I had a conversation with a colleague of mine yesterday about the role of banks, the relative importance of QE/The Wealth Effect and the potential for growing distortions FIVE years into ZIRP/QE Infinity. More people ought to be having those conversations, but unless you're in this business.... the markets/asset prices are used as a passive gauge of growth.

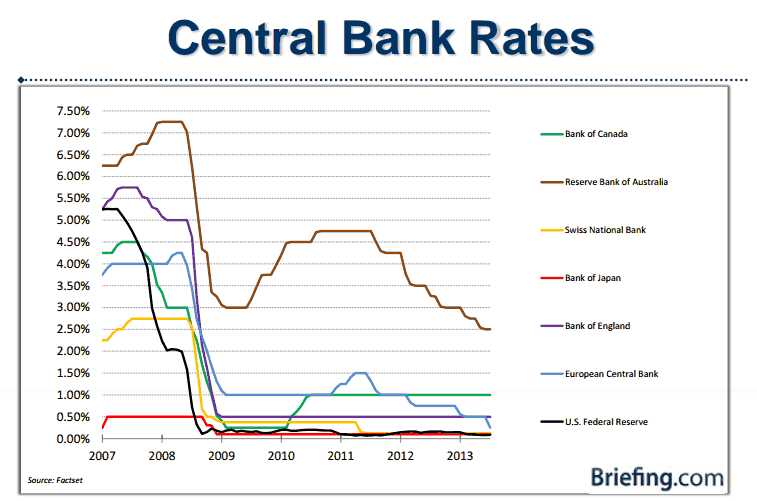

Industrialized nations have done nothing but CUT RATES and BUY ASSETS to support prices (perception is everything) for at least two year now. Back in 2011 there was a spat of inflationary fear (Arab Spring and Food prices) but since then EVERYONE has played the same game. The Fed's balance sheet is expanding at a rate of $1 TRILLION annually and on a relative basis the Bank of Japan/Abe's effort to debase the Yen makes Bernanke and Co. look like a Junior Varsity team.

Thomas Jefferson was much smarter than me. Back in the early years of our nation there was a tug of war between Jeffersonians (Democratic Republicans) and Hamiltonians (Federalists) centered on the proper role of government.

Tangentially related was the appropriate role of the banking sector (Bank runs were commonplace 200 years ago and there was NO FDIC, NO Federal Reserve, NO interest rate swaps, HA).

Jefferson had this to say:

"If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around them will deprive the people of all property until their children wake up homeless on the continent their Fathers conquered...I believe that banking institutions are more dangerous to our liberties than standing armies... The issuing power should be taken from the banks and restored to the people, to whom it properly belongs."

Perhaps that was hyperbole...........but maybe Jefferson was correct.

Anyhow, I realize that day in and day out for the past 14 years I've focused on the markets (equities, options, commodities, etc) and I'm passionate about it which colors my sentiment. I have a bunch of intelligent friends. They are software consultants, attorneys (all jokes aside), CPAs, etc. and most of them have NO IDEA what the Federal Reserve has been up to. They just look at their Investment portfolio (401k) and the value of their home and say....."well, things look a lot better".

Maybe that's a good thing. I don't know......but Central Bank policies affect everyone and in this case Ignorance may be bliss for right now, but eventually....it may not be.

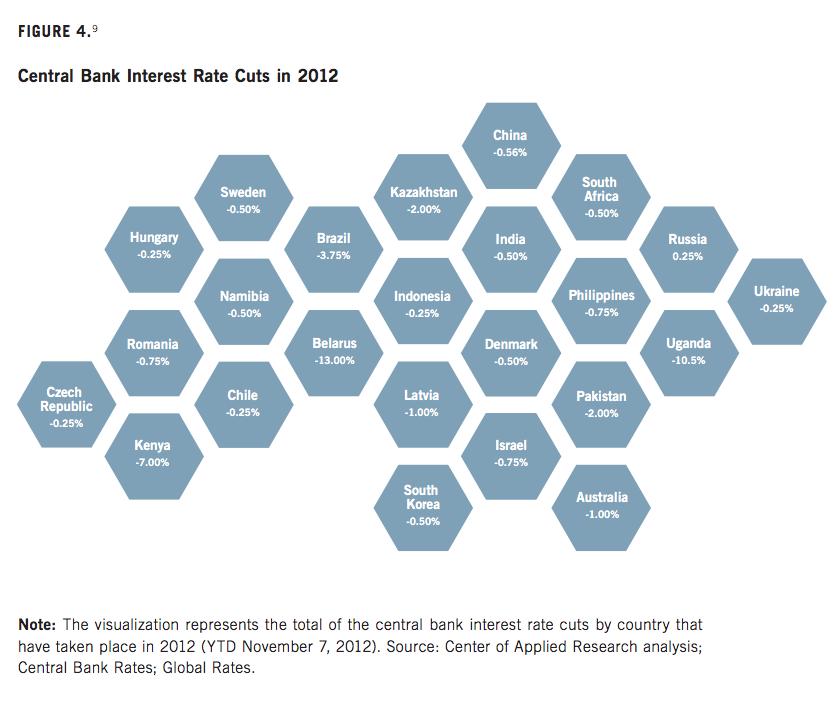

It's not just the G8 that's pushing the cheap money:

So Central Banks have TOLD YOU to own things. The chase yield and the market has responded. Things certainly don't feel like they did in 2008 or 2009 which is fantastic. Play the game.... participate in the wealth effect, but be wary because at some point (could be a very long time from now) the Training wheels will need to come off the global economy.

From a micro standpoint:

- Dec Crude calls that expire on Friday seem like a cheap defined risk play (own the 95 strike for 15 cents. Risk $150 plus frictional costs).

- The Dec RBOB v. Heating Oil spread tested the July highs and failed around 25.75 wide. Interesting.

- If you've been long Natural Gas for the past week, I would consider exit or hedge.

- If you got long Coffee last week, I would consider an exit or hedge.

- I'll be watching the Metals as they test support. Considering LONG in Mini Silver around 20.35.

- Watch the Yen/USD @ PAR.