New Zealand commodity prices fell in June

New Zealand export commodity prices fell 19.7% from a year ago, led by falling aluminium and dairy prices. The index contracted for the third straight month by 3.1%m/m in June while previous reading was revised lower to -4.9% from -4.7%. Dairy prices declined by -4.4%m/m, Aluminium by -6.4%m/m while meat, skins and wool prices decreased by -3.4%m/m. However, thanks to a weaker NZD that reduced significantly the negative impact of lower world prices. Once converted to New Zealand dollar, prices rose 2.9%m/m while the fall in aluminium price was reduced to -0.5%m/m.

All in all, we do not expect the outlook to improve substantially over the medium-term as demand from China is expected to remain subdued while demand for dairy products will likely be weak as Russia maintained its ban on dairy imports. We therefore expect the RBNZ to support further the Kiwi economy - especially since inflation remains at record low - by cutting further its official cash rate by 25bps at its next meeting on July 23. NZD/USD validated a break of the 0.6795 support and is currently heading toward the following one lying at 0.6561. Since the market is pricing another rate cut for 2015, this support should therefore not offer too much resistance.

US NFP eyed

Non-farm payrolls and unemployment rate are due later today. Those data are well considered and an adverse outcome will diminish speculations about a September rate hike. US NFP are expected to come in lower than next month at 233K vs 280k. However, Tuesday’s ADP came in largely above expectations at 237K vs 218K median forecast. Despite spectacular misses over the last few years, it has been often a good indicator of US non-farm payrolls.

For the time being, even if the traders are focused on the Greek referendum, markets will considerer closely those data in order to assess the likelihood of a rate hike in September. Over the last few months, US data came in mixed, both strong (NFP) and disappointing (home sales, consumer expectations). The pressure is now on the job market as a rate hike in September is highly dependent of a sound labour market. Furthermore, good NFP will keep on fuelling a virtuous circle that will increase consumer confidence and consumer spending which will be necessary to reach the 2% inflation target. Before increasing rates, the Fed wants to feel more confident about achieving the 2% inflation target.

This is why we think that good job figures will not be sufficient for markets to correctly price in a September rate hike. We need an additional inflation pressure. June CPI figures will be released in a couple of weeks. It will provide reasonable grounds that the 2% target is reachable. Without those basics, the Fed will take a huge risk increasing the rate. Aside inflation figures, Q2 GDP will give the final point of rate hike speculations for September and markets will start considering 2016 as a decent outcome.

EUR/USD price action is driven by Greece’s referendum, however against a backdrop of US recovery, the pair should gain downside momentum. As long as there are serious talks of increasing rates, the greenback will strengthen.

Gold - Approaching support at 1159

The Risk Today

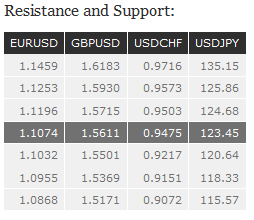

EUR/USD is decreasing. Hourly resistance is at 1.1278 (29/06/2015 high). Stronger resistance lies at 1.1436 (18/06/2015 high). Hourly support is given at 1.0868 (28/05/2015 low). We expect the pair to stabilize below 1.1100. In the longer term, the symmetrical triangle from 2010-2014 favors further weakness towards parity. As a result, we view the recent sideways moves as a pause in an underlying declining trend. Key supports can be found at 1.0504 (21/03/2003 low) and 1.0000 (psychological support). Break to the upside would suggest a test of resistance at 1.1534 (03/02/2015 reaction high).

GBP/USD is still trading between the hourly resistance at 1.5930 (18/06/2015 high) and 1.5542 (167/06/2015 low). We expect the pair to gain upside momentum and to challenge again the resistance at 1.5930. In the longer term, the technical structure looks like a recovery bottom whose maximum upside potential is given by the strong resistance at 1.6189 (Fibo 61% entrancement).

USD/JPY is now increasing. Hourly resistance can be found at 124.45 (17/06/2015 high) and hourly support is given at 121.94 (30/06/2015 low). We expect the pair to gain momentum to reach back the resistance at 124.45. Key resistance still lies at 135.15 (14-year high). A long-term bullish bias is favored as long as the strong support at 115.57 (16/12/2014 low) holds. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) is favored. A key support can be found at 118.18 (16/02/2015 low).

USD/CHF is heading toward the hourly resistance at 0.9543 (27/05/2015 high). Stronger resistance can be found at 0.9721 (23/04/2015 high). Hourly support can be found at 0.9072 (07/05/2015 low). We expect the pair to test the stronger resistance at 0.9543. In the long-term, there is no sign to suggest the end of the current downtrend. After failure to break above 0.9448 and reinstate bullish trend. As a result, the current weakness is seen as a counter-trend move. Key support can be found 0.8986 (30/01/2015 low).