For months we were in a Bizaro World where good news was great, bad news was pretty good, and horrible news was great because the Fed wouldn't take away the constant liquidity flow.

Fundamentals haven't mattered for a long time (because they have been generally horrible with the exception of Housing data for the past six months -- especially in Europe and China).

Well with the assistance of all sorts of automobile analogies (foot on gas, coasting, braking, etc) Bernanke made algos, money managers, and yield chasers everywhere hit the sell button around 1pm Chicago time yesterday. They are still hitting the same button.

The Energies had been the leader in the Commodity complex, but after trading just north of $99 yesterday, WTI is down to $95.50. Gasoline is off by over 3% today and 12 cents off last week's highs. The Metals are in full on liquidation mode. Gold and Silver made new lows. Copper, Platinum, and Palladium at right at recent lows. Down between 3 and 8%.

The last time Silver was below $20 was early September of 2010. Bernanke had hinted at QE2 a week earlier at Jackson Hole and Silver was on it's way up to nearly $50.

I've been wrong in Silver. Just wrong and I do believe at some point it's going the find a 2002-2003 like "value", it's very difficult to see things clearly after a 43% selloff since early October. The Bond market, particularly the short end of the curve has been the petri dish for Bernanke (and Central Bankers everywhere). Yesterday the percentage move in the US five-year note was (I believe) the biggest on record.

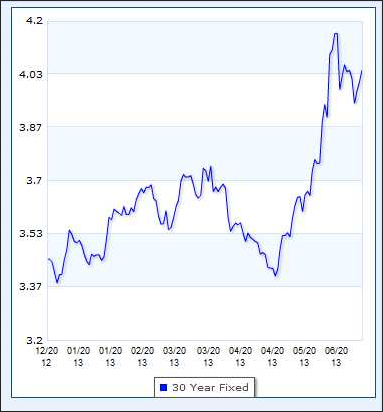

The last FOMC meeting was 5/1 and a 30-year mortgage was around 3.4%. Tomorrow when Fannie Mae releases the updated rate, it will probably be between 4.3 and 4.4%. I feel for somebody that decided NOT to lock a rate on a new home about six weeks ago. The American Dream just got a WHOLE LOT more expensive every month.

Example, borrow 250k with good credit and 20% down six weeks ago. Your monthly payments would be around $1425/month.

Given the move in rates, the same loan would run you about $1575/month. That's 10% more per month for 30 years.

This chart does NOT reflect this weeks collapse in the Bonds (increase in yield).

48 hours ago the RUT was 1000, The S&Ps were 1655, and the DJIA was 15,300. Risk gets repriced quickly......and if Commodities are any indication - the future doesn't look so bright.

There is a QUARTERLY EXPIRATION tomorrow morning. The SPX is BELOW the 50 day moving average again, which has pretty much held since December of 2012 (with a little wiggle room). We're testing the 6/6 lows.

The VIX (cash) is just over 19, and higher than it's been at any point since the end of year "Fiscal Cliff" fears. Last summer during the washout the cash VIX traded up to 20.50 right before the Draghi "Whatever It Takes" speech.

Watch the term structure in the VIX. It's not inverted YET, but if it does, you might find a tradable bottom (for short termers).

Also, watch China.

Commodities "topped" in Feb when the Shanghai Composite traded to highs. They are on lows today as China flirts with 52-week lows (130 points lower). They are dealing with a serious liquidity crisis and the Peoples Bank of China has not responded authoritatively.

Quad Witching Tomorrow

Gasoline, Heating Oil, Natural Gas, Gold, Silver, Copper options expire this coming Tuesday.

Hold on to your hats. Bernanke is driving the cab and he doesn't know whether to push the gas, leave it in neutral or brake.

Consider SELLING July VIX v. BUYING AUG VIX futures if it goes EVEN to INVERTED. Currently 35 cents away ($350/spread). Also........You could give a look at Platinum long around 1385 (PLV13) with TIGHT STOP.

and Platinum

Risk Disclaimer: This information is not to be construed as an offer to sell or a solicitation or an offer to buy the commodities and/ or financial products herein named. The factual information of this report has been obtained from sources believed to be reliable, but is not necessarily all-inclusive and is not guaranteed to be accurate. You should fully understand the risks associated with trading futures, options and retail off-exchange foreign currency transactions (“Forex”) before making any trades. Trading futures, options, and Forex involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more than your initial investment. Opinions, market data, and recommendations are subject to change without notice. Past performance is not necessarily indicative of future results. This report contains research as defined in applicable CFTC regulations. Both RCM Asset Management and the research analyst may have positions in the financial products discussed.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Commodities: Is It A Global Liquidation?

Published 06/20/2013, 11:13 AM

Updated 07/09/2023, 06:31 AM

Commodities: Is It A Global Liquidation?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.