The market has gone into consolidative mode with the key ECB rate decision on tap later this evening. For the most part, markets were quiet with European equities mirroring the movements in crude oil prices, which continued to rebound. Fed members Williams and Lacker took to the airwaves expounding their case for a September hike, despite the weak ISM data. However, interest rate markets were virtually unmoved by the latest Fed speak and currency markets spent most of the NY session in consolidation mode. However, we should not get too complacent, as there are many important pieces of the complex conundrum yet to unfold.

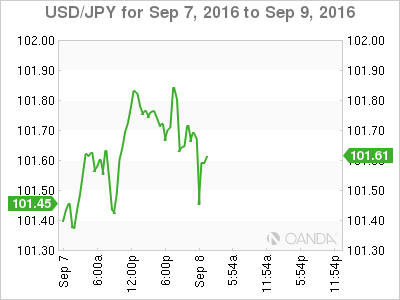

Japanese Yen

The USD/JPY has certainly been the market’s favorite whipping boy over the past 24-hours, bearing the strain of weak US economic data, brewing conflict among BoJ board members and a significant technical breach below 102.

With the ISM fallout having all but run its course as the September US rate hike probabilities plummeted to 15%, the focus now shifts to the Bank of Japan’s upcoming policy meeting. It certainly was not a good start for the BoJ in September when it was reported that there was a three-way division amongst BoJ board members concerning policy. It is hardly startling news, but when you factor in comments from Abe’s advisor Hamada that the BoJ should wait for the Fed before deciding on next policy step, it starts to add up. This type of indecision and waffling is an open invitation for traders to pounce, and they will continue to, as long as Japan remains the poster child for the ineffectiveness of monetary policy in a low-interest rate environment, especially to influence currency markets.

However, with the September US rate hike probabilities likely under-priced after the ISM miss, which suggests some form of retracement, and with several weeks to go before the BoJ’s policy decision providing ample time for the BoJ to step up the damage control measures, dealers may be less inclined to chase the USD/JPY below 101 until after the dust settles on both the BoJ’s and FOMC’s decision later in the month. In fact, we may get a glimpse of what damage control measures are in store, as there’s a planned speech later in the day by BoJ Deputy Governor, Hiroshi Nakano, which might provide traders with a glimpse on future policy surrounding NIRP. At a minimum, I anticipate some form of unified policy stance delivered in the speech.

.

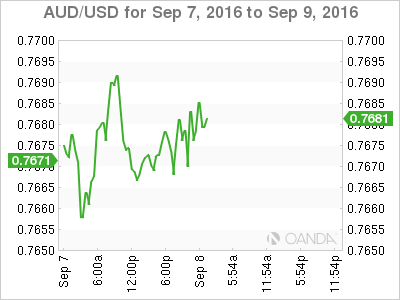

Australian Dollar

The failure to breach the .77 technical resistance levels saw the AUD fall back to the .7675 level consolidating ahead of today’s Domestic Trade Balance.

Despite the relatively slow pace overnight, we could see an uptick in inter-day volatility. In addition to the domestic trade data, we have kept a close eye on the China Trade Data. While the trade data could provide some inter-day intrigue, unless a there is a complete outlier the AUD landscape will continue to be cultivated by external factors, specifically the probabilities surrounding US interest rates.

The Aussie dollar was unmoved by the domestic trade data coming in at -2.4B V -2.7BE and was equally unmoved on the China trade data which came in at USD/CNY 346B; $ V $58.4BE despite the positive turn in both imports and exports. We may see a positive delayed reaction to the China trade print.

The ECB’s rate decision will be on local trader’s radar as a dovish ECB should play into the carry trade mentality and be supportive of the Aussie dollar.

Commodity markets are looking firm, which should underpin the Aussie case, and with oil prices surging higher on the back of the recent API inventory data, the Aussie should remain firmly supported on dips.

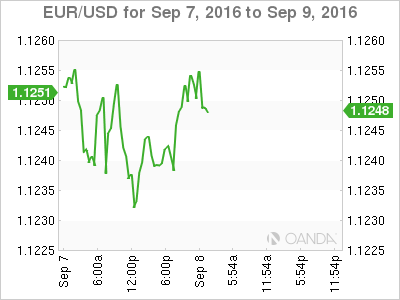

EURO

The ECB will fall on traders' radars later this evening and “the street” economists are calling for ECB extension of stimulus efforts, which should prove to be negative for the Euro. However, as we’ve seen from the ECB in the past- what appears to be a clear-cut decision, is seldom so.

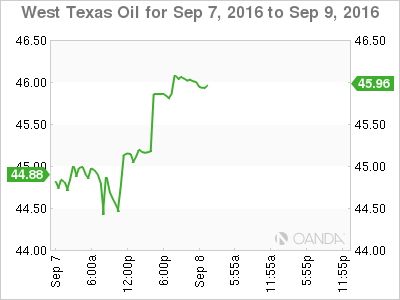

Oil Markets

Looking at the erratic price action recently, traders are obviously in a state of confusion, whipsawed by OPEC comments that run counter to the fundamental supply argument. However, at the NY close dealers were mulling over the recent API inventory supply data, which showed a much larger than expected 12.08 million barrel draw and WTI rocketed above USD 46.00 per barrel and is consolidating those gains around 46.10-20 in early APAC trade. Expect oil prices to be supported by the surprising API draw.

Currently trading just above support levels and likely to trade offers with oil prices again surging, and BNM staying the course on interest rates.