This article aims to provide forecasts for commodity prices (world bank’s Pink Sheets) for July 2016. The Pink Sheet is a monthly statistical report on prices of major agricultural commodities: metals, minerals, energy and fertilizers (1960-2016).

Monthly prices for the series are published at the beginning of each month. The Pink Sheets for July 2016 will be released on August 3, 2016. The prices are positively correlated with the futures prices (see article for the May forecasts). Because of both high positive correlation and accuracy of forecasted values, it is recommended to check the values provided in this article. They can be used for identifying price trends of commodity futures.

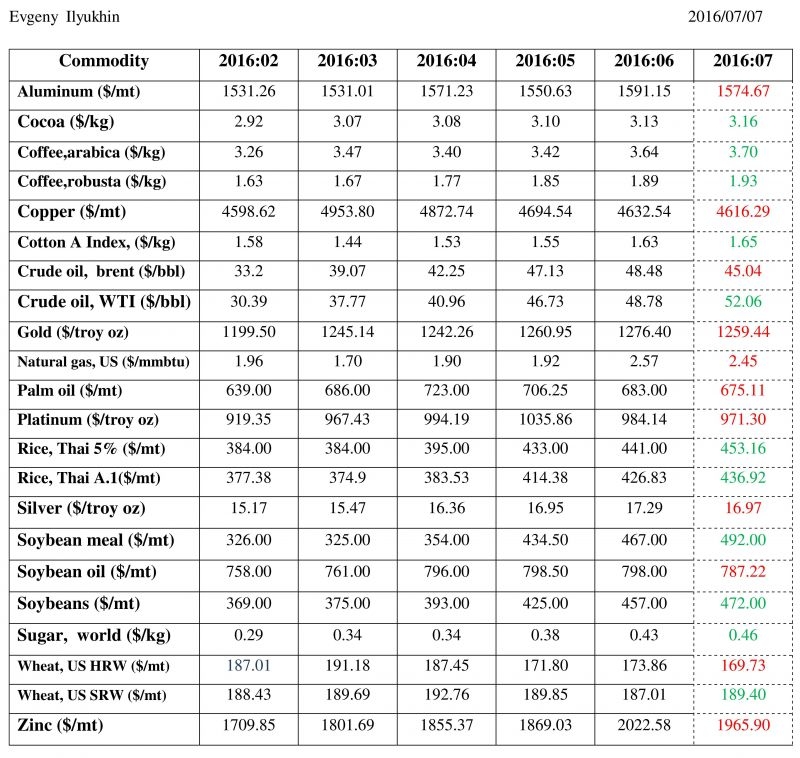

The monthly commodity prices in nominal US dollars over the period from February 2016 to June 2016 (world bank’s Pink Sheets) and forecasted period (author’s calculations) for July 2016 are presented in the table below (futures related commodities are presented only).

Forecasts are projected with an Autoregressive Integrated Moving Average (ARIMA) model based on monthly historical data that is relevant for calculations. Commodities are placed in alphabetical order. Forecasted values: increase in green; decrease in red. It is advised to use forecasted values for identifying the short-term price trends over the period firstly.

The notable positive changes are expected for Sugar (6.98%), WTI Crude Oil (6.72%) and Soybean Meal (5.35%).

Brent Crude Oil (-7.10%), Natural Gas (-4.67%) and Zinc (-2.80%) will likely drop in price over the period.