Condor Gold’s (CNR) longer-term target is to define the potential of the La India land package, which currently has 2.4Moz at 4.6g/t. However, the important short-term objective is now to establish over 1.0Moz high-grade Indicated category open-pit gold resources, which could support a +110,000oz pa low-cost initial production schedule. This has strong cost advantages and a new resource statement, due in October 2013, should support the objective and be incorporated in the ongoing feasibility process.

Initial open-pit project should support development

The PEA (March 2013) was based on gold production over 13 years of 1.46Moz grading 3.8g/t split 50:50 between open-pit and underground mining. Exploration has since defined the ‘shape’ of the mineralised structures to suggest development of near-surface resources along the 1.6km La India Vein Set zone through a series of open pits. This should involve higher margins and significantly lower start-up capital costs without compromising the long-term potential of the La India district.

A new resource statement due in October 2013

The work programmes were not affected by the gold market downturn and the company has completed a 23.6km drilling since November 2012, which will support a new La India Vein Set resource statement, plus further definition of the America Vein Set and the Central Breccia resources. A geophysical survey over the entire 280km2 La India Project land package has also been completed, from which new longer-term resource targets could add an extra dimension to the regional potential.

A busy schedule ahead should be newsworthy

In addition to drilling results and the new resource and production options, an expanding technical team will be reporting on geotechnical drill results and metallurgical testing, plus Environmental and Social Impact Assessment studies and other supportive requirements for the initial preliminary feasibility study (PFS). Planned work programmes are funded to mid-2014.

Valuation: Currency and debt-adjusted value at 593p

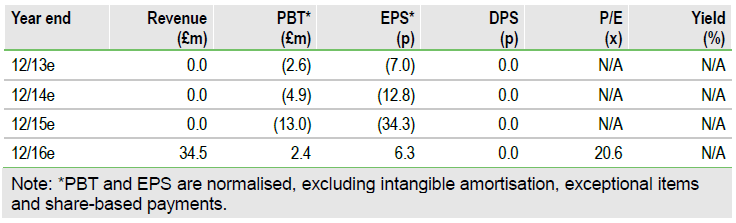

We value Condor at 593p based on the March 2013 PEA (against 614p previously), but this still underlines the quality of the resource. The market continues to rate Condor purely as an early-stage exploration company, but we expect recognition of the initial open-pit strategy will be shown in the new La India Vein resource numbers and the subsequent PFS will underpin an enhanced market rating.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Condor Gold: New Resource and Production Options

Published 09/09/2013, 08:01 AM

Updated 07/09/2023, 06:31 AM

Condor Gold: New Resource and Production Options

La India project resource shaping up

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.