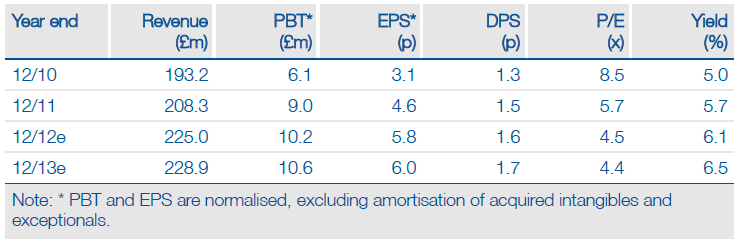

While the market is focused on economic uncertainties, Communisis’s corporate performance remains sound, as its trading statement emphasises. We expect EPS growth of 26% in 2012, reflecting new business wins, investment and cost cutting as the strategy unfolds. Acquisitions (such as today’s TGML) should help attract new business. The shares are on a humble rating in view of the performance and the prospects.

Communisis reports that trading since the last IMS (2 May) has been encouraging, with the pipeline of opportunities remaining strong, and it remains positive about first-half trading. Our estimates are unchanged.

Communisis has acquired 49% of The Garden Marketing Limited (TGML) for £0.4m with an option to acquire the balance for about £0.6m. TGML is a small (£1m of revenues) full service, integrated marketing agency. It specialises in lead creation and collateral marketing communications, largely for financial services and technology clients, which include Lloyds TSB, Legal &General, Ricoh and Cisco. The deal enhances further the group’s creative services operations and follows the acquisition in May of Kieon (a website and app developer) and Yomego (a social media agency).

Since our note on 3 May, the shares have fallen by 25%. For 2012, this leaves the shares on a discount of 69% to the Support Services sector and 61% to the FTSE Small Cap Index (2013: 67% and 46%). The market is clearly focused on macroeconomic concerns, but at some point the focus will switch to corporate performance, the low P/E and the well-covered (3.6x) and rising dividend. The NAV is 93p (end December 2011).

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Communisis: Acquisition, Trading Update

Published 06/20/2012, 08:01 AM

Updated 07/09/2023, 06:31 AM

Communisis: Acquisition, Trading Update

Trading Continues Positive

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.