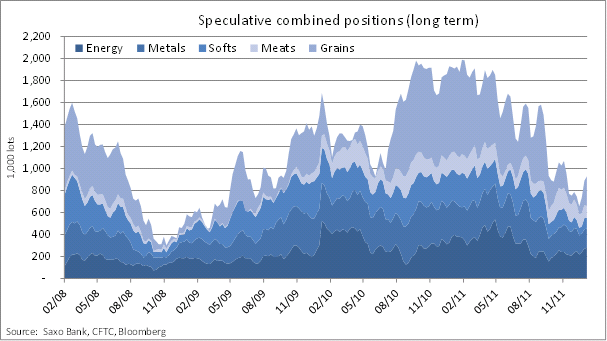

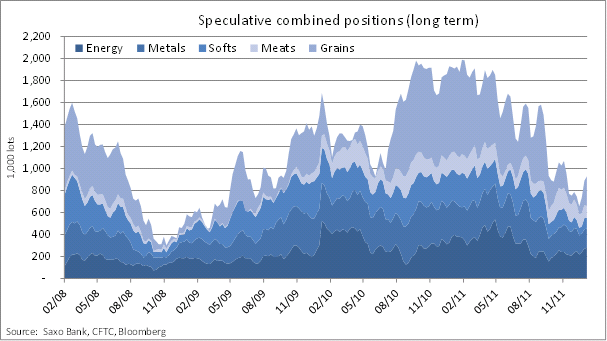

Speculators increased long positions to the highest level since November. Last week they expanded their net long position of futures and options by another 4.6 percent to 929,000 contracts. In nominal terms this was a USD 7.3 billion increase on the previous week. Since the low point reached just three weeks ago hedge funds have increased their long exposure to commodities by 42 percent and they only hold outright short positions in 6 out of the 24 contracts that we track.

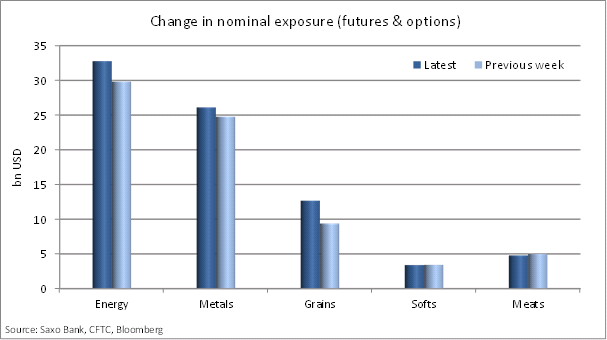

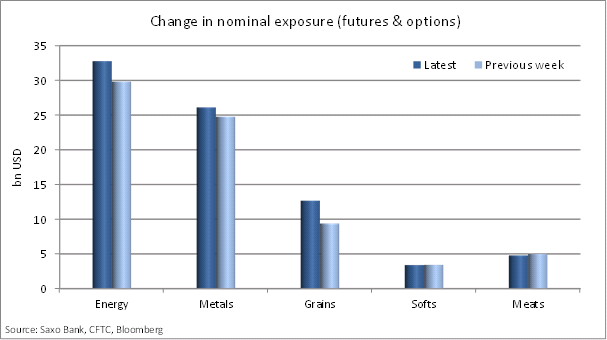

Three sectors: energy, metals and grains rose while softs and meats saw reductions.

The increase in net longs happened just ahead of the biggest three-day slide in almost a month leaving many licking their wounds. Especially the grain market which had seen speculators piling back in over the last three weeks, increasing positions almost four-fold, got caught out by the USDA report last Thursday. It surprisingly pointed towards much higher levels of production and inventories than had been expected after the drought in South America had raised worries about especially corn.

Energy exposure remains almost unchanged but hides a major move out of natural gas into crude oil. The chronic short position in natural gas more than doubled as the price slumped below 3 dollars with no end in sight while crude investors have added 20 percent with geopolitical concerns overriding fears of a slowdown.

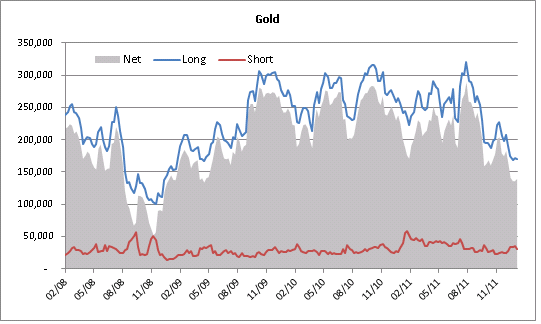

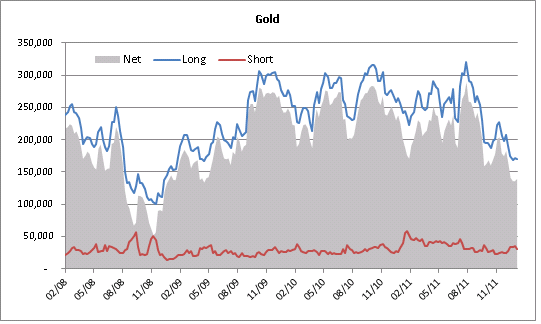

Gold investors are only hesitantly returning to gold, despite the better performance as of late. Last week they increased net longs by just 3 percent, the first rise in a month. Copper traders remain net short while platinum still looks exposed to the upside as the net long hides a major short position which could be forced to reduce should it continue its recent ascent.

The soft sector sector saw a small decrease in long positions as reductions in sugar, cocoa and coffee were only somewhat off-set by increases in orange juice and cotton.

Three sectors: energy, metals and grains rose while softs and meats saw reductions.

The increase in net longs happened just ahead of the biggest three-day slide in almost a month leaving many licking their wounds. Especially the grain market which had seen speculators piling back in over the last three weeks, increasing positions almost four-fold, got caught out by the USDA report last Thursday. It surprisingly pointed towards much higher levels of production and inventories than had been expected after the drought in South America had raised worries about especially corn.

Energy exposure remains almost unchanged but hides a major move out of natural gas into crude oil. The chronic short position in natural gas more than doubled as the price slumped below 3 dollars with no end in sight while crude investors have added 20 percent with geopolitical concerns overriding fears of a slowdown.

Gold investors are only hesitantly returning to gold, despite the better performance as of late. Last week they increased net longs by just 3 percent, the first rise in a month. Copper traders remain net short while platinum still looks exposed to the upside as the net long hides a major short position which could be forced to reduce should it continue its recent ascent.

The soft sector sector saw a small decrease in long positions as reductions in sugar, cocoa and coffee were only somewhat off-set by increases in orange juice and cotton.