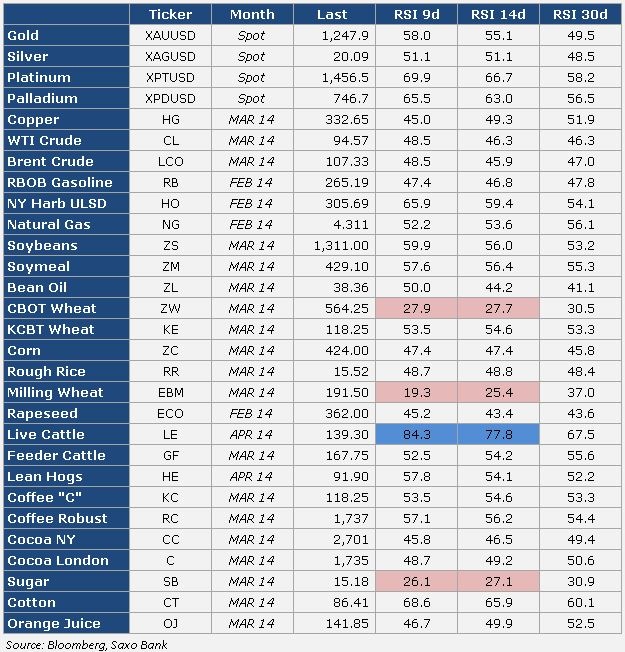

Relative Strength Index (RSI) is a technical-momentum indicator which attempts to determine when a market is in an overbought or oversold condition. It is deemed to be overbought when above 70 and oversold when below 30, but traders often have individual preferences and set their parameters accordingly. RSI is best used as a valuable complement to other individually preferred technical tools.

Only a few markets are currently considered to fall into these categories and they all belong to the agriculture sector. Wheat prices both in Chicago and Paris have been under some considerable selling pressure over the past week as bulging global supplies weigh on the price. CBOT wheat has fallen to the lowest since July 2010 but signs of demand from top importers such as Egypt could help put a floor under the market.

Sugar has moved in and out of oversold territory for the past few months and the latest move lower was triggered last week by news that India, a top global producer, was going to unleash 4 million tons into an already oversupplied global market over the next couple of years.

Live cattle for April delivery remains the only overbought commodity out there at the moment. The price for beef in the cash market continues to trade at a premium to the April futures and as long this unusual situation remains the future price will remain supported.