Market Brief

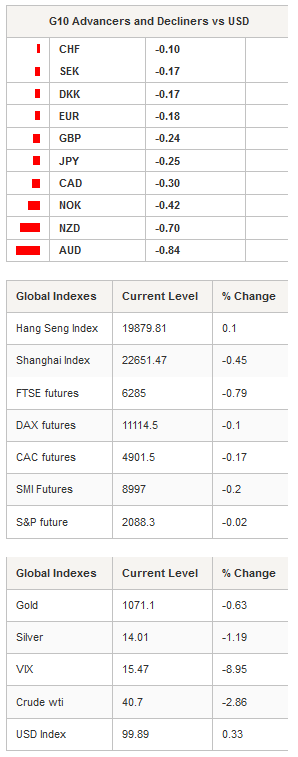

Commodity currencies were badly hit in the Asian session as they erased previous gains. The Australian dollar was the worst performer, with a drop of 0.80% from Friday’s close, as crude oil prices continue to slip further. In spite of a higher open, West Texas Intermediate was off 2.85% to 40.73 in Tokyo. WTI has been unable to break the strong support standing at around 39-40 dollar a barrel. Metals were also under heavy selling pressures with gold losing 0.65%, silver dropping 1.19% and platinum falling 0.50%, while palladium moved below $560, down 1.10%. AUD/USD found a strong support at 0.7150 and is now trading slightly higher at around 0.7170 as the US dollar is running out of steam. The dollar index is testing the key resistance lying at 100 (psychological threshold and April 13th high).

We believe that the dollar rally is coming to an end as traders finish to price in a December rate hike by the Federal Reserve. The probabilities extracted from the OIS swap rose to 64%, indicating that a lift-off before Christmas is likely. However, we think that the Fed’s final decision remained data dependent and that a solid reading of Wednesday’s PCE deflator would anchor a monetary policy tightening in 2015. A strong personal income reading would also be required. The market is expecting the latter to come in at 0.4%m/m (s.a.) in October, up from 0.1% in September, while the Fed’s favourite inflation gauge is expected to rise to 1.4%y/y from 1.3%y/y in the previous month.

EUR/USD continues to slide toward the next support standing at 1.0458 (low from March 16th). Nevertheless, a weaker support stands at 1.0521 and will likely slowdown temporarily the EUR’s fall. The single currency lost almost 8% since mid-October and is set to lose another 1.50% in the next few days.

In the equity market, regional bourses were mixed in Asia as Japanese markets were closed for holidays. In mainland China, equities were pairing losses across the board with the Shanghai and Shenzhen Composite down 0.56% and 0.76% respectively. Further south, the ASX and NZX were trading in positive territory in spite of a sump of most commodity prices. In Australia and New Zealand equities are up 0.39% and 1.15% respectively. In Europe, futures are pointing toward a lower open as most indices almost completely recovered from the late summer debasement. The FTSE 100 is down 0.79%, the DAX 0.10%, the CAC 40 0.17% and the SMI 0.20%. The broader Euro Stoxx 600 fell 0.26%.

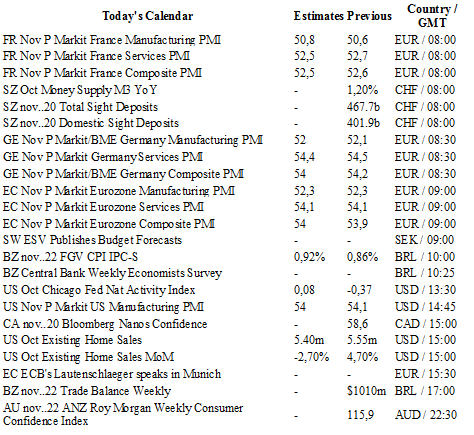

Today traders will be watching Markit PMI from Germany, Eurozone and the US; Chicago Fed Nat Activity index and existing home sales from the US; SNB sight deposits.

Currency Tech

EUR/USD

R 2: 1.1387

R 1: 1.1095

CURRENT: 1.0630

S 1: 1.0458

S 2: 1.0000

GBP/USD

R 2: 1.5659

R 1: 1.5529

CURRENT: 1.5162

S 1: 1.5027

S 2: 1.4566

USD/JPY

R 2: 135.15

R 1: 125.86

CURRENT: 123.11

S 1: 120.07

S 2: 118.07

USD/CHF

R 2: 1.0676

R 1: 1.0240

CURRENT: 1.0189

S 1: 0.9739

S 2: 0.9476