Crude Oil's bounce early this week, had short sellers scrambling from their positions but the reality is that the respite will be short lived. Global prices are forecast to continue their slide in a move that provides a gloomy future outlook for the commodity currencies.

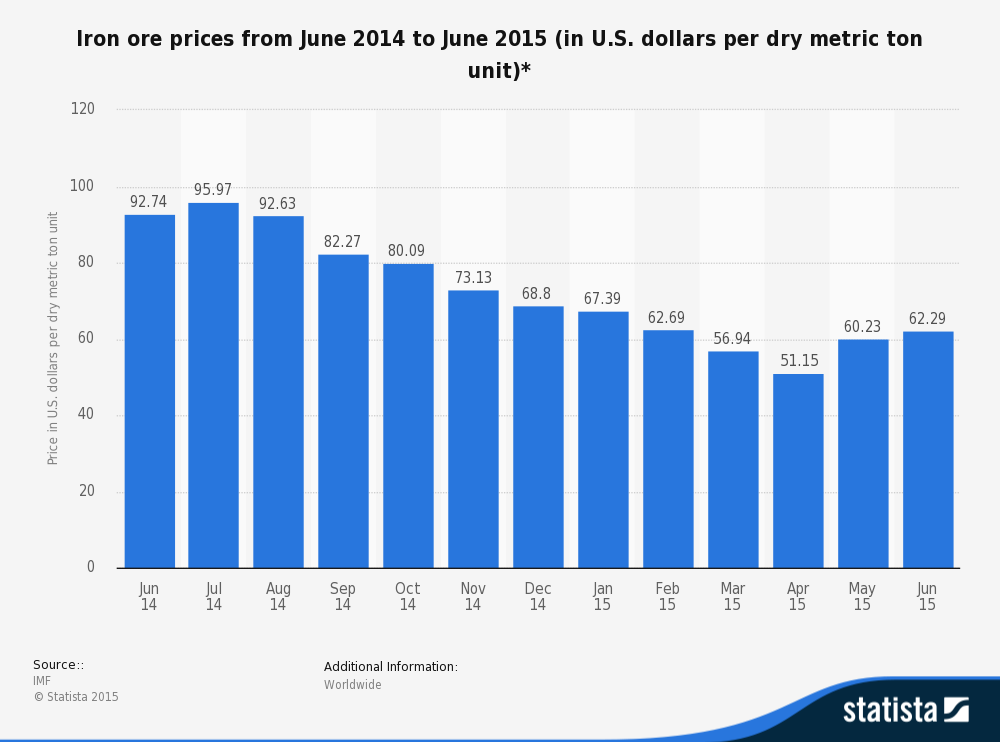

The Australian, Canadian, and New Zealand dollars have all experienced a significant selloff throughout the year and subsequently retreated to levels not seen since the onset of the global financial crisis. In particular, Australia is dealing with a sustained fall of iron ore prices and an economy highly focused upon the mining industry. In comparison, New Zealand and Canada are also experiencing a significant downturn in their major export industries, dairy and oil.

The respective nations are all grappling with economies highly concentrated toward commodity production and exports. The reality is that currencies like the Australian and Canadian Dollar are facing further down-side risk, especially considering the potential for a significant domestic slowdown in China. In fact, forecasting by some analysts has highlighted the risk of a 14% drop to the CAD based on falling energy sector demand.

The other looming risk on the horizon to commodity currencies is a hawkish U.S. Federal Reserve intent on raising interest rates. The negative correlation between the US dollar and the aforementioned currencies is clear as they both start to trend in opposite directions. Subsequently, the U.S. talk of raising rates is fuelling an, already substantial, short bias of currencies reliant upon commodities.

Long term forecasting of commodity prices is also adding to the case for further depreciation of the Canadian and Australian Dollar. In particular, long-run Iron Ore predictions show the commodity still facing additional price declines, in a move that will strongly impact the Australian economy.

The Bloomberg Commodity also tells an interesting tale as the key metric fell to a 13 year low recently. The decline in the indicator has mirrored much of the slowing manufacturing activity occurring in mainland China. The index is watched closely by many as the harbinger of contraction within Australia and Canada and many now question whether the commodity dependent countries will experience recession in the early part of 2016.

The reality is that Canada, Australia, and New Zealand have hitched their respective economies to a burgeoning and expanding China. Their respective GDP diversities are limited and they therefore face the very real prospect of contraction within their economies in the medium term.

Ultimately, caution should be the order of the day when positioning for any potential long-side corrections within the commodity currencies. A significant demand slow down, coupled with the possibility of further accommodative monetary policy from their respective central banks, means that the currencies are likely to move in only one direction in the medium term…lower.