Finally a bit of a breather from the central bank merry-go-round we have been riding over the last week.

A breather that I’ve taken as a chance to reset some of my charts and expand what I’m looking at to encompass some of the pairs I don’t pay a lot of attention to.

Pairs like the Kiwi:

Oh wait, that’s not the NZD/USD chart. Sorry about that New Zealand!

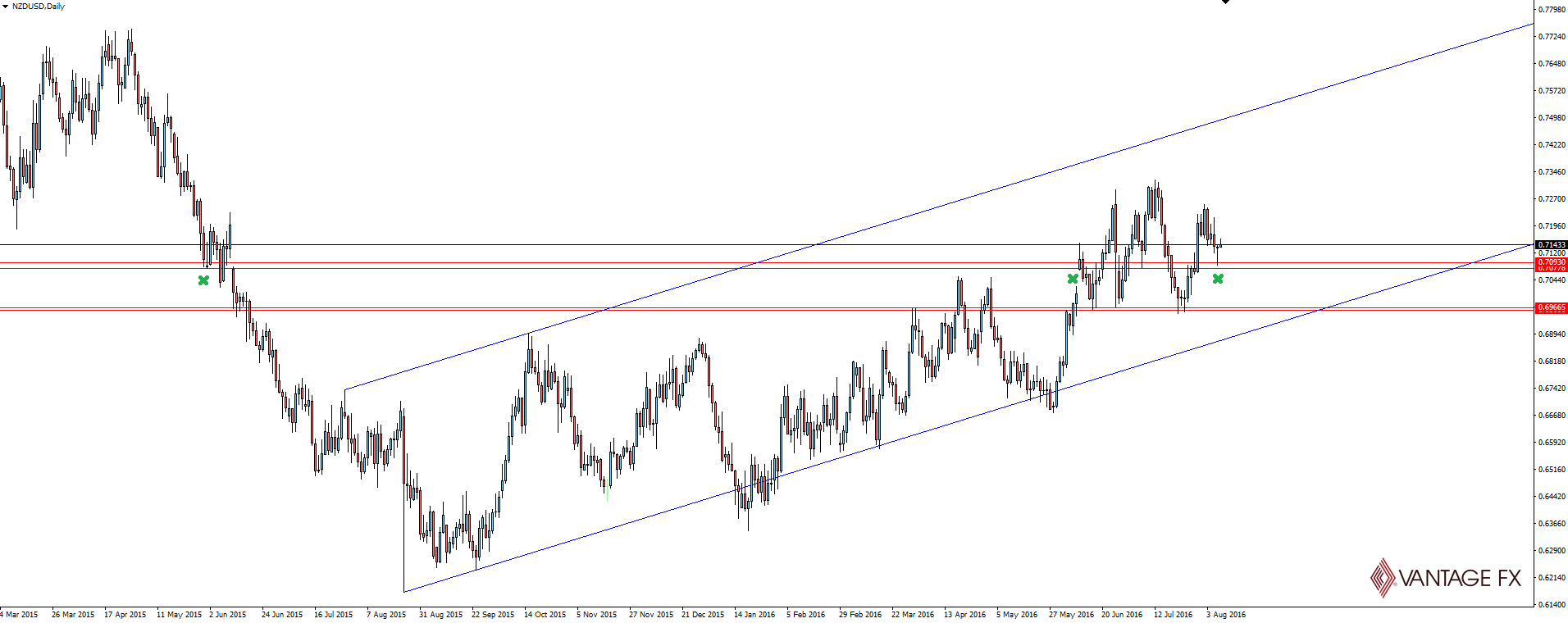

NZD/USD Daily:

There we go, that’s the one.

With the RBNZ expected to cut on Thursday morning, direction will come from any forward guidance in the accompanying rate statement. Expectation seems to be that Wheeler will take a neutral stance heading into the decision and combined with the continual hunt for yield in a low interest rate environment, the pair has continued to rally whether the USD is or not.

The Daily chart shows a clear, higher time frame bullish trend. Something that’s always important to first take a look at before going any further. Add in the markers where a gap also lines up with a past area of interest on the chart, and we have something to start to form a trade around.

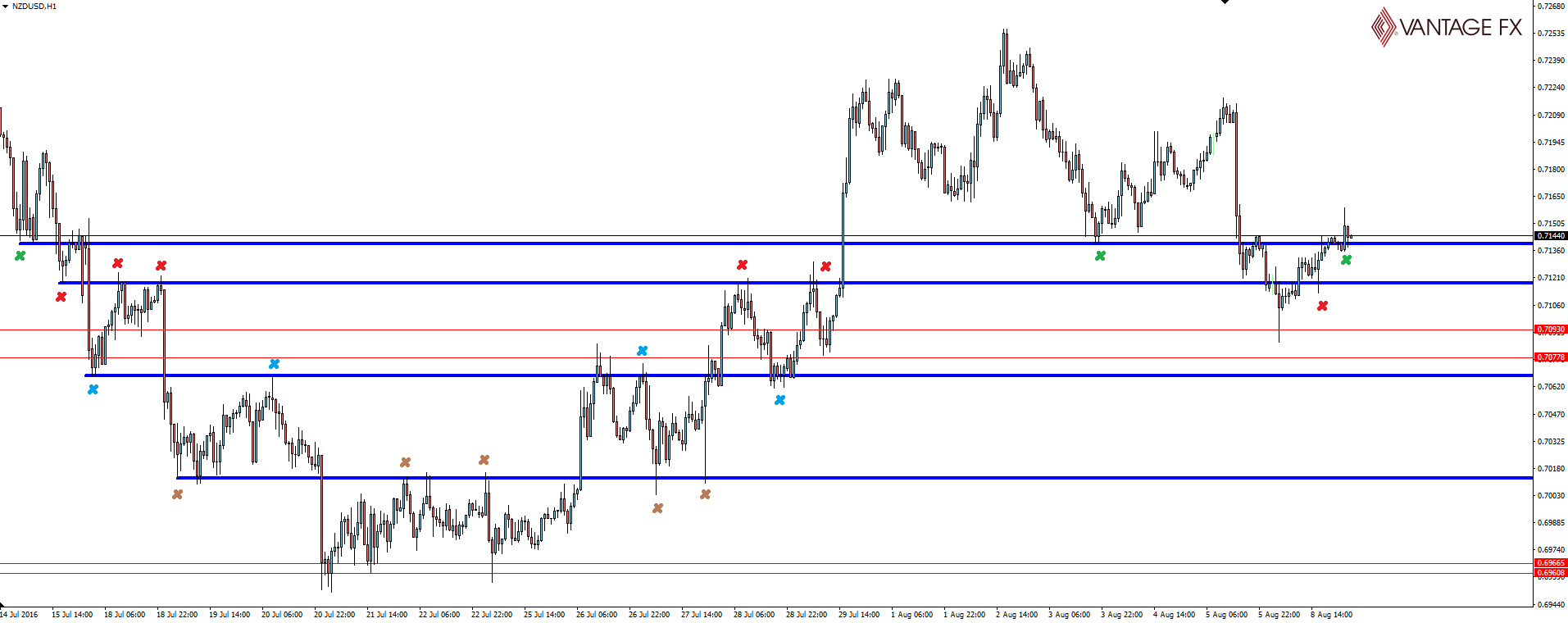

The NZD/USD hourly chart I’ve gone with here might look a little crowded, but enlarge it and bare with me.

The red horizontal lines are the higher time frame levels from the daily chart above, while the thick blue lines are all previous swing lows as Kiwi trended down cleanly around a month ago.

The crosses are colour coded to mark the touches on each line and highlight just how cleanly technical the pair continues to trade. With the latest bounce out of the higher time frame price level, that latest ‘red re-test’ looks like today’s key level which allows us to manage our risk around.

Are you bullish NZD/USD? Share your trading ideas and charts with us at @VantageFX on Twitter.

On the Calendar Tuesday:

AUD NAB Business Confidence

CNY CPI y/y

CNY PPI y/y

GBP Manufacturing Production m/m

Dane Williams – @VantageFX

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Forex broker Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently any person acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the Forex account of the reader. We always aim for maximum accuracy and timeliness, and FX broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.