Commodities seem to have found a support level after a massive selloff recently. The CRB index recently broke through the previous support, correcting back to the levels of the early days of QE2. Have we now stabilized?

This stabilization in the past few days seems to be driven by stories of a potential coordinated central bank action that will supposedly provide liquidity after the Greek election this weekend. Given the global slowdown, central banks seem to be the only source of support for risk assets, as global addiction to stimulus continues.

Reuters: - European Central Bank President Mario Draghi said on Friday the bank was ready to support euro zone banks, should it be required, while Bank of Japan Governor Masaaki Shirakawa said central banks can offer liquidity to calm markets in case the weekend Greek elections heighten tension.

Short-Lived Fix

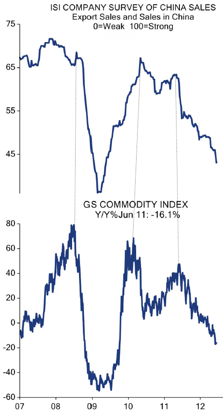

But we've seen this movie before. A new action from central banks, even a coordinated one, is not expected to last long. As soon as stimulus stops, risk assets (such as commodities) begin to correct (unless another stimulus action is anticipated). Ultimately any lasting strength in the commodities markets will have to come from emerging markets growth -- particularly from China. The chart below from the ISI Group shows how strong the relationship between China's corporate sales and global commodity valuations has been.

If China experiences a "hard landing", it would be hard to imagine that the ECB, the Fed, and the BoJ can really do anything to prop up risk assets. And although analysts are not yet predicting such a sharp slowdown, even the expectations from within China have not been great:

Reuters: - China's annual economic growth could drop below 7% in the second quarter, an influential government adviser said in published remarks on Wednesday, the most pessimistic forecast of any government or private-sector economist.

Sub-7% growth would reflect the pace of the economy during the global financial crisis. China reported economic growth of just 6.6% in the first quarter of 2009. Ultimately to understand the longer term trend in the commodity markets, one needs to pay far more attention to China than to central banks.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Commodities Will Be Driven By China, Not Central Banks

Published 06/15/2012, 03:04 PM

Updated 07/09/2023, 06:31 AM

Commodities Will Be Driven By China, Not Central Banks

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.