Brazilian retail giant Companhia Brasileira de Distribuicao (NYSE:CBD) or Grupo Pao de Acucar (GPA) reported sales growth in the second quarter of 2017, driven by solid growth at Assai and continued growth at the Extra banner. Both Multivarejo and Assai continued to gain market share in the quarter.

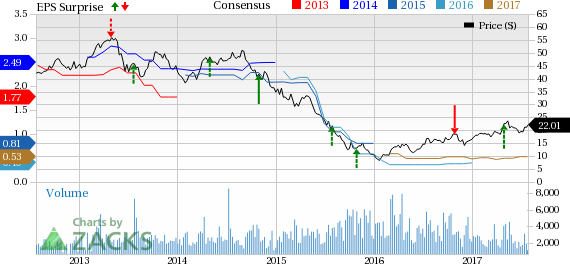

Coming to the share price movement, CBD’s shares rallied 34.0% over the past one year, outperforming the industry’s 2.7% gain.

Results in Detail

In the second quarter, net sales, adjusted for calendar effect increased 9.0% year over year. The improvement was backed by the continued recovery in Extra Hiper markets and consistent growth at Assai. However, the growth was lower than the preceding quarter’s improvement of 9.5% year over year. Comparable store sales (comps) grew 1.2% adjusted for the calendar effect in Multivarejo, while it rose 13.5% in Assai in the second quarter. Inflation levels declined from 5.2% in the first quarter to 2.3% in the second quarter.

Adjusted EBITDA grew 73.4%, while EBITDA margin expanded 340 bps to 9.1%. Excluding non-recurring tax credits, adjusted EBITDA grew 92.8%, while EBITDA margin expanded 210 bps to 4.9%. The growth in EBITDA was driven by higher gross margins posted by Multivarejo and Assaí.

During the second quarter, the company opened three stores, of which two were in the Minuto Pao de Acucar format and one Assai (another four are under construction). The company also converted additional three stores in the quarter, besides 11 stores are undergoing conversion. By the end of 2017, the company expects to complete 16 store conversions and also expects to open six to eight new Assai stores, which are expected to deliver a return of over 20%.

Segment Details

GPA’s brick-and-mortar stores and e-Commerce operations are divided into three business units:

Multivarejo operates in the supermarket, hypermarket and Minimercado store formats as well as fuel stations and drugstores under the Pao de Acucar and Extra banners.

This segment’s net sales remained flat in the second quarter, with comps same-store sales growing 1.2%. Accelerated growth of Extra Hiper, driven by the sequential improvement of non-food categories led to improved performance in the quarter. However, the growth was negatively impacted due to decline in inflation levels and the closure of Extra Hiper stores, which will be converted into Assai stores.

Adjusted EBITDA, excluding tax credits, saw a whooping increase of 82.3% from 2Q16 levels. Adjusted EBITDA margin also expanded 220 bps to 4.9%. Higher gross margin and a decline in selling, general and administrative expenses led to improved performance during the quarter.

Assai operates in the cash-and-carry wholesale segment. GPA Malls is responsible for managing the Group's real estate assets, expansion projects and new store openings.

Net sales increased 27.7% in the second quarter and were up 29.2% excluding the calendar effect, driven by comp sales. Comps grew 13.5%, with strong customer traffic expansion and increase in sales volume, offsetting the effect of the slowdown in food inflation.

Adjusted EBITDA, excluding tax credits, surged 142.4% from 2Q16 levels. Adjusted EBITDA margin also expanded 260 bps to 5.6%, driven by expansion in gross margin and higher dilution of expenses, backed by strong sales growth.

Via Varejo’s operations have discontinued and its bricks and mortar electronics and home appliances stores have come under the Casas Bahia and Pontofrio banners. It falls under the e-Commerce segment.

2017 Outlook

Keeping in view the strong second-quarter results, GPA expects to reiterate its focus on higher-return formats, such as Assai and Multivarejo. The company also expects to renovate stores and focus on conversions of Extra Hiper stores into Assai, in order to strengthen its portfolio. The company also expects EBITDA margin of around 5.5% in the Food segment, supported by higher profitability at Assai and stability at Multivarejo.

Zacks Rank & Stocks to Consider

Companhia Brasileira de Distribuicao currently carries a Zacks Rank #2 (Buy).

Other top-ranked stocks in the retail sector are Deckers Outdoor Corporation (NYSE:DECK) , Caleres, Inc. (NYSE:CAL) and Wal-Mart Stores, Inc. (NYSE:WMT) . All of them carry a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Deckers Outdoor has a long-term earnings growth of 9.8%. Caleres and Wal-Mart have expected long-term earnings growth of 11.0% and 6.1%, respectively, for the next three to five years.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early. See Zacks' 3 Best Stocks to Play This Trend >>

Wal-Mart Stores, Inc. (WMT): Free Stock Analysis Report

Companhia Brasileira de Distribuicao (CBD): Free Stock Analysis Report

Deckers Outdoor Corporation (DECK): Free Stock Analysis Report

Caleres, Inc. (CAL): Free Stock Analysis Report

Original post

Zacks Investment Research