Putting it into context

Management’s drive to reposition Comptel (CTL1V:Helsinki) as a leading supplier of solutions for automated customer interaction is a significant undertaking. However, it is based on solid fundamentals, both from a demand perspective and through providing a natural route for Comptel to leverage its established products, expertise and relationships. If the company can continue to build on its early progress with these solutions, then financial and share price upside should follow.

Focus on automated customer interaction

Comptel is progressing thorough a repositioning process aimed at establishing the company as a leading supplier of automated customer interaction solutions for telecommunications operators. The strategy involves combining the company’s legacy strengths in mediation and provisioning with fulfilment and predictive analytics capability to predict a customer’s requirements and to automatically trigger the appropriate response.

Building on early successes key

Comptel now has 15 customers for its Social Links, analytics/customer interaction product and signed its first €1m+ analytics deal, with Bangladeshi mobile operator Robi Axiata in Q4. In a fiercely competitive and consolidating B/OSS landscape, we see progress in expanding the analytics customer base as the key value driver for the company.

Financials: In better shape to make headway

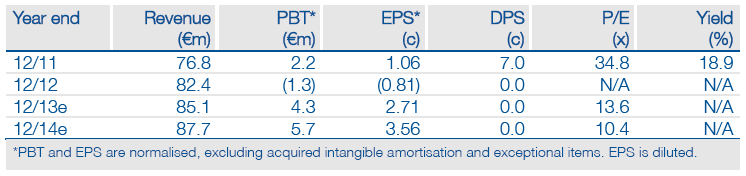

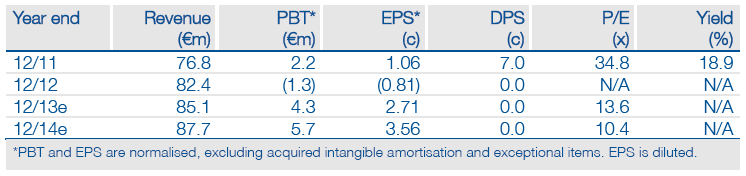

Overall performance in 2012 was clearly disappointing, but Comptel did grow revenues at a respectable 7.4% rate (we estimate 4-5% organic) and H2 was profitable. With the restructuring now complete, the company should be able to reach its lower threshold 5% margin target with little to no growth. We forecast 3% revenue growth this year with 5.9% operating margins, but incremental growth beyond this, particularly a recovery in licensing momentum, should now drop much more strongly through to earnings. If high interest levels in the key Social Links and Fulfillment solutions can be converted into deal flow, we should see upside to our forecasts.

Valuation: Traction in analytics key to upside

Comptel’s forward P/E ratio of 13.6x for 2013 falling to 10.4x for 2014 looks fair on the basis of our current estimates. The EV/sales ratio of 0.5x remains eye-catchingly low and highlights the earnings expansion potential if margins can be recovered. Progress with automated customer interaction is the key catalyst, both through opening up the possibility of upgrades and a re-rating of the stock as growth prospects and strategic value are visibly enhanced.

To Read the Entire Report Please Click on the pdf File Below.

Management’s drive to reposition Comptel (CTL1V:Helsinki) as a leading supplier of solutions for automated customer interaction is a significant undertaking. However, it is based on solid fundamentals, both from a demand perspective and through providing a natural route for Comptel to leverage its established products, expertise and relationships. If the company can continue to build on its early progress with these solutions, then financial and share price upside should follow.

Focus on automated customer interaction

Comptel is progressing thorough a repositioning process aimed at establishing the company as a leading supplier of automated customer interaction solutions for telecommunications operators. The strategy involves combining the company’s legacy strengths in mediation and provisioning with fulfilment and predictive analytics capability to predict a customer’s requirements and to automatically trigger the appropriate response.

Building on early successes key

Comptel now has 15 customers for its Social Links, analytics/customer interaction product and signed its first €1m+ analytics deal, with Bangladeshi mobile operator Robi Axiata in Q4. In a fiercely competitive and consolidating B/OSS landscape, we see progress in expanding the analytics customer base as the key value driver for the company.

Financials: In better shape to make headway

Overall performance in 2012 was clearly disappointing, but Comptel did grow revenues at a respectable 7.4% rate (we estimate 4-5% organic) and H2 was profitable. With the restructuring now complete, the company should be able to reach its lower threshold 5% margin target with little to no growth. We forecast 3% revenue growth this year with 5.9% operating margins, but incremental growth beyond this, particularly a recovery in licensing momentum, should now drop much more strongly through to earnings. If high interest levels in the key Social Links and Fulfillment solutions can be converted into deal flow, we should see upside to our forecasts.

Valuation: Traction in analytics key to upside

Comptel’s forward P/E ratio of 13.6x for 2013 falling to 10.4x for 2014 looks fair on the basis of our current estimates. The EV/sales ratio of 0.5x remains eye-catchingly low and highlights the earnings expansion potential if margins can be recovered. Progress with automated customer interaction is the key catalyst, both through opening up the possibility of upgrades and a re-rating of the stock as growth prospects and strategic value are visibly enhanced.

To Read the Entire Report Please Click on the pdf File Below.