As was highlighted last week in Gentlemen, Start Your Printing Presses!, the key theme since 2011 has been declining inflation and economic growth rates. Lower inflation and weak economic growth is not the environment that favors investments in commodities or commodity-sensitive currencies (CAD, AUD). Amid increased deflation fears, global capital has sought refuge in the USD, leading to a dollar rally since 2011, which has pressured commodities. However, this two year disinflationary trend is getting stretched where sentiment is overly pessimistic on commodities and commodity-sensitive currencies while overly bullish on the USD. As I argued previously, we now have an environment conducive toward renewed easing by global central banks, which may produce a very violent and strong recovery in commodities caused by short covering.

Sentiment At Extreme Levels

As mentioned above, it’s been a near one-way street since 2011 with the CRB Commodity Index declining while the USD has been rallying as seen below (Note: USD shown in black and inverted for directional similarity).

This two-year trend has pushed sentiment toward commodities to an extreme and we are likely at or near a major inflection point. One way to measure sentiment is by using the Commitments of Traders Report (COT) published every Friday by the Commodity Futures Trading Commission (CFTC). COT reports break out positions by commercials (considered “smart money”) and non-commercials or speculators (“dumb money”).

By examining the net position of non-commercials relative to total open interest we can examine sentiment where large net short positions relative to open interest typically marks bottoms as sentiment gets too bearish, while large net long speculative positions relative to open interest typically marks tops as sentiment becomes too bullish.

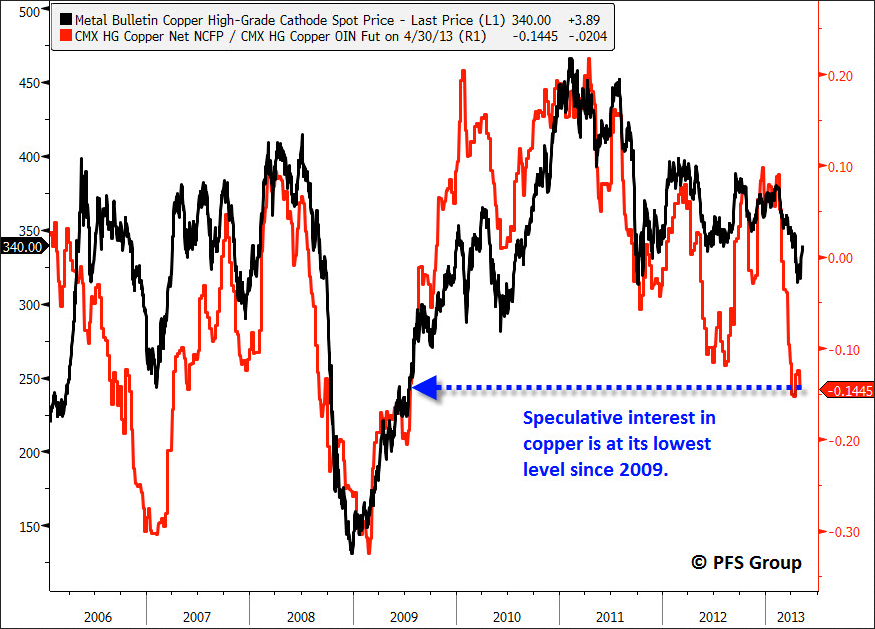

Copper

Looking at net speculative positions in copper shows that sentiment is the most bearish it has been since 2009 and we may be due for a rally as sentiment appears stretched to the downside.

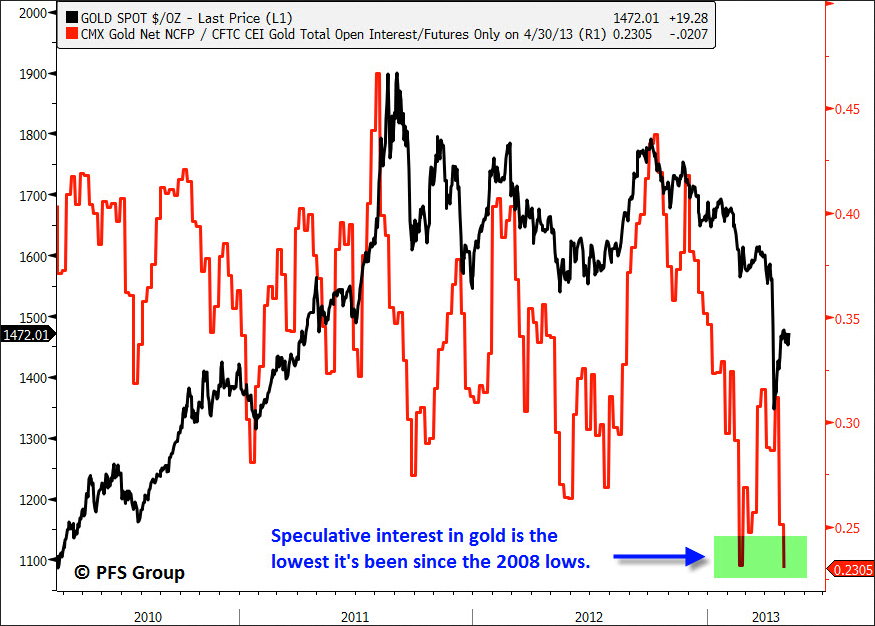

Gold

Looking at gold shows a similar picture with net speculative interest in gold at the lowest levels since the late 2008 lows in gold, a clear reversal of the 2011 and late 2012 highs in which bullish speculative interest hit multi-year highs.

Silver

Sentiment toward silver is also at a bearish extreme with the last time we saw sentiment at these levels silver rallied nearly 35% over a few months in late 2012.

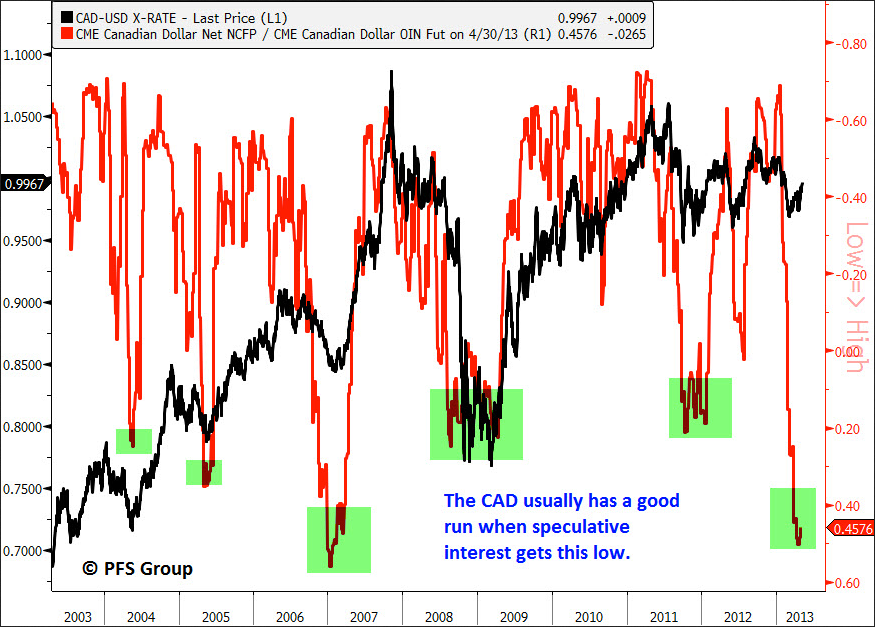

CAD

The Canadian Dollar (CAD) may be the poster child of bearish sentiment as net speculative positions relative to open interest is at its lowest levels since early 2007. After reaching these levels back in 2007 the CAD rallied strongly relative to the USD heading into the 2008 commodity peak. With sentiment this bearish on the CAD, the downside is probably limited.

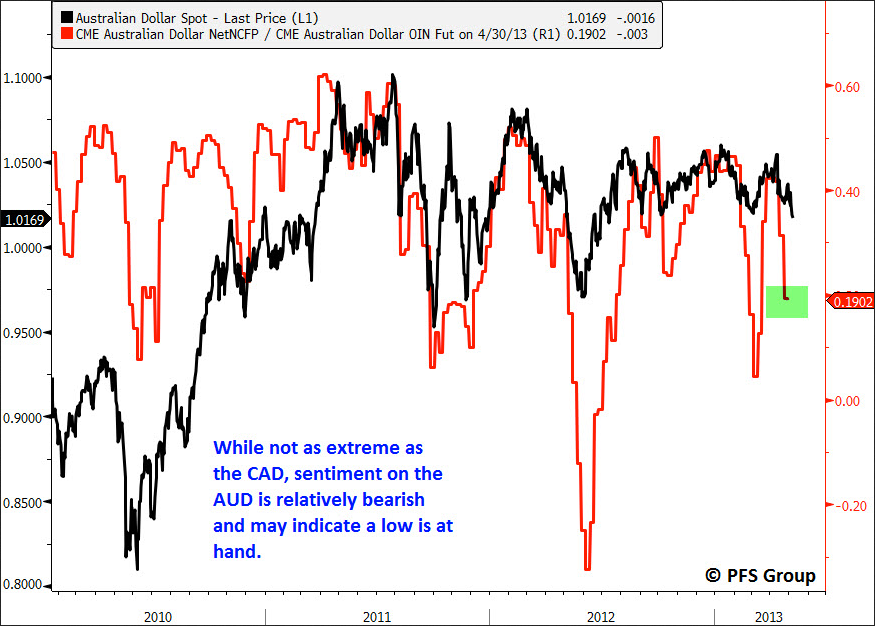

AUD

Not quite as extreme as the CAD, the Australian Dollar (AUD) appears to be near the lower end of sentiment swings of the last three years and may be attempting to bottom.

USD

In contrast to the bearish sentiment above, sentiment toward the USD is close to a five year high with current levels typically associated with meaningful tops in the USD.

Summary

Sentiment toward commodities, commodity-sensitive currencies and the USD are at extremes and it wouldn’t take much for sentiment to swing in the opposite direction. As argued last week, renewed central-bank easing globally may be the spark to bring a commodity rally on renewed hopes of global growth accelerating from depressed levels. Central banks certainly have the latitude to expand monetary stimulus amidst low growth and low inflation and they’ve certainly shown a willingness to print as the past few years have shown. If global growth does accelerate and central banks expand their balance sheets, the commodity-coiled spring is likely to lead to a strong rally and may be one of the key investment themes for the rest of the year.