Investing.com’s stocks of the week

The markets have bounced nicely over the last several days as the recent "crisis" in the emerging market countries has subsided. Furthermore, Janet Yellen smoothed over many of the financial market's concerns with promises of continued accommodative support. As shown in the chart of the volatility index below, these events led to the rapid decline from "panic" to "complacency" within just a few days.

I have noted the spikes in volatility with related market declines. The last real sign of investor panic ws in 2011 during the debt ceiling debate. Since then, primarily due to a conviction that the "Fed will do whatever is necessary to bail out the markets," each spike in volatility has been to lower levels. As a consequence, the market declines have also been very muted.

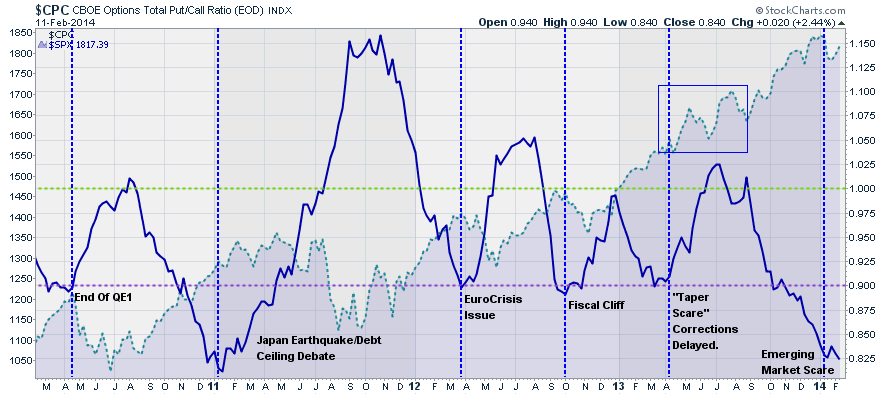

Another measure of complacency is the total put/call options ratio from the CBOE. The chart below shows, that despite the "panic" from the emerging market crisis, there was very little movement in the put/call ratio indicating real "fear" in the markets. Currently, this indicator is at levels that have been historically associated with bigger corrections. I believe this to be the bigger concern for the markets in the next few months.

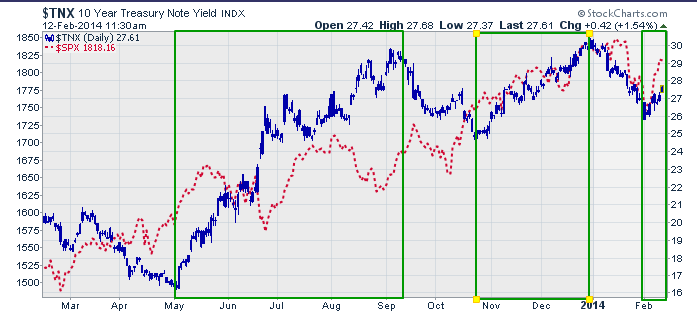

What is interesting though is that the bond market does not seem to be supporting the return of exuberance in the stock market. The chart below shows the 10-year treasury rate versus the stock market.

Previously. when stocks were in rally mode, bonds were selling off (causing rates to rise) as risk was preferred over safety. However, during the most recent correction, the flight to safety accelerated and pushed yields down to 2.6% on the 10-year. Despite the quiet emanating from emerging markets along with Yellen's soothing comments, the surge in stocks is not being fully accounted for by a substantive rise in interest rates.

The question on everyone's mind is simply whether the recent correction is over? I think a bulk of the answer lies behind the closed doors of the Federal Reserve. The recent rout, as discussed yesterday, was triggered by the Fed's "tapering" of their bond purchases as leverage was unwound. While Yellen stated that she would continue to monitor incoming data, will the issue of continued bouts of soft economic data be enough to change her stance on monetary policy? Or, will the "tapering" continue with an estimated exit as early as October of this year?

One thing is for sure. Despite much rhetoric to the contrary, the stock market is as dependent today on the Fed's interventions as ever. Fundamental valuations are no longer cheap, margin debt is near record levels, and retail investors are all in. This leaves little room for error at a point where small changes in Fed policy has an immediate impact on the financial markets.

The recent "dip" in the markets may have indeed been a short term buying opportunity. However, that only means that the eventual reversion, and the real long term investment opportunity, is still yet to come.