erased early losses to finish marginally higher on the day. Continue to use the 9 and 18 day MAs as your pivot points which currently comes in at $104.80/104.90 in September. Though I am not ruling out a test of $108 I prefer bearish exposure with clients. As for the products I lightly worked back into some crack spreads, long RBOB and short heating oil at 10 cent premium to heating oil. I am looking for 300-400 points in the next few sessions. Both products appear to be supported at their 50 day MA and under that level the 100 day MA should be the line in the sand. Natural gas probed its 8 day MA but failed to close above that pivot point. Finishing 2.48% higher on the day but $3.33 will need to be taken out to see further upside. I’m still expecting a closure of the gap from 7/26 which would lift current trade approximately 9%.

Stock Indices: The S&P pared losses to finish 12 points off its lows and just off its intra-day highs. All trade under 1675 in September futures have been supported for the last three weeks - will this continue? Until 1700 is reclaimed I am mildly bearish. Dow futures found support just under 15300 finishing in up just shy of 100 points off its lows. 15500 is my bull/bear line in this index. The sentiment remains extremely bullish but when the ship is leaning so heavy in one direction I get leery.

Metals: Gold penetrated its 50 day MA to end up 1.68% on the session as futures are approaching $1350/ounce - a resistance level since prices broke that level on the way down on 6/19. I missed this leg and quite frankly did not anticipate this move for clients. A close above $1350 the next few days will get me interested enough to price out bullish trades. A settlement back below $1300 would put me back in the bear camp. Today’s chart of the day was silver which closed 4.57% higher and above its down sloping trend line for the first time since February. A trade back to the 50 day MA that holds would get me probing bullish trades for clients, in September that level is $20.25.

Softs: A higher high and higher low in cocoa which has gained for eight of the last ten sessions. I think we are in the 8th or 9th inning and see a retracement around the bend. My suggested way to probe bearish trade is buying put options. Sugar was higher by just over 1% to close at 7 week highs. Continue to buy dips that remain above the 50 day MA in 14’ contracts. Cotton leapt 1.29% to trade above 90 cents for the first time in 13’. On two previous attempts in June and March trade was rejected at this level. A bullish USDA report contributed but I see very little gas in the tank. I will be pricing out bearish plays in the coming sessions. OJ gave up 2.64% and on its lows completed a 61.8% Fibonacci retracement. OJ is lower by 15 cents in the last 2 weeks and has moved enough for me to close out all my clients’ bearish trades at a profit. If we find some buying interest around $130 I will probe bullish trades with clients and go the other direction…stay tuned. No freeze damage in coffee reported as of yet but we did grind higher gaining 6 out of the last 7 sessions. Today futures closed above the 50 day MA for the first time since 5/9. Kevin Davitt and I release a monthly coffee report written with one of our clients Rao Achutuni was finished today and will be published tomorrow. Anyone that would like to read this specialty piece contact me. I continue to like bullish exposure in December with options protection.

Treasuries: A mid-day reversal in Treasuries has bullish debt traders on their heels. With the USDA report behind us now weather is the determining factor. 30-yr bonds closed under their 20 day MA but the 9 day MA did hold at 133’20. A settlement under that level and it would suggest lower trade. Same tune in 10-yr notes with their respective pivot points at 134’6 followed by 133’20. Use these pivot points to help navigate entry and exit whether playing bullish or bearish trades. Flat line in Eurodollars but my advice remains the same, work into bearish trades in 16’ contracts looking to add length ahead of next month’s FOMC.

Livestock: A higher high and higher low in live cattle but the ascent seems to be slowing. Those in bullish trade should stay the course but be trailing stops. As long as the 9 and 20 day MAs hold sentiments remain bullish. The problem being I do not know if I’d be willing to give back that much as those MAs are 1.25% under current trade. Lean hogs found support at their 9 and 20 day MA to rally 1.44% lifting future near their recent highs. Those short futures should be long calls in case we do get a breakout higher. A trade above 87 cents in October I’d suggest cutting losses.

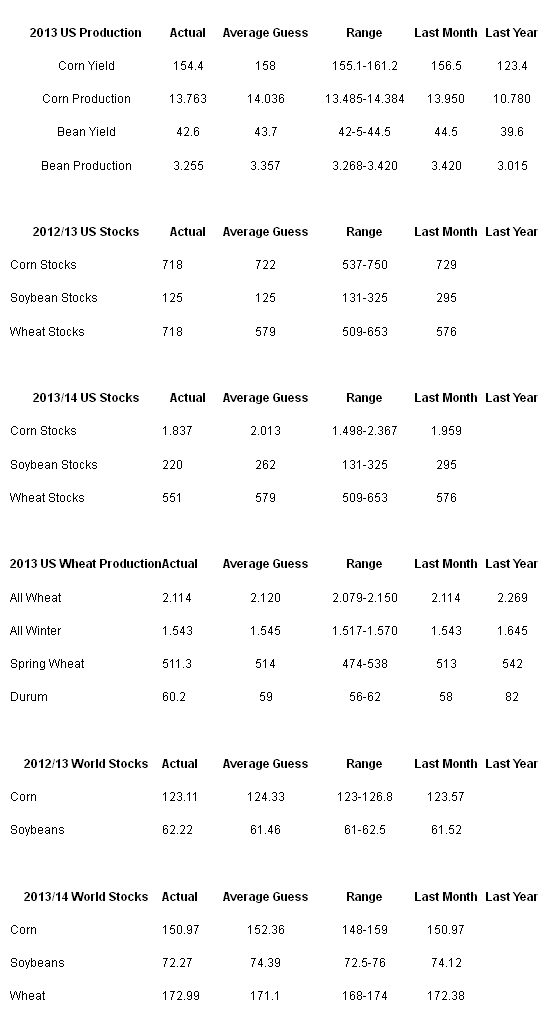

Grains: There was a bullish reaction to today’s USDA report…let’s look at the numbers.

HIGHLIGHTS

- Bean yield and production well below trade estimates, but US and world ending stocks still well above year ago levels. Weather moving forward is more important than anything on the report.

- Corn ending stocks well below trade guess for next year, but ending stocks above 1.8 bbu, still comfortable especially compared to the last few years.

- Wheat report not bearish, but nothing overly bullish either.

In regards to trade ideas I will touch on corn, soybeans and wheat tomorrow. Outside of that in this complex I like soybean oil. I’ve suggested of late selling December puts and I still like that course of action. Futures gained 2.08% today and closed above their 9 day MA. Friday could serve as an interim low…stay tuned.

Currencies: The dollar picked up slightly today as I think we stage a rally from here lifting September to 82.25/82.50. I’m operating under the influence traders can probe bearish plays in the Pound, Swiss and Euro with stops above the recent highs. I did analyses last week on a bearish plays in the Pound via option, read that post from last week. The commodity crosses were also hit today even in face of rising energy and metals prices…could that be a tell? The Yen has started to move lower...take off all remaining bullish trades.

Risk Disclaimer: This information is not to be construed as an offer to sell or a solicitation or an offer to buy the commodities and/ or financial products herein named. The factual information of this report has been obtained from sources believed to be reliable, but is not necessarily all-inclusive and is not guaranteed to be accurate. You should fully understand the risks associated with trading futures, options and retail off-exchange foreign currency transactions (“Forex”) before making any trades. Trading futures, options, and Forex involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more than your initial investment. Opinions, market data, and recommendations are subject to change without notice. Past performance is not necessarily indicative of future results. This report contains research as defined in applicable CFTC regulations. Both RCM Asset Management and the research analyst may have positions in the financial products discussed.