The European debt crisis took a decidedly disastrous turn for the worse last night when the almighty Germany failed to receive bids for 39% of the 10 year bonds it had offered for sale causing a shock wave in credit markets that has not yet finished reverberating. This fig-ure is the highest percentage of unsold debt since 1995. The question must be: if Germany is having trouble raising capital, what will happen at the upcoming auctions for other European countries. As credit default swaps on German debt rose, the EUR plunged more than 1.3% to as low as 1.3320.

Faltering European credit markets dominated the headlines with Belgian 10 year yields skyrocketing more than 40 basis points to as high as 5.53%, French yields soared and Greek two year notes jumped to a staggering 120%. Investors are cutting their holdings of European debt aggressively with Japan's largest mutual fund selling its entire holding of Italian government debt in early November. Spain is now paying higher interest than Portugal and Ireland did just before they sought financial bailouts. The developments out of Europe saw in-vestors rush the exits. The Australian dollar was hard hit with aggressive stop loss selling seeing it trade as low as 0.9664 overnight.

US economic data releases didn't help to ease investor concern as consumer purchases, which account for 70% of the US economy, grew by only 0.1% against higher expectations and 0.7% for the previous month. Furthermore, durable goods orders fell more than expected. The developments from both sides of the Atlantic saw share markets plunge. The DAX fell 1.44% to 5,458 while the FTSE was down 1.29% to 5,140. The S&P 500 fell for the sixth consecutive day to close down 2.21% at 1,162. Nine stocks fell for every one that gained on USD exchanges as Bank of America and Citigroup fell more than 3% and Groupon collapsed to 15% below its IPO price.

Commodity prices sunk as yields in Europe rose and data in the US pointed to a further slowing of the world's largest economy. WTI crude fell by 1.55% to $96.50. Precious metals lost ground with gold losing 0.38% to $1,696 while silver lost 3.18% to $32.00. Soft com-modities saw significant falls with soybean and corn hardest hit while copper lost 1.69%. The CRB index has lost 4.2 points 306.73. To-day, there are no data releases of consequence and investors will be focussed on the negative lead from European and American trade.

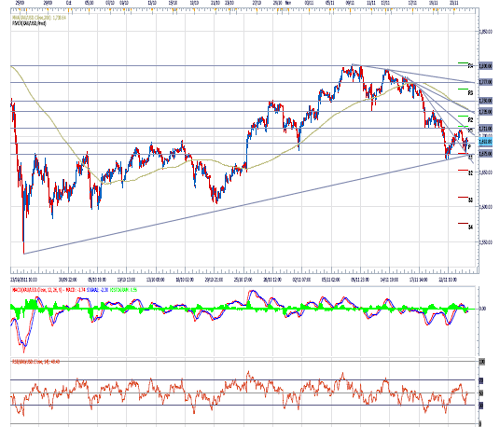

GOLD saw minor decline s in offshore trade and continued to hold up very well in light of heavy USD buying and equities ultimately collapsing. Safe-haven flows are still flowing into Gold but we are seeing top-side pressure remain as we see global markets slide with-out any rebound at all. This is seeing liquidation of nearly every asset and investors are moving further into cash. Gold finished US trade weaker by 0.60% at $1,696. Ulti-mately, we are seeing gold prices remain well bid in the face of another global markets collapse and the only reason we have not seen prices rise dramatically just yet is that we have not seen any consolidation in equity mar-kets or currency markets and we must see these markets settle before gold can really gain. The increased volatility scares off investors and we need some calm before the next big push higher. Support down at $1,675 held per-fectly last night and stops on longs were suggested to be just below this level. We have since move back above $1,690 support and this is a good sign and it looks as though we are now forming a base here. We were slight-ly pre-emptive on turning bullish again and we still need to see a close/break above $1,711 to confirm our short-term view. However, in the long-run, above $1,600 and we are headed higher. Intraday buyer of dips to $1,685 and offers towards $1,711 should cap today.

![]()

AUD/USD continues to tumble as the world looks to be heading into recession as the European leaders fail to plan actions that could possibly save the Euro from breaking up. Ger-many failed to fill its 10year bond auction and with this in mind the German public is already against the one European currency and this looks more than likely to grow! The fear of the markets saw the risk sentiment increase and we know what happens to Aussie when this hap-pens. During the late US morning the AUD hit a low of 0.9665 but late sovereign buying has smoothed the waters somewhat with the pair now bouncing between 0.9680 and 0.9725.

There is no Australia data and with the negative lead of the foreign equity markets and talk of repatriation of funds into Europe, the AUD will most likely continue to decline. Look for sup-port at the overnight low and if broken don’t try and pick bottoms as the fall could gain mo-mentum quickly. A break of the 0.9665 will catch out the bullish buyers!

![]()

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Compass Directions: Morning Report For November 24, 2011

Published 11/24/2011, 02:39 AM

Updated 07/09/2023, 06:31 AM

Compass Directions: Morning Report For November 24, 2011

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.