Commodities have been mired in a bear market since 2011 and continued to lose ground in 2013. But bear markets don’t last forever and commodities will eventually enter into another bull market. Many have given up on the commodity secular bull market that began around the year 2000. They have been seduced especially by recent stock market gains in 2013 and given up on commodities since they have sustained losses for multiple years. This is natural human behavior to chase winners and give up on losers.

The commodity sector is something to monitor though in 2014 since it will be a 3-year old bear market for many commodities. Bear markets typically don’t last for longer than 2 or 3 years. The continuous commodity index also looks to still be in a structural bull market even though commodities have pulled back for a few years.

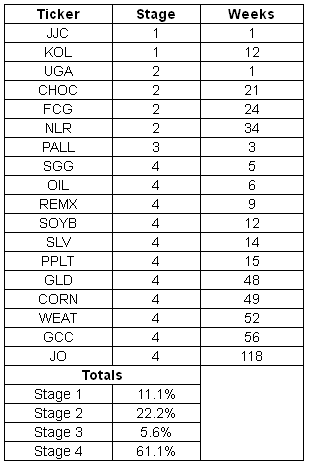

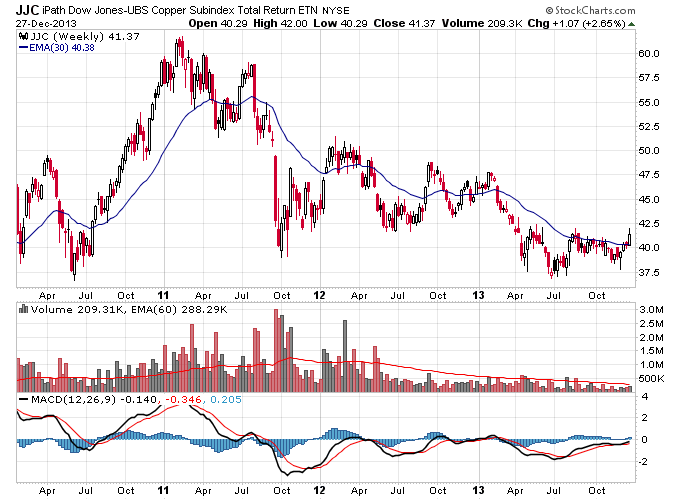

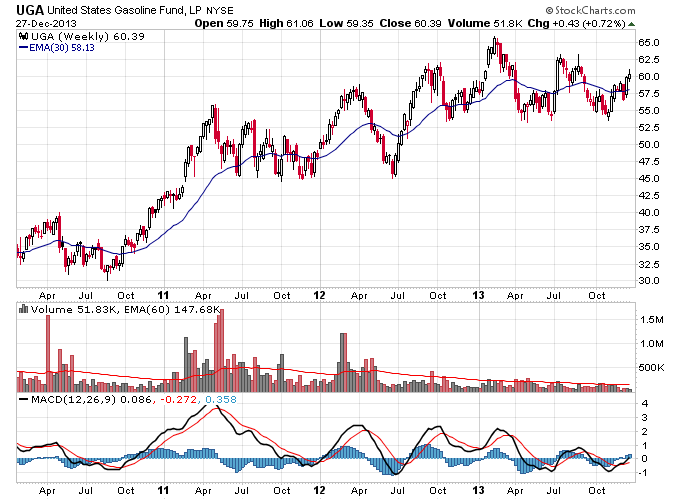

The following table below shows the Stage Analysis for different commodities and gives a depiction of the current state of the market. Note that Natural Gas and Nuclear are the two markets that are moving strongly higher in the commodities space. Grains and Coffee are the weakest markets as they have been in a bear downtrend for a long time. Copper is looking interesting as it just transitioned into a Stage 1 base. Gasoline just transitioned into a Stage 2 uptrend. The chart of oil is also not far from moving into a possible new uptrend with some more gains.

The base copper has formed in 2013 is very tight and is the type of base that could power copper back into an uptrend. This would bode well for the commodities sector and might pave the way for other commodities to end their bear markets.

Stage Analysis

Stage Transitions

JJC transitioned from Stage 4 to Stage 1

UGA transitioned from Stage 1 to Stage 2

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Commodities Weekly Report: Commodity Market Should Be Monitored In 2014

Published 12/29/2013, 05:18 AM

Updated 07/09/2023, 06:31 AM

Commodities Weekly Report: Commodity Market Should Be Monitored In 2014

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.