Europe's defences against a catastrophic escalation in the debt crisis are being breached. An unprecedented financial attack on Italian bonds saw the yields on 10 year bonds surge to a euro-era record high of 7.25% and above the critical level that saw Greece, Portugal and Ireland throw in the towel and seek financial bailout. The question that European leaders have failed to answer or are too afraid to contemplate is how far will they go to defend the Euro? Italy's debt of $2.6 trillion dollars is more than that of Greece, Spain, Portugal and Ireland combined. Margins required for dealing Italian securities overnight were raised by LCH Clearnet with international investors unconvinced that Italy can avoid the debt contagion. Berlusconi fiddles with the orchestra of European leaders while Rome burns.

The EUR was smashed more than 2% from 1.3860 to as low as 1.3522 as investors fretted over whether Italy was too big to fail or too big to save! IMF monitors are visiting Rome soon and if the situation does not improve, Italy may come under IMF administration. To make matter worse, the situation in Greece has become a farce with the 'unity government' splinter- ing over a number of issues including who the new leader will be. In this environment, it was inevitable that the risk currencies would be severely punished. The Australian dollar has lost more than 2.5 cents to trade as low as 1.0136 this morning and looks likely to break parity imminently.

Equity markets globally were pummelled last night as Italy teeters on the brink of financial collapse. Furthermore, news that German legislators are looking at options for European nations to stop using the shared currency while keeping European Union membership didn’t help matters. The DAX lost 2.21% to 5,829 while the FTSE fell 1.92% to 5,460. As the bad news piled up, the S&P 500 was smashed lower by more than 3.7% to 1,229 with broad and heavy selling hitting all stocks.

Commodity prices fell as situation in Europe got significantly worse. WT crude oil is fairing well considering the massive falls in equity prices down only 0.54% to $96.30. Precious metals have lost some ground with gold down 1.4% to $1,774 while silver is down 3.00% to $34.10. Soft commodities plunged with wheat, cocoa and sugar down more than 2% while copper plunged almost 4%. The CRV index is down 4.15 points to 318.46. We have the release of the high impact Chinese Trade balance data.

The EUR was smashed more than 2% from 1.3860 to as low as 1.3522 as investors fretted over whether Italy was too big to fail or too big to save! IMF monitors are visiting Rome soon and if the situation does not improve, Italy may come under IMF administration. To make matter worse, the situation in Greece has become a farce with the 'unity government' splinter- ing over a number of issues including who the new leader will be. In this environment, it was inevitable that the risk currencies would be severely punished. The Australian dollar has lost more than 2.5 cents to trade as low as 1.0136 this morning and looks likely to break parity imminently.

Equity markets globally were pummelled last night as Italy teeters on the brink of financial collapse. Furthermore, news that German legislators are looking at options for European nations to stop using the shared currency while keeping European Union membership didn’t help matters. The DAX lost 2.21% to 5,829 while the FTSE fell 1.92% to 5,460. As the bad news piled up, the S&P 500 was smashed lower by more than 3.7% to 1,229 with broad and heavy selling hitting all stocks.

Commodity prices fell as situation in Europe got significantly worse. WT crude oil is fairing well considering the massive falls in equity prices down only 0.54% to $96.30. Precious metals have lost some ground with gold down 1.4% to $1,774 while silver is down 3.00% to $34.10. Soft commodities plunged with wheat, cocoa and sugar down more than 2% while copper plunged almost 4%. The CRV index is down 4.15 points to 318.46. We have the release of the high impact Chinese Trade balance data.

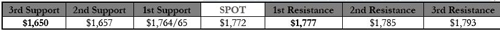

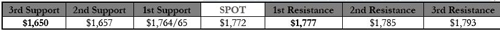

GOLD moved sharply lower in offshore trade as we saw broad selling in equities and commodities as the outlook now looks grim yet again as debt problems look to be out of control right now in Europe and until we see something concrete that could save the region we will see the bears re-enter the market. A sharp rise in the USD and big falls in Copper which are a key indicator to growth and demand pushed commodities firmly lower across the board as safe-haven assets were attacked as well. Gold finished US trade weaker by 1.55% at $1,770. We suspected that even gold would suffer last night as profit taking set-in and the bears re-emerged on the back of rising debt fears in Europe. Nothing concrete has been done to support the region and until we see radical change in the area we will see investor uncertainty re-main. Gold will suffer in the short-term but as we said yesterday, we would be a buyer again towards support at $1,750 with stops just below 41,695 and we would accu-mulate down to wards our stops. Trend support sits around $1,750 so we expect this to halt any weakness and for safe-haven flows to pick up as the USD rise settles. Intra day, offers towards $1,777 should cap and at best we may see $1,785 again. Only a breach back above $1,800 suggests a bottom is in place and we should move towards $1,820/30.

Compass Direction

Short-Term Medium-Term

NEUTRAL BULLISH

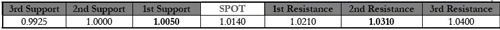

AUD/USD broke through the 1.0330 support line which we had been watching for the last couple of days and when it broke it went with a bang as the pair has fallen down into the mid 1.01’s as the global markets have finally had enough of the Euro holding in as the news out of European continues to send a doom and gloom message. LCH changed the margin requirements of Italian Bonds as they hit new record highs with the mar- ket quickly liquidating as this drove Euro and the European equity markets lower there was nothing for the AUD to do but be smashed as it is a bigger risk currency and risk was off the board today! We close the day at the lows with little sign of a bounce and we are looking at possibly meeting parity even quicker than we expected just yester- day. Australian Unemployment numbers are due during the late morning with expectation slightly lower at +10k last months +20.4k was a surprise and this is almost enough for us looking towards a number back towards zero with full time jobs taking a hit. In any case anything bad will extend the fall for the AUD!

Compass Direction

Short-Term Medium-Term

BEARISH BEARISH

Compass Direction

Short-Term Medium-Term

NEUTRAL BULLISH

AUD/USD broke through the 1.0330 support line which we had been watching for the last couple of days and when it broke it went with a bang as the pair has fallen down into the mid 1.01’s as the global markets have finally had enough of the Euro holding in as the news out of European continues to send a doom and gloom message. LCH changed the margin requirements of Italian Bonds as they hit new record highs with the mar- ket quickly liquidating as this drove Euro and the European equity markets lower there was nothing for the AUD to do but be smashed as it is a bigger risk currency and risk was off the board today! We close the day at the lows with little sign of a bounce and we are looking at possibly meeting parity even quicker than we expected just yester- day. Australian Unemployment numbers are due during the late morning with expectation slightly lower at +10k last months +20.4k was a surprise and this is almost enough for us looking towards a number back towards zero with full time jobs taking a hit. In any case anything bad will extend the fall for the AUD!

Compass Direction

Short-Term Medium-Term

BEARISH BEARISH