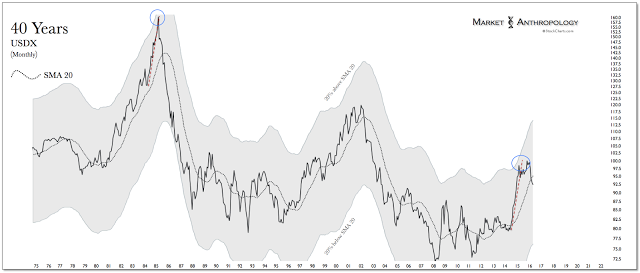

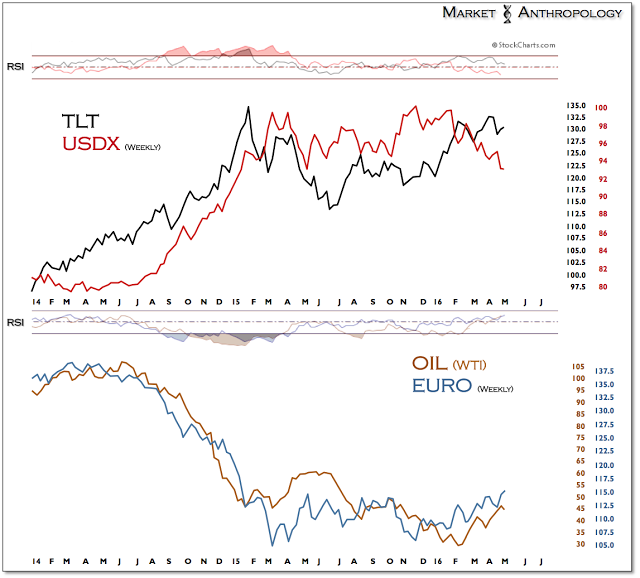

While we remain steadfast, long-term bears on the dollar and believe the majority of the move over the past two years will eventually get unwound, over the short-term we're more inclined to speculate the recent leg lower in the dollar index over the past week will be retraced, with the yen appearing most vulnerable to newfound dollar strength. That said, keep in mind the bigger picture headwinds working on the dollar both at home and abroad, that remain long-term bearish—in our opinion.

Considering the recent move lower, we have adjusted our outlook for a more moderate retracement target in the US dollar index back to ~ 94.50.

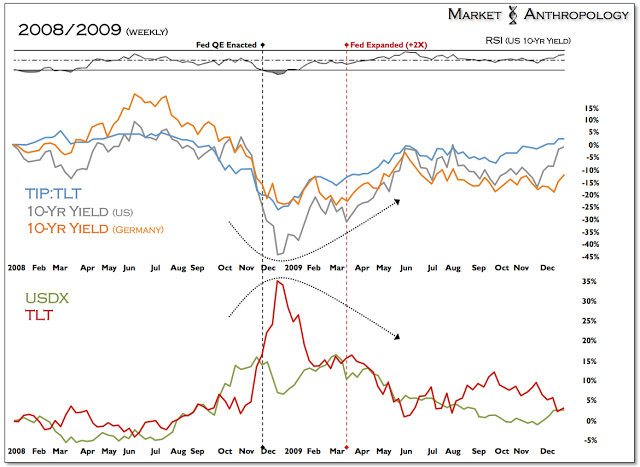

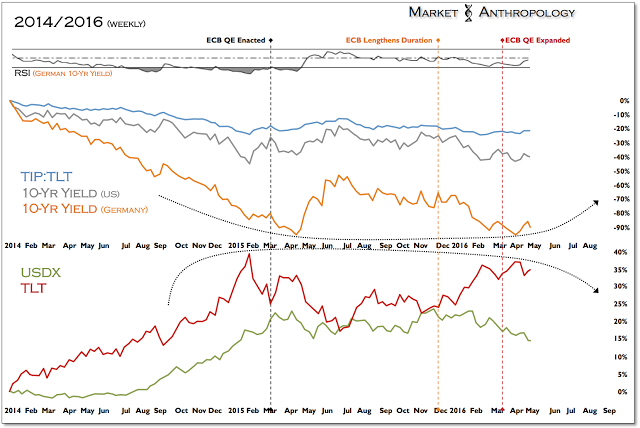

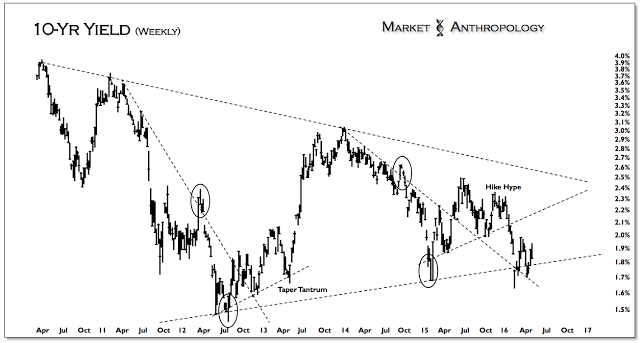

Yields

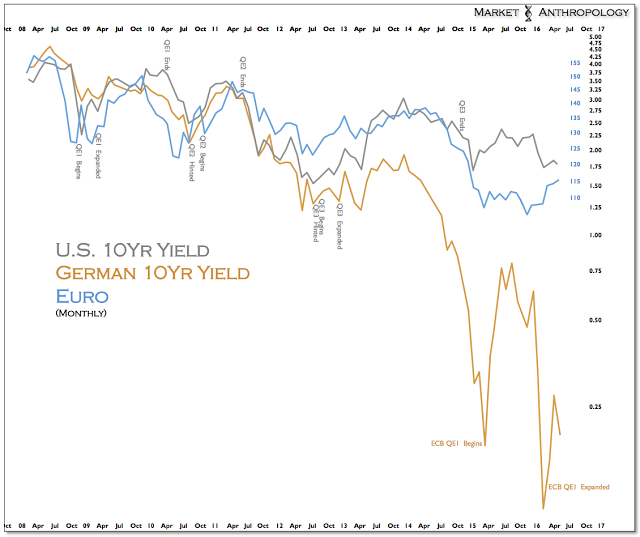

Since breaking below last year's low in February, the U.S. 10-Year yield has bounced between ~ 2.0 and 1.7 percent. Over the intermediate-term we continue to believe that yields will drift higher, perhaps extending the range up to ~ 2.2 percent. Moreover, we see greater upside risk in European markets, with a target of ~ 0.6 percent for Germany's 10-Year yield.

Commodities

What's interesting to note is that despite oil's massive rally since February, it has yet to realize a move above the highs (~50/barrel WTI) from last fall. Collectively, both precious and industrial metals indexes—as well as the agricultural commodity index—have all achieved this benchmark. Considering the lag from the lows in oil, it wouldn't surprise us to see the rally extend above 50 before consolidating.

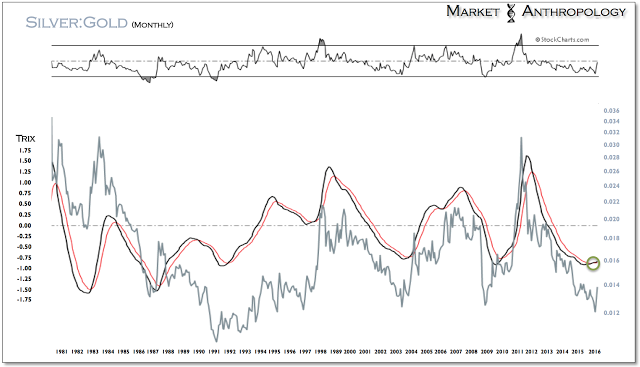

Taking their cues from dollar, gold and silver surprised to the upside last month, resolving higher from their respective consolidation ranges. Moreover, silver strongly outperformed gold, fulfilling the positive momentum signal evident in its long-term ratio since the end of last year.

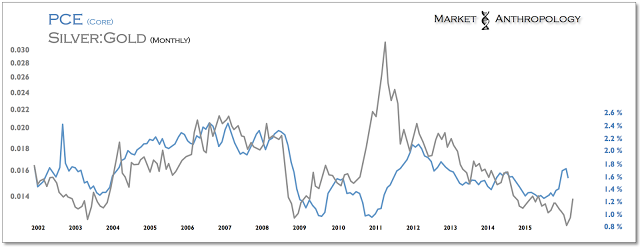

Overall, this is broadly bullish towards silver and should delineate the beginning of a new cycle for precious metals. In the past, the silver:gold ratio has led benchmarks of inflation – as evident with the lag in the Fed's preferred measure of the core PCE index. Should the relationship continue, core PCE would make a new cycle low over the coming months, which would likely alleviate pressures on the Fed to again raise rates.

Similar to the firmness in the dollar going into June 2009 that allowed another consolidation decline in precious metals, the current market may work off the shoulder trend lines that extend from last summer's highs.