It has been more than a month since the last earnings report for Conatus Pharmaceuticals Inc. (NASDAQ:CNAT) . Shares have added about 7% in that time frame.

Will the recent positive trend continue leading up to the stock's next earnings release, or is it due for a pullback? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at its most recent earnings report in order to get a better handle on the important drivers.

Conatus Q2 Loss Narrows Y/Y, Revenues Beat Estimates

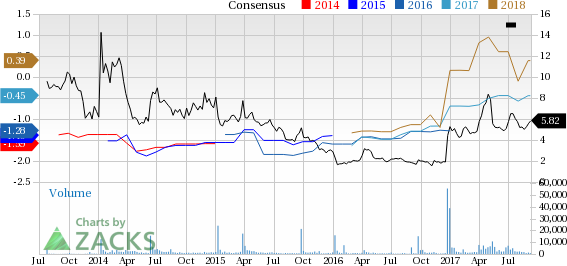

Conatus Pharmaceuticals reported second-quarter 2017 loss of 19 cents per share, wider than the Zacks Consensus Estimate of 11 cents. However, the loss was narrower than the year-ago figure of 30 cents.

Conatus has no approved product in its portfolio at the moment. However, the company recognized $10 million as collaboration revenues for the second quarter of 2017. Revenues beat the Zacks Consensus Estimate of $8 million. The collaboration revenues were related to an agreement with Novartis.

In the second quarter, research and development expenses were $13.2 million, up 214.3% from the year-ago quarter. This was mainly due to costs related to the ongoing ENCORE studies. General and administrative expenses were flat at $2.2 million compared with the year-ago quarter’s tally.

In May, Conatus completed an underwritten public offering of 5.9 million shares and raised $30.7 million as proceeds. The company used approximately $11.2 million of net proceeds to re-purchase and retire shares of Conatus’ common stock held by funds affiliated with Advent private equity.

Guidance

Conatus raised its cash guidance for 2017. The company now expects cash, cash equivalents and marketable securities between $55 million and $65 million by year-end 2017 compared with $45-$55 million, expected previously.

Notably, Conatus had announced last month that its licensing agreement with Novartis, inked in December 2016, for worldwide development and commercialization of emricasan, has become effective. Good news is that the company received a $7 million amount for this. Conatus expects its current financial resources along with the receipt of $7 million, to be sufficient for continuing operations through 2019-end.

How Have Estimates Been Moving Since Then?

Analysts were quiet during the past month as none of them issued any earnings estimate revisions.

VGM Scores

At this time, Conatus' stock has a nice Growth Score of B, however its Momentum is doing a bit better with an A. However, the stock was allocated a grade of D on the value side, putting it in the bottom 40% for this investment strategy.

Overall, the stock has an aggregate VGM Score of B. If you aren't focused on one strategy, this score is the one you should be interested in.

Our style scores indicate that the stock is more suitable for momentum investors than growth investors.

Outlook

The stock has a Zacks Rank #4 (Sell). We are expecting a below average return from the stock in the next few months.

Conatus Pharmaceuticals Inc. (CNAT): Free Stock Analysis Report

Original post

Zacks Investment Research