Traders are poring through the history books, looking for anything that will explain the latest thrashings in the commodity markets. Shockwaves have pulled back from their recent fever pitch, and, as volatility subsided, a new level of stability has finally settled market tensions. But uncertainties remain. An apparent bottom in commodity indices is forming, roughly 18% below previous high ranges, but the US dollar’s rise to prominence can only account for a third of the drop.

The issue now, of course, is what will happen next? Has the political unrest in Russia, the Ukraine, and the Middle East reached a crescendo, or is more “bad” in the offing? Have the growth engines in the West and in Asia failed to find a higher gear, despite an abundance of liquidity in capital markets? Will the fear of disinflation and falling prices result in another recession in the near term? These questions do not have easy answers, the reason why tight ranges, coupled with high volatility, are ruling the day.

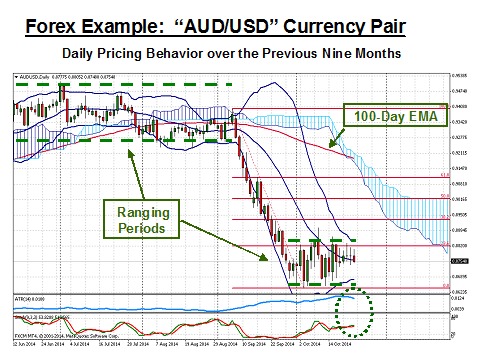

In the forex market, greater attention is being afforded the obvious commodity currencies – the AUD, NZD, and CAD (and some would include the NOK, as well). All of these have depreciated in a similar fashion versus “King Dollar” over the previous quarter, but the Aussie took the quickest hit in the shortest period of time, as shown below:

So go commodities, so go their currency cousins. But can we glean any insights from these chart details? The oscillating indicator rests at a midpoint, while volatility, as measured by the ATR, has peaked, but is still high. The upper border of resistance hovers about the 23.6% Fibonacci line, which is more an indication of weakness than anything else. This resistance is formidable, having been tested on three occasions with no success. The only solace can be found in the 100-Day EMA, which could draw the Aussie upwards, but the Kumo Cloud is not signaling any kind of reversal on the near-term horizon.

What are bank and forex analysts adding to the mix of opinions? Forecasts from three weeks back suggested that the Aussie might bounce back to 0.91 from its present level of 0.886, but, with the rowdy commotion in the commodity markets, consensus forecasts have been ratcheted back to the point that the AUD, NZD, and CAD would now end the year at or near their present values of 0.875, 0.781, and 1.123, respectively.

At least for the Asian currencies, analysts are clear on the fundamental causes, which number four at present, that could lead to more downside action:

1) The U.S. Fed will surely tighten liquidity by tapering and by raising interest rates, even if the timing is suspect;

2) The present low-interest environment has pushed a large portion of investor and institutional capital into high-risk, but low-liquidity instruments, setting the stage for a rush to safe havens;

3) China is a big question mark that could make the waters very murky;

4) Behind the scenes, the U.S. capital account has been improving, and, sooner or later, forex valuations will need to absorb this fact.

How good are these forex experts at predicting future valuations? An old Alan Greenspan quote, made back in 2004, is quite evocative on this topic:

“The inability to anticipate changes in supply and demand for a currency is at the root of the statistically robust finding that Forecasting exchange rates has a success rate no better than that of forecasting the outcome of a coin toss.”

Alan could have said that forex forecasting was a 50/50 proposition, but, in this case, the current pressure is decidedly downward.

Disclaimer: Trading Foreign Exchange on margin carries a high level of risk and may not be suitable for all investors. The possibility exists that you could lose more than your initial deposit. The high degree of leverage can work against you as well as for you.