Premier North American food company ConAgra Foods, Inc. (NYSE:CAG) reported weaker-than-expected results for fourth-quarter fiscal 2016 (ended May 29, 2016).

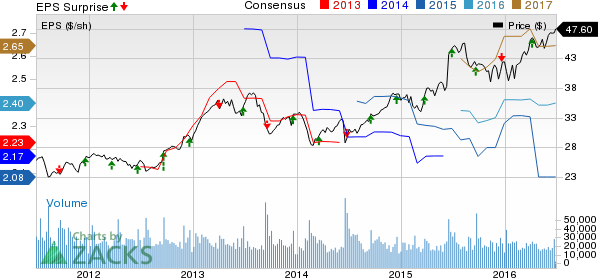

Quarterly earnings came in at 52 cents per share, in line with the Zacks Consensus Estimate. However, the bottom line missed the year-ago tally of 55 cents per share.

For full-year fiscal 2016, the company reported adjusted earnings of $2.08 per share as against $1.93 in the year-ago comparable period.

Revenues

ConAgra generated net revenue of $2,827.5 million in the fiscal fourth quarter, down 9.5% year over year. The top line also missed the Zacks Consensus Estimate of $2,908 million.

On a segmental basis, Consumer Foods revenues declined 11.9% to $1,693.5 million.

Revenues from the Commercial Foods segment were down 5.7% to $1,134 million.

Fiscal 2016 net revenues were $11,642.9 million compared with $11,937 million in a year ago

Other Financial Fundamentals

ConAgra’s cost of goods sold decreased 10.9% year over year to $2,066.6 million. Selling, general and administrative (SG&A) expenses increased 97.8% year over year to $789.7 million. Interest expenses decreased 30.8% to $61 million owing to lower debt levels.

ConAgra exited the fiscal fourth-quarter with cash and cash equivalents of $834.5 million, substantially higher than $164.7 million recorded at the end of fiscal 2015. Senior long-term debt (excluding current portion) was $4,721.9 million, down from $6,693 million as of May 31, 2015.

In the fiscal-fourth quarter, ConAgra generated net cash worth $1,045.3 million from operating activities, down from $1,215.4 million in fourth-quarter fiscal 2015. Capital spent on additions of property, plant and equipment totaled $429.8 million, up 22.4%.

During the reported quarter, ConAgra paid dividends worth $432.5 million compared with $425.2 million paid a year ago.

Outlook

ConAgra expects to enhance its business through innovations, in turn, boosting shareholders’ value. In order to achieve greater flexibility and operational efficiency, the company has decided to split its more profitable Commercial Foods segment and less profitable Consumer Foods segment into two separate public companies – ConAgra Brands and Lamb Weston – by the end of fiscal 2016.

Share price of the company stood at $47.60 per share as of Jun 29, 2016. We expect the company’s earnings release to result in stock price movement.

Other Stocks to Consider

ConAgra currently holds a Zacks Rank #2 (Buy). Other well-ranked stocks in the industry include Post Holdings, Inc. (NYSE:POST) , The J. M. Smucker Company (NYSE:SJM) and United Natural Foods, Inc. (NASDAQ:UNFI) . All the three companies presently sport a Zacks Rank #1 (Strong Buy).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report >>

UTD NATURAL FDS (UNFI): Free Stock Analysis Report

CONAGRA FOODS (CAG): Free Stock Analysis Report

SMUCKER JM (SJM): Free Stock Analysis Report

POST HOLDINGS (POST): Free Stock Analysis Report

Original post

Zacks Investment Research