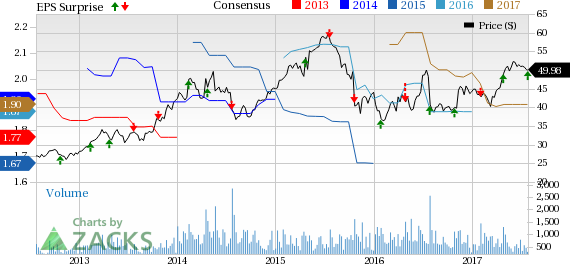

Headquartered in Utica, NY, leading medical technology player CONMED Corporation (NASDAQ:CNMD) reported second-quarter 2017 adjusted earnings of 41 cents per share, in line with the Zacks Consensus Estimate. Also, earnings deteriorated 12.8% on a year-over-year basis due to the unfavorable impact of foreign exchange rates, partially offset by higher sales.

Revenues rose 3% to approximately $197.2 million, ahead of the Zacks Consensus Estimate of $195 million. Revenues also increased 3% on a constant currency basis (cc).

Revenue Details

In terms of product line, orthopedic surgery revenues increased 0.9% on a year-over-year basis at cc. Revenues at this segment totaled $105.6 million. The general surgery segment saw a solid quarter, registering a 5.5% increase in revenues at cc. General surgery organic revenues increased to $91.6 million from $87.6 million in the year-ago quarter.

In terms of product category, revenues from single-use products increased 4.6% at cc to $159.5 million. Coming to the capital products, revenues declined 3.3% at cc to $37.7 million.

On the basis of geographies, CONMED witnessed a 1.3% uptick in domestic revenues to $100 million. CONMED saw 4.7% growth in international revenues to $97.2 million.

Balance Sheet

CONMED had a cash balance of $40.1 million at the end of the second quarter, compared with $34.7 million at the end of first-quarter 2017. Also, long-term debt was $484.0 million in the second quarter as compared with $487.0 million in first-quarter 2017. The inventory balance was $136.5 million at the end of the quarter under review.

Guidance

For the full year, CONMED revised the lower end of the sales growth guidance from the band of 1% to 3% to 2% to 3% at cc. The company reaffirmed the adjusted earnings per share at the range of $1.85 to $1.95.

Our Take

Foreign exchange movements have been impacting the company’s results over quite a few quarters. Furthermore, CONMED operates in a highly competitive environment which is likely to impede top-line growth.

However, an increase in sales in both Orthopaedic surgery and General surgery is encouraging. Also, the company’s global growth buoys optimism.

Zacks Rank & Key Picks

CONMED currently has a Zacks Rank #3 (Hold).A few better-ranked medical stocks are Mesa Laboratories, Inc. (NASDAQ:MLAB) , INSYS Therapeutics, Inc. (NASDAQ:INSY) and Align Technology, Inc. (NASDAQ:ALGN) . Notably, INSYS Therapeutics sports a Zacks Rank #1 (Strong Buy), while Mesa Laboratories and Align Technology carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

INSYS Therapeutics has a long-term expected earnings growth rate of 20%. The stock has gained around 5.7% over the last three months.

Mesa Laboratories has a positive earnings surprise of 2.84% for the last four quarters. The stock has added roughly 4.1% over the last three months.

Align Technology has an expected long-term adjusted earnings growth of almost 24.1%. The stock has added roughly 32.1% over the last three months.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future. Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Mesa Laboratories, Inc. (MLAB): Free Stock Analysis Report

Insys Therapeutics, Inc. (INSY): Free Stock Analysis Report

CONMED Corporation (CNMD): Free Stock Analysis Report

Align Technology, Inc. (ALGN): Free Stock Analysis Report

Original post

Zacks Investment Research