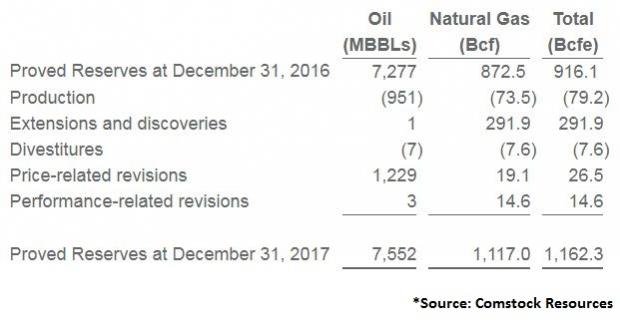

Comstock Resources, Inc. (NYSE:CRK) recently announced that its proved reserves as of Dec 31, 2017 increased 27% year over year to 1,162.3 billion cubic feet of natural gas equivalent (Bcfe). Following the news, the company’s shares rallied more than 8%. This continues the recent uptrend for the company as the stock is now up 24% in the last 30 days.

Per the company, it has taken into account oil and natural gas prices, which were a respective 30% and 26% higher than 2016, in order to determine the proved reserves. Comstock operates 98% of the proved reserves.

The notable rise in proved reserves is primarily due to the success of the Haynesville shale drilling program in 2017, which helped the company to add 292 Bcfe to its reserves. Moreover, the improvement in realized prices and solid well performance last year added 41 Bcfe to the company's reserves. Notably, the company's development activities witnessed spending of $174.6 million in 2017.

We would like to remind investors that the company has low liquidity and high leverage, which remains an overhang on its growth plans. It has a long-term debt to capital ratio of 91.8%, much higher than the industry’s 49.3%. To counter the situation, Comstock plans to divest its Eagle Ford shale properties in South Texas. These assets include 10.5 Bcf natural gas and 7.1 million barrels of oil of the latest proved reserves.

About the Company

Frisco, TX-based Comstock is an independent oil and gas exploration and production company engaged in the acquisition, exploration, and development of oil and gas properties.

Comstock’s major position in the prolific Haynesville/Bossier Shale play provides a highly visible and cost-effective production growth profile. However, being a relatively small player, Comstock lacks the financial resources of larger industry giants. As such, during periods of prolonged credit crunch, the company is forced to spend within its internal cash generation. This may prove detrimental to its growth plans.

Zacks Rank and Stocks to Consider

Comstock has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the oil and energy sector are Cabot Oil & Gas Corporation (NYSE:COG) , Suncor Energy Inc. (NYSE:SU) and Pioneer Natural Resources Company (NYSE:PXD) . All the companies sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Houston, TX -based Cabot is an independent energy company. Its sales for the fourth quarter of 2017 are expected to grow 37.2% year over year. Earnings for 2017 are expected to be up 352.4%.

Suncor Energy is a Calgary, Canada based integrated energy company. Its revenues for the fourth quarter of 2017 are expected to increase 5.5% year over year. The company delivered a positive earnings surprise of 57.7% in the third quarter of 2017.

Irving, TX- based Pioneer Natural Resources is an independent oil and gas exploration and production company. Its earnings for the fourth quarter of 2017 are expected to increase 49.1% year over year. The company delivered a positive average earnings surprise of 67.6% in the last four quarters.

Zacks Top 10 Stocks for 2018

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2018?

Last year's 2017 Zacks Top 10 Stocks portfolio produced double-digit winners, including FMC Corp (NYSE:FMC). and VMware which racked up stellar gains of +67.9% and +61%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2018 today >>

Suncor Energy Inc. (SU): Free Stock Analysis Report

Pioneer Natural Resources Company (PXD): Free Stock Analysis Report

Cabot Oil & Gas Corporation (COG): Free Stock Analysis Report

Comstock Resources, Inc. (CRK): Free Stock Analysis Report

Original post

Zacks Investment Research