The early half of this decade was looking quite grim for teen retailers. Companies including Abercrombie (NYSE:ANF) and American Eagle (NYSE:AEO) were seeing sharp declines in earnings as preferences were changing. Teens were no longer yearning for the same shirt as their peers, instead they were identifying with new fashion trends as they looked to individualize themselves. Logo centric apparel that Abercrombie and its peers had been churning out since the 90s had fallen by the wayside in favor of unique products. Traffic at malls, where these brands do most of its business, were also reaching all time lows with teens opting for different forms of entertainment.

However, all is not lost as teen retailers appear to be making a comeback. After parting ways with its founder and CEO in 2014, Abercrombie has ushered a new wave of change in the past two years. The company has moved away from its notoriously sexy image, to better position itself in the rapidly changing fashion industry. Abercrombie has been quick to restructure its stores away from the club like ambience of shirtless models and provocative ads for which they had become famous. These efforts have not only impacted its core business, but subsidiaries Hollister and Gilly Hicks as well. Abercrombie recently shut the doors on its Gilly Hicks business and is now pushing Hollister into the burgeoning fast fashion segment. The move into fast fashion should provide Abercrombie an edge over its competitors and also drive top line expansion.

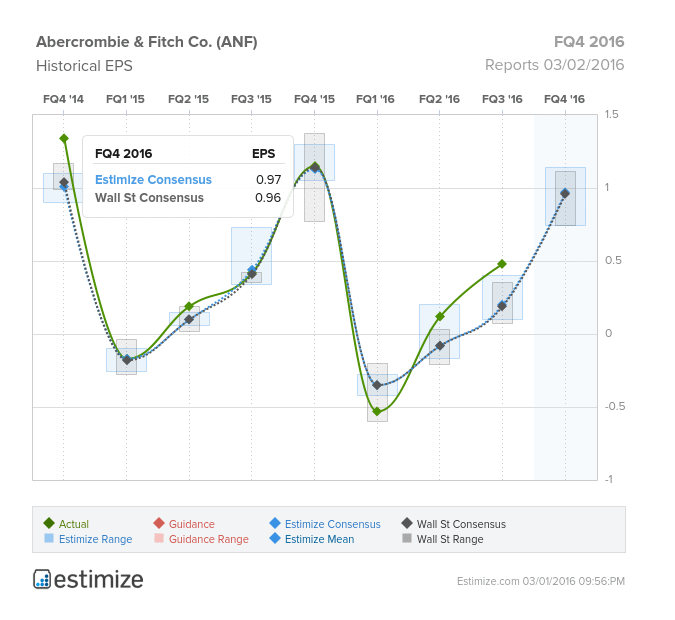

Early indications look as though Abercrombie is finally gaining traction. The company is coming off two consecutive quarters of positive earnings surprises with shares soaring 46% in the past 6 months. This quarter, the Estimize consensus is calling for EPS of $0.97 and revenue of $1.10 billion, 1 cent higher than Wall Street on the bottom line. Given the weak holiday season, profitability looks as if it will fall short on Wednesday, projected to decline 15% on a YoY basis. That said, the apparel retailer has consistently beat on earnings, eclipsing the Estimize consensus 60% of the time while beating Wall Street 80% of the time.

American Eagle, on the other hand, has been the biggest success story in this category. The company had been one of the earliest adopters of the new age in fashion, turning around its core business to profitability in two years. Last quarter, American Eagle reported a 9% increase in comparable store sales, with gains across both the American Eagle and Aerie brands. The biggest changes American Eagle have made include improving the quality of its products, keeping a leaner inventory and pushing its popular Aerie brand. By keeping inventory at a manageable level, the retailer has been able to reduce the amount of markdowns its offers and vastly improve profit margins.

In contrast to Abercrombie’s checkered past, American Eagle has had some PR wins as of late. It’s Aerie brand has teamed up with the National Eating Disorders Associations to help promote positive body images. The lingerie brand features women of all shapes and sizes with the hope it will remove the stigma of being too curvy. The campaign has helped propel sales in recent months, further setting it apart from its competition.

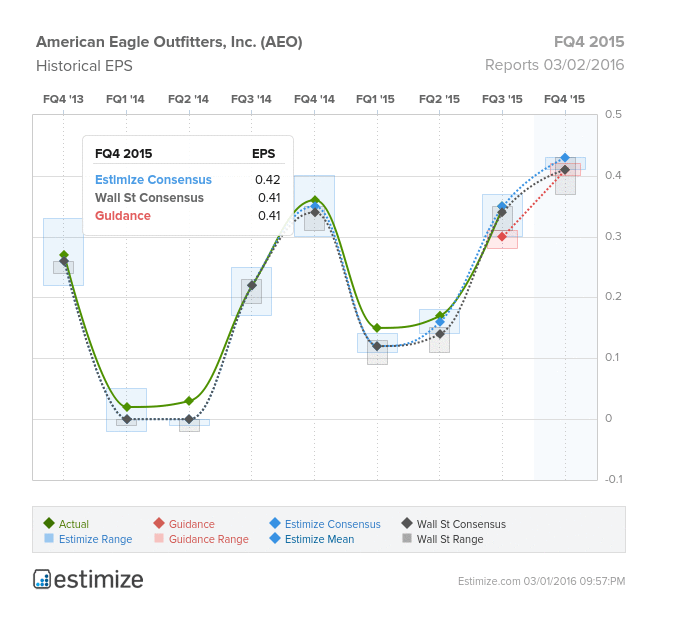

The Estimize community has been optimistic in regards to American Eagle, calling for EPS of $0.42 and revenue expectations of $1.11 billion, 1 cent higher than Wall Street on the bottom line. However our Select Consensus, which more heavily weights historically accurate analysts and recent estimates, is expecting a larger beat by 2 cents. Compared to the same period last year, this predicts as an 18% gain in earnings while sales are expected to grow 4%. On average American Eagle has consistently beat expectations, trumping the Estimize community in 92% of earnings reports.

That being said, neither label is in the clear yet. Both Abercrombie and American Eagle continue to lose market share to the rapidly emerging fast fashion brands like H&M and Forever 21. These brands have become popular with teens for their fashion forward styles at value prices. A branded polo at Abercrombie, its flagships product, will set you back $50 while a similar style at H&M retails between $15 and $20. Despite more modest pricing from the teen retailers in recent years, they still have trouble positioning themselves against discount and fast fashion retailers.

Not everyone has fared as well as Abercrombie and American Eagle. Aeropostale (NYSE:ARO), the lowest priced of the three companies, continues to be plagued by its failing strategy. Instead of trying to keep pace with fashion trends, the company remains focused on providing teens with a uniform of basic clothing. So far, this strategy has failed Aeropostale as it continues to post declining comparable sales and announced they would be laying off 13% of their corporate employees.

While Abercrombie and American Eagle have made progress matching teens’ preferences, they will have to continue to adapt as to not lose any more ground to the fast fashion industry.