U.S. Dollar Trading (USD) we saw some USD strength overnight as commodities including Gold and Oil fell during the US session. Moves were relatively small though with many traders sitting on the sidelines ahead of the Jackson Hole Speech tomorrow. US Pending house Sales gained 2.4% m/m in July and follows a series of stronger housing data releases lately. Looking ahead, July Personal Income forecast at 0.3% vs. 0.5% previously. Weekly Jobless claims forecast at 370k vs. 372k. previously.

The Euro (EUR) some discord between European leaders appeared overnight with differences of opinions the role of the ECB. Italy’s Monti and Germany’s Merkel have different views on the ESM getting a banking license and borrowing from the ECB. Another fierce Critic of the ECB intervening in the bond market who has been quite vocal in his opposition is the German Central Bank Governor (BUBA) Weidmann. The Sterling (GBP) Cable was stronger than most holding above 1.5800 and testing 1.5850 yesterday as traders remain bullish. GBP/AUD is continuing to rally and is pushing towards 1.5300. Looking ahead, German August Unemployment Change forecast a t8k vs. 7k previously. Also July UK Mortgage Approvals forecast at 47k vs. 44.2k previously.

The Japanese Yen (JPY) USD/JPY was supported making small gains overnight as traders hedge bets on Bernanke’s speech tomorrow. EUR/JPY and GBP/JPY are supporting the major but AUD/JPY is following commodities lower and dampening the sentiment of the Japanese Carry Trade. Australian Dollar (AUD) the AUD/USD is getting a lot of attention in recent days with the China slow down story getting worldwide press and Iron Ore Prices tumbling as demand from China slumps. Large mining companies in Australia are falling heavily as the market gets spooked on the outlook. Q2 CAPEX was still strong at 3.4% vs. 2.4% forecast.

Oil & Gold (XAU) Gold fell sharply to $1655 as profit takers booked more trades from the recent run. OIL/USD fell back as commodities in general retreated. Support was found at $95 the same level as Monday’s trade.

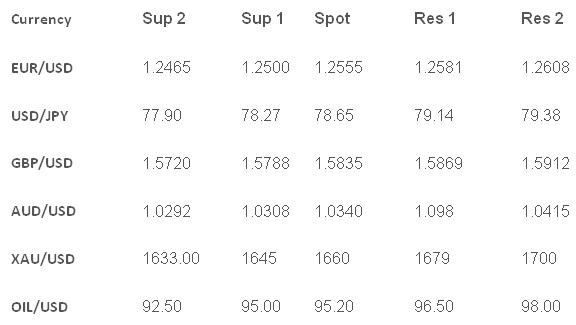

Pairs to watch

EUR/USD range trading until Jackson Hole Speech?

OIL/USD to hold at $95 or further pullback?

TECHNICAL COMMENTARY

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Commodity Linked Currencies Under Pressure

Published 08/30/2012, 07:14 AM

Updated 03/09/2019, 08:30 AM

Commodity Linked Currencies Under Pressure

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.