Commodities have been strong for weeks now, but the price gap (marked in red) represents, to my eyes, an important point of resistance.

More specifically, the largest component of the DBC instrument, crude oil (shown here as USO)) has been the driving force behind DBC’s strength. Take note, however, that this has only accomplished something done multiple times already: marked another “lower high”.

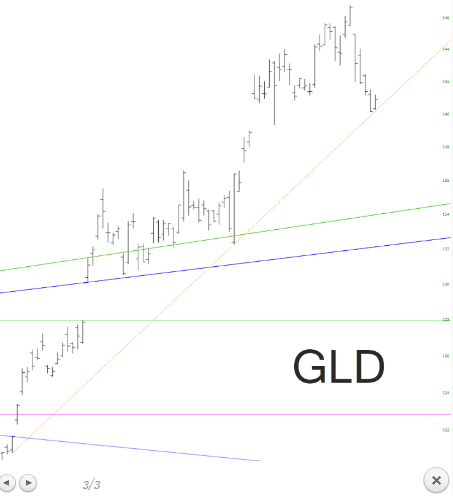

Another component of DBC, gold (shown here via GLD) is at risk but, for the moment, teetering on its supporting, ascending trendline. My opinion about oil (bearish) has more conviction than my opinion about precious metals.