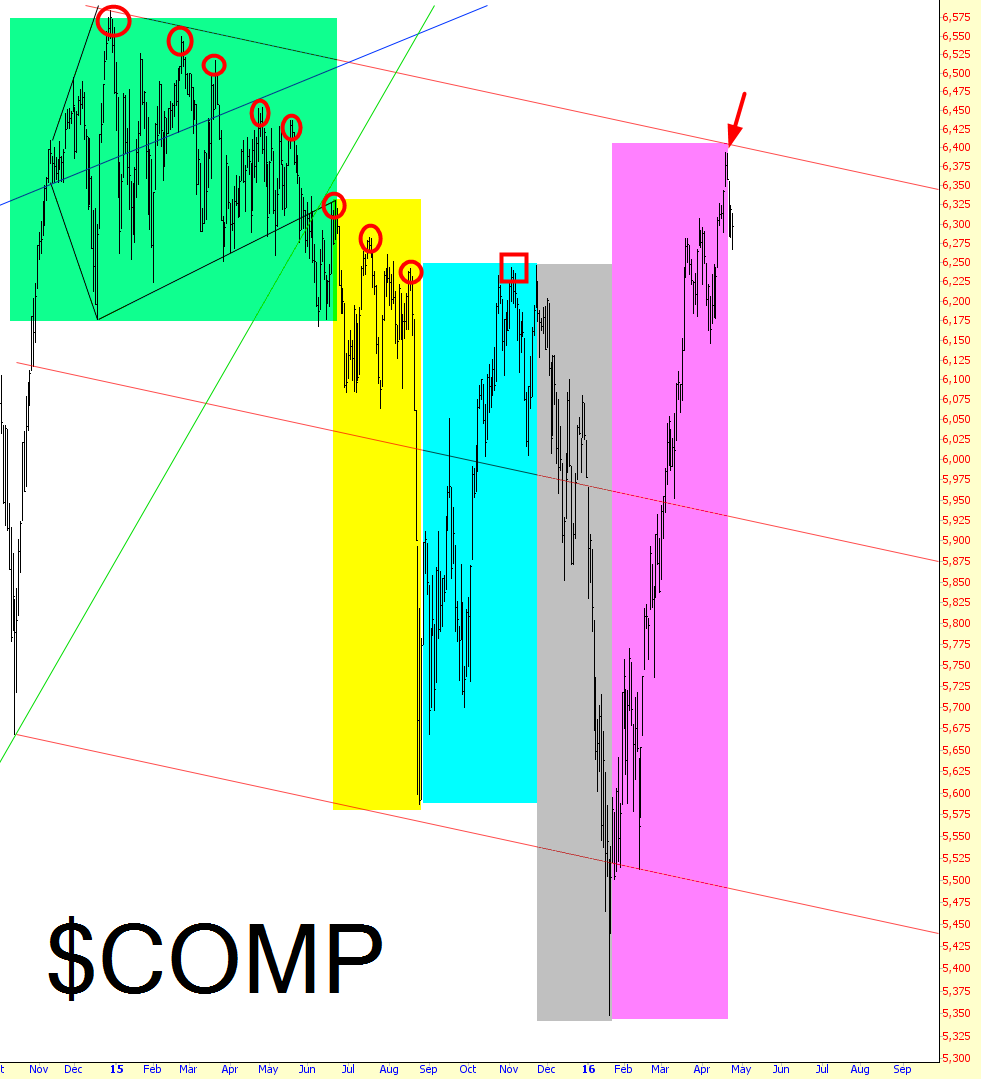

Let’s take a step back at look at the Dow Jones Composite and the various phases it has gone through:

GREEN was what I called the “Ichthus” pattern, which was remarkably well-formed and accurately predicted the drop that was to transpire. It had a clean series of lower lows, as well.

YELLOW was the first big plunge that terminated on that big day in late August when the Dow was down 1,000 points early on (if you can imagine such a thing now).

CYAN was the “we’ve got to do something!” rally, which resulted in a slightly higher high, breaking that clean series of circles you see.

GREY was when reality came back once more, aided largely by declining crude oil prices, creating a miniature bear market that spanned December 29 through January 20.

MAGENTA was the “we’ve really got to do something rally” that central bankers around the world led, this time aided by rising oil prices.

Prices threatened to break above the channel last week, as denoted by the arrow, but at this point, the channel is still containing price action.

We now all wait for more central banker nonsense on Wednesday, both from Yellen and Kuroda. My spidey sense is that there won’t be “big news” from either of them, but it’s the market’s reaction……….even to non-news……..that counts. Keep your eye on that channel for a breakout. If the market is chilly to the actions (or non-actions) of the bankers, it wouldn’t take much for prices to ease back down to about the 6,200 level.