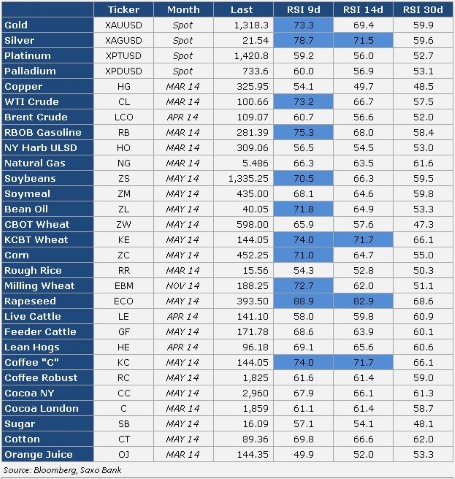

The Relative Strength Index (RSI) is a technical-momentum indicator which attempts to determine when a market is in an overbought or oversold condition. It is deemed to be overbought when above 70 and oversold when below 30, but traders often have individual preferences and set their parameters accordingly. The default setting by most traders for the RSI is 14 days. RSI is best used as a valuable complement to other individually preferred technical tools.

The continued rally across the different commodity sectors has set the broad-based DJ-UBS commodity index on track for its best monthly performance since July 2012. As a result we are seeing the RSI monitor beginning to light up as several commodities have begun to move into overbought territory.

The metal sector is being led by silver which is now in need of consolidation after jumping almost 7 percent over the past week. The same goes for gold which has become overbought for the first time since last August. In order to maintain the positive momentum, both metals will now be focusing on holding onto support at their 200-day moving averages at 1,303 USD/oz on gold and 21.04 USD/oz. on silver respectively.

WTI crude has been supported by a very cold winter which has lifted demand for products such as heating oil together with expectations that demand in China and the US, the world's two biggest consumers will remain strong. Stockpiles at the former bottleneck of Cushing, Oklahoma have begun to shrink as increased pipeline infrastructure is now moving oil away from the delivery hub for WTI crude oil. This is also assisting the ongoing reduction in the arbitrage between the two global benchmarks of WTI and Brent crude.

Adverse weather in both North and South America has been the biggest drivers behind the gains seen across the agriculture sector this past month. Kansas and Chicago wheat have both been supported by the risk of winter kill across the US Midwest while soybeans is supported by reduced yields in South America caused by hot and dry weather in Brazil and persistent rain in Argentina in recent weeks. Corn has been supported by very strong export demand due to competitive prices with Reuters reporting that US corn exporters have booked almost 12 percent of their annual shipments in just three weeks, the strongest such run in six years.

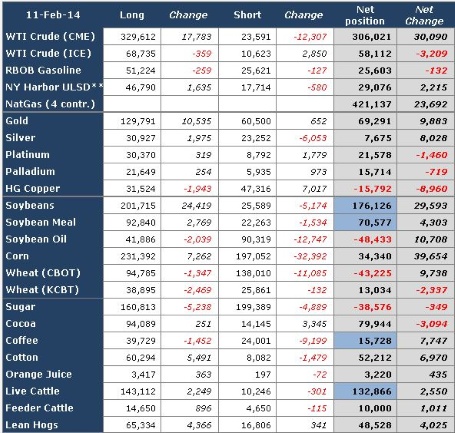

The speculative net-long positions held by hedge funds have risen strongly on the back of the fundamental supporting news, so much that hedge funds during the latest reporting week of February 11 were net-buyers of 11 out of 14 agriculture commodities.