Market Brief

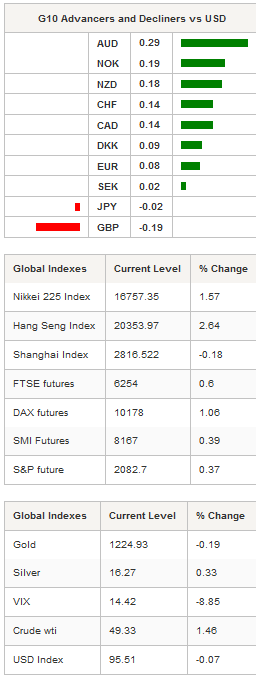

Crude oil extended gains in New York yesterday as an easing supply glut takes the front stage after months of oversupply worries. The US gauge, the West Texas intermediate, rose as high as $49.35 a barrel, while the international gauge, the Brent crude, tested the $49.26 threshold. We expect crude oil prices to continue to climb higher in response to months of almost no investment in oil and gas. It will take an extended period of time to return to normal, which would favour further crude oil strength.

In the FX market, the US dollar wiped out yesterday’s gains with the dollar index, falling 0.20% to 95.48 after hitting 95.78. Among the G10 complex, the Australian dollar rose the most against the US dollar, rising 0.30% and returning above the 0.72 threshold. Over the past few weeks, the Aussie suffered from a strengthening US, bolstered by increasing Fed rate hike expectations but also enhanced by the collapse of iron ore prices. Indeed, the most liquid future contracts on the Dalian commodity exchange are down more than 30% since the end of April as it slid from roughly 500 CNY/metric tons to 342 CNY/metric tons this morning. Further weakness of the Australian dollar cannot be ruled out as we anticipate iron ore prices to continue to adjust to the downside; however we also expect the greenback to reverse momentum as the market will start to price out a June rate hike, which would provide support to AUD/USD.

The New Zealand dollar, was also better bid after the country’s trade surplus surprised massively to the upside. Exports rose to NZ$4.30bn, beating expectations of NZ$4.08bn and previous month’s reading of NZ$4.20. Simultaneously, imports rose NZ$4.01bn versus NZ$3.98bn median forecast, unchanged compared to March’s data. All in all, the trade surplus printed at NZ$292mn versus NZ$25mn consensus, while the previous month’s reading was upwardly revised to NZ$189mn from NZ$117mn first estimate. NZD/USD surged 0.18% in Tokyo, hitting 0.6764.

EUR/USD remained under pressure as it failed to clearly reverse the negative momentum in spite of a dollar rally that is losing steam. The currency pair tested the 1.1144 support (low from March 24th) but was able to hold ground above it. We continue to expect the single currency to reverse momentum, especially against the USD, all the more so as the Eurozone finance minister and the IMF secured a deal on the Greek debt early this morning. It should therefore allow financial markets to spend a relaxing summer, free of Greek worries. The market will now focus on the Brexit story, however, according to the latest polls, a Brexit is almost off the table.

Currency Tech

EUR/USD

R 2: 1.1479

R 1: 1.1349

CURRENT: 1.1152

S 1: 1.1058

S 2: 1.0822

GBP/USD

R 2: 1.4770

R 1: 1.4663

CURRENT: 1.4604

S 1: 1.4404

S 2: 1.4300

USD/JPY

R 2: 111.91

R 1: 110.59

CURRENT: 109.89

S 1: 108.23

S 2: 106.25

USD/CHF

R 2: 1.0257

R 1: 1.0093

CURRENT: 0.9915

S 1: 0.9751

S 2: 0.9652