Community Health (NYSE:CYH) Systems, Inc. CYH continues to be in investors’ good books on the back of its strategic initiatives, divestitures and cost-reduction efforts. Buoyancy in the hospital space also contributes to its growth.

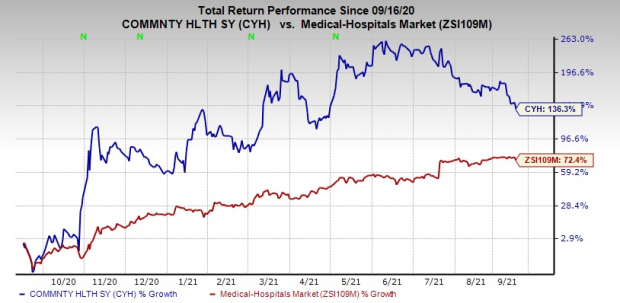

Shares of this currently Zacks Rank #3 (Hold) company have skyrocketed 136.3% year to date compared with its industry’s growth of 72.4%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Image Source: Zacks Investment Research

An aging population, growing demand for healthcare services, reducing expenses and accretive acquisitions are key positives for this hospital company.

Although the hospital industry suffered in 2020 due to the postponement of elective surgeries amid the pandemic, it regained momentum this year on the back of recovering volumes.

In the second quarter, its results gained momentum owing to improved revenues and an uptick in patient volumes. It benefited from the robust recovery of non-COVID-19 patient volume as lesser number of COVID-19 cases were reported in the quarter under review. The company also gained from margin improvement.

Following second-quarter results, the company upped its 2021 outlook. Net income per share is anticipated to be 60-80 cents in 2021, up from the prior outlook of 25-60 cents. Net operating revenues are estimated between $11.9 billion and $12.3 billion, compared with the prior guided range of $11.7-$12.5 billion.

Community Health has been gaining from a series of buyouts over the past many years. It continues to acquire hospitals to expand its number of licensed beds. It generally targets hospitals that cater to relatively non-urban and suburban communities where management can add value through a specialty medical service expansion, economies of scale, additional investment in new technology and an improved process management.

In the first six months of 2021, it spent $4 million on buyouts.

Moreover, the company is consistently adding beds to meet patients’ demand in the areas like Birmingham, Tucson, Naples, Knoxville, Northwest Arkansas, Fort Wayne and others.

In the June quarter, it opened the Knoxville rehabilitation hospital in partnership with Kindred. It also announced a de novo JV project with Select Medical (NYSE:SEM) in Tucson. It has plans to launch another facility in Fort Wayne as a joint venture with Acadia Healthcare (NASDAQ:ACHC). It recently invested in bed and service-line expansions in Birmingham, Naples, Huntsville, Knoxville, et al.

It has a pipeline of activities slated for 2021 and beyond. We expect the company to gain momentum from all these strategic initiatives.

Community Heath also announced certain alliances that will expand its access to post-acute and behavioral health services.

The company continues to divest hospitals on a regular basis. Shedding small assets helps it focus on its core business that comprises large hospitals, which in turn, promises higher returns. This year, the company already sold its Lea Regional Medical Center, Tennova Healthcare (Tullahoma), Tennova Healthcare (Shelbyville) and Northwest Mississippi Medical Center. Given these divestitures, it expects same-store metrics and cash flow to improve.

After the company took certain restructuring measures, it could steadily reduce its expenses. Operating costs as a percentage of net revenues declined to 90.4% as of Dec 31, 2020 from 95.1% at 2019 end. Although the same increased to some extent in the first six months, we expect the metric to decline going forward. The company is constantly monitoring operational activities to cut down on costs.

Further Upside Left?

We believe that the company is well-poised for growth on the back of various initiatives.

The stock carries an impressive VGM Score of A. Here V stands for Value, G for Growth and M for Momentum with the score being a weighted combination of all three factors.

The Zacks Consensus Estimate for the company’s 2021 earnings indicates an improvement of 71.1% from the year-ago reported figure.

Stocks to Consider

Some better-ranked stocks in the medical space are Acadia Healthcare Company, Inc. ACHC, Universal Health (NYSE:UHS) Services, Inc. UHS and HCA Healthcare (NYSE:HCA), Inc. HCA, each carrying a Zacks Rank #2 (Buy), currently.

Acadia Healthcare, Universal Health and HCA Healthcare have a trailing four-quarter earnings surprise of 26.14%, 29% and 11.65%, respectively, on average.

Time to Invest in Legal Marijuana

If you’re looking for big gains, there couldn’t be a better time to get in on a young industry primed to skyrocket from $17.7 billion back in 2019 to an expected $73.6 billion by 2027.

After a clean sweep of 6 election referendums in 5 states, pot is now legal in 36 states plus D.C. Federal legalization is expected soon and that could be a still greater bonanza for investors. Even before the latest wave of legalization, Zacks Investment Research has recommended pot stocks that have shot up as high as +285.9%.

You’re invited to check out Zacks’ Marijuana Moneymakers: An Investor’s Guide. It features a timely Watch List of pot stocks and ETFs with exceptional growth potential.

Today, Download Marijuana Moneymakers FREE >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Universal Health Services, Inc. (UHS): Free Stock Analysis Report

Community Health Systems, Inc. (CYH): Free Stock Analysis Report

HCA Healthcare, Inc. (HCA): Free Stock Analysis Report

Acadia Healthcare Company, Inc. (ACHC): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research