What started out as a slip from China ended in a rout through the commodity space yesterday. Fears over the state of the global economy combined with poor manufacturing data from the US, and a knee-jerk safe-haven reaction following the horrific scenes in Boston overnight, have left markets considerably lower than where they were this time yesterday.

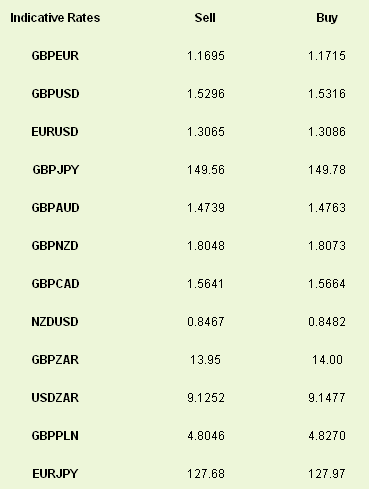

The big fallers yesterday started early following the poor Chinese news overnight. Growth slipped to 7.7% in Q1 against Q4’s number of 7.9%. The ensuing sell-off of all commodities (gold, silver, oil) saw currencies highly correlated with those commodities such as AUD, NZD, ZAR and CAD take a beating throughout the session. Likewise, the haven currencies of the JPY, CHF and USD all came better through the day’s trade. We have seen a fight back for these commodity currencies overnight as traders came in to scoop up markets on the cheap, but things are feeling a lot more skittish than they have in a fair while.

Sentiment is unlikely to be improved today with a sharp dip in German investor confidence due in today’s ZEW survey. Last month’s figure was a multi-year high as the market still remained ambivalent to the risk posed by Cyprus, Slovenia, the political vacuum in Italy and falls in German productivity – the market is looking for a sharp slip lower as investors became aware that the Eurozone remained the most broken area in world finance.

Inflation in the Eurozone should also be shown to be remaining below target for another month today as pressure increases on the ECB to do something – anything – to help the Eurozone economy. A speech from Mario Draghi yesterday emphasised however, that the ECH feels that it has done everything it can for now to help the region without political expedience first.

Inflation is also due from the UK today before tomorrow’s unemployment figures, Bank of England minutes and Thursday’s retail sales numbers. While the CPI release is expected to show no increase from last month’s 2.8%, the pressure definitely remains to the upside following reports of higher input prices in the latest manufacturing releases. The recent falls in oil may temper this in the long run however.

Data from the US is more than likely to increase pressure on the USD, especially if we see a continued pull higher for assets that were discarded in yesterday’s trade. Lower inflation is expected while industrial production should also show that the strength of the recovery remains very much in question.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Commodity Currencies Battered On China, Yield Issues

Published 04/16/2013, 06:16 AM

Updated 07/09/2023, 06:31 AM

Commodity Currencies Battered On China, Yield Issues

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.