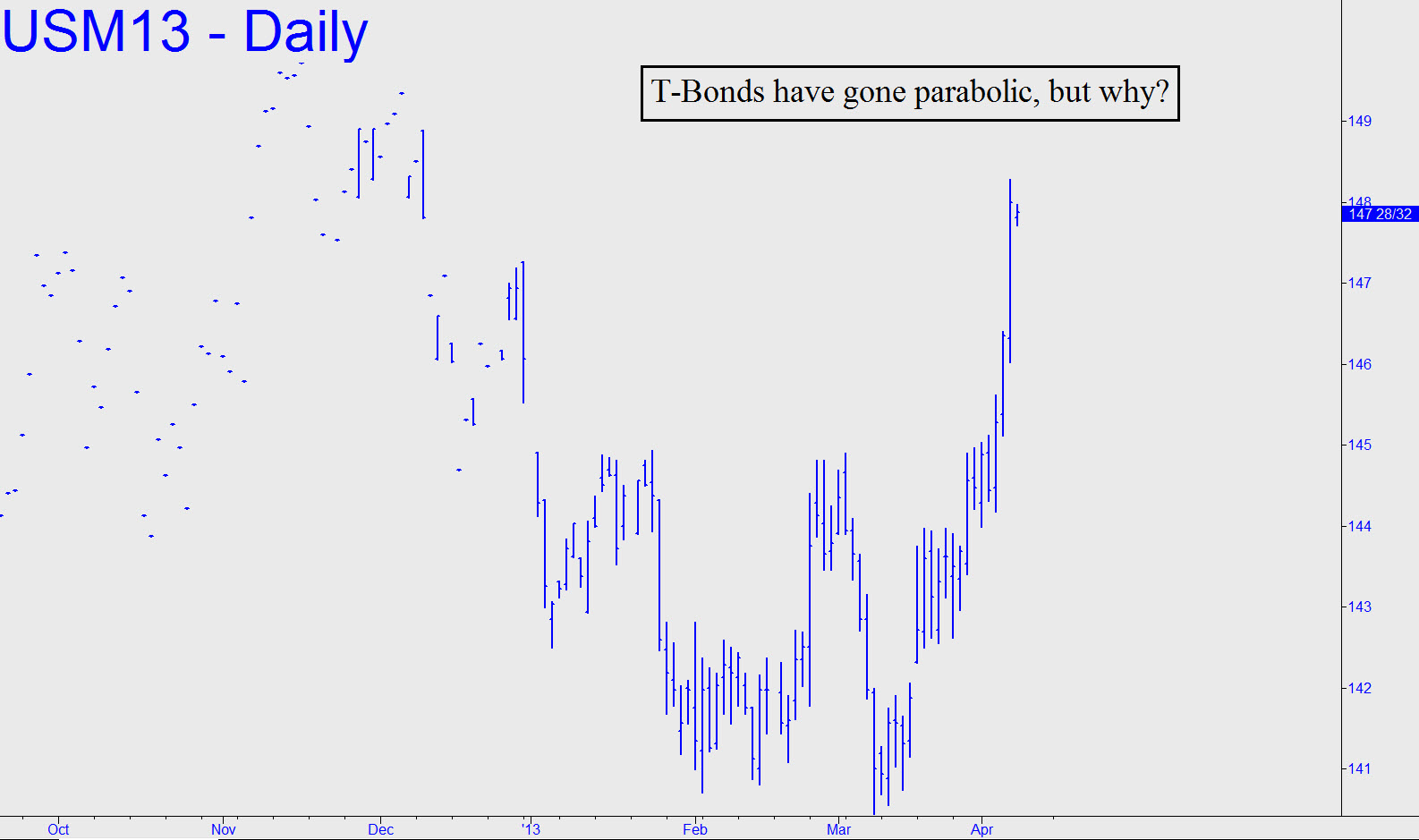

The June contract has blown past some important prior highs with the ease we’d anticipated. The rally is parabolic at this point and suggests that, at least for the foreseeable future, market forces will not seriously challenge the Fed at its game. I’d said this would be bullish for stocks, and that would be true if the perception still ruled that absurdly low interest rates will somehow benefit the economy going forward. This delusion may be dying, however, wounded anew by the stock market’s inability on Friday to rally on news that the U.S. economy had created just 88,000 jobs in March.

The June contract has blown past some important prior highs with the ease we’d anticipated. The rally is parabolic at this point and suggests that, at least for the foreseeable future, market forces will not seriously challenge the Fed at its game. I’d said this would be bullish for stocks, and that would be true if the perception still ruled that absurdly low interest rates will somehow benefit the economy going forward. This delusion may be dying, however, wounded anew by the stock market’s inability on Friday to rally on news that the U.S. economy had created just 88,000 jobs in March.Meanwhile, the complexity of factors that have been interacting to send the U.S. dollar and T-Bonds higher, and gold lower, may be growing too difficult to analyze with much confidence. Under the circumstances, perhaps the best we can do is study the technical picture diligently while avoiding the temptation to think it’s possible to divine the meaning of it all in a political and economic world where insanity rules.