More than a year ago, on September 19th, 2023, we introduced our readers to leading metal payment cards manufacturer CompoSecure (NASDAQ:CMPO). It had gone public via a SPAC less than three years ago and the stock was still in the doldrums.

The company was the leader in its niche, however, and was not only healthily profitable but also extremely undervalued at just 7 times earnings. In addition to this, there appeared to be a bullish Elliott Wave setup in place.

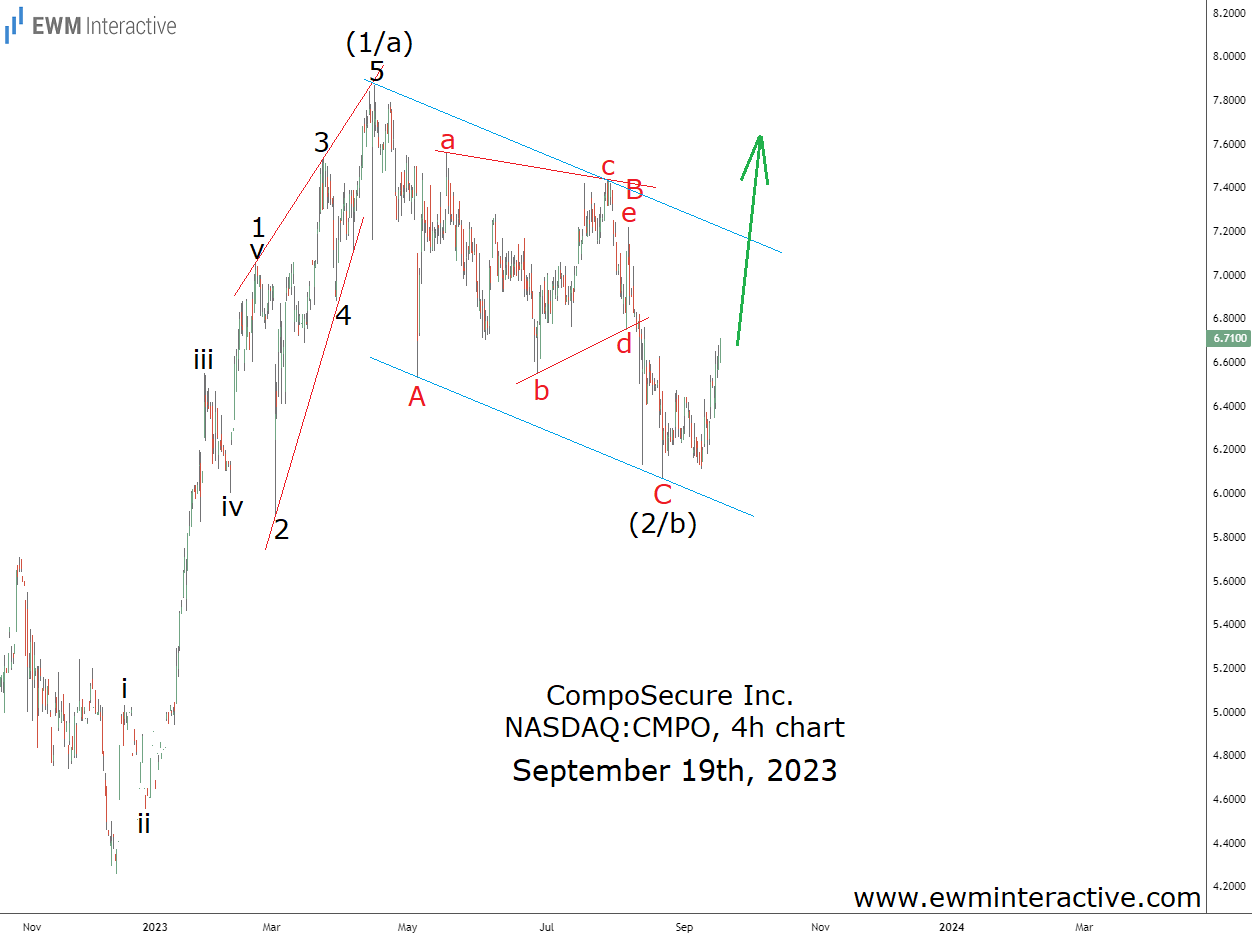

It consisted of a leading diagonal pattern to the upside, marked 1-2-3-4-5, followed by a simple A-B-C zigzag to the downside. According to the theory, the trend was supposed to resume in the direction of the five-wave sequence. With that in mind, we thought that “the stock can plausibly double from here.“

In a great example of the maxim that a cheap stock can always become cheaper, CompoSecure didn’t start rising right away. It took its time and even fell further in wave (2/b) over the following six months. Given its strong fundamentals, however, it didn’t make sense to abandon it simply because of the lower stock price. In fact, it made sense to buy more. Our patience has been rewarded in the end.

The catalyst, which triggered the start of CompoSecure’s recovery was the publication of its Q4 2023 report, which surprised to the upside on March 6th. Not long after that, in August, someone with deeper pockets in the face of David Cote recognized the value we had seen and decided to purchase 60% of the company. This really got the stock moving.

CompoSecure closed at $16.17 a share before Thanksgiving, up 141% since we turned bullish in September, 2023, and 250% from the bottom of wave (2). It was worth the wait no matter how you slice it. Alas, no trend lasts forever and this one seems to be getting exhausted already. The sharp surge since March looks like a textbook five-wave impulse, marked 1-2-3-4-5 in wave (3).

If this count is correct, a notable pullback in wave (4) down to the 38.2% Fibonacci level near $12 a share can soon be expected. Another rally in wave (5) should then follow, although fifth waves are never guaranteed, since there is no rule stating that a five-wave impulse must always form. Sometimes, a three-wave structure is all the market can offer. In other words, we think that the easy money has been made in CompoSecure stock and investors shouldn’t extrapolate the recent past into the future.