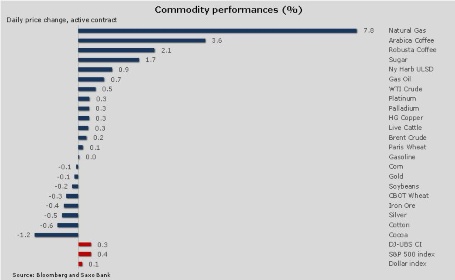

It has been a relatively quiet day so far with stocks in both sides of the Atlantic hovering close to unchanged while the dollar remains range-bound after the recent sell-off. Commodities have also been struggling to gain any traction with the major movers still primarily being driven by weather developments in Brazil and the US East Coast.

US natural gas for March delivery has risen to a four-year high just shy of USD 6 per therm as forecast for intense cold weather into March continue to erode inventories already at a ten-year low. The risk of periodic shortages due to high consumption is creating havoc with regional cash prices on the East Coast reported to have briefly surged above USD 100 per therm.

Coffee and sugar are still being supported by dry conditions in Brazil which yesterday led to an 8.8 percent rally in Arabica coffee, the biggest one-day rally in ten years. The price is currently up by 44 percent year-to-date and the move has now grabbed the attention of the general press with news articles highlighting the violent spike. The move has to a large extent been driven by speculative buying and although it is too early to talk about a bubble, as long the news from Brazil remains supportive, the fear of a correction will begin to build.

WTI crude is outperforming Brent crude for a second day in a row with the discount staying below USD 8/barrel. The weekly inventory report due Thursday, one day later than normal due to Presidents day Monday, is expected to show another draw in inventories at Cushing, Oklahoma. This combined with unseasonable strong demand for distillate products have led to performance today.

Gold is trading sideways for a second day after the technical buying following the break higher on Friday seems to have run its course. Traders who filled their boots on the break are now looking for a driver to carry the price forward with a failure to do so raising the risk of some long liquidation. A weaker housing starts in the US failed to create any buzz as traders concluded that the current cold winter was to blame. Silver has now officially posted the longest rally in at least 45 years, according to Bloomberg and as a relative trade to gold the ratio on XAUXAG has fallen to 60.4 ounces of silver before finding support.

Ole Hansen is widely recognised as an industry-leading analyst on commodities. To read more of Ole's commentary, click here on our social trading platform.