- Taking stock of the latest euro area macro data signals, we conclude that investors should brace themselves for more negative economic surprises in coming weeks.

- We expect GDP growth in Q2 to fall back to 0.2% q/q, as exports and investments are prone for a correction, while PMIs should be in for another round of declines in Q3. This should support the ECB's narrative that further stimulus is warranted.

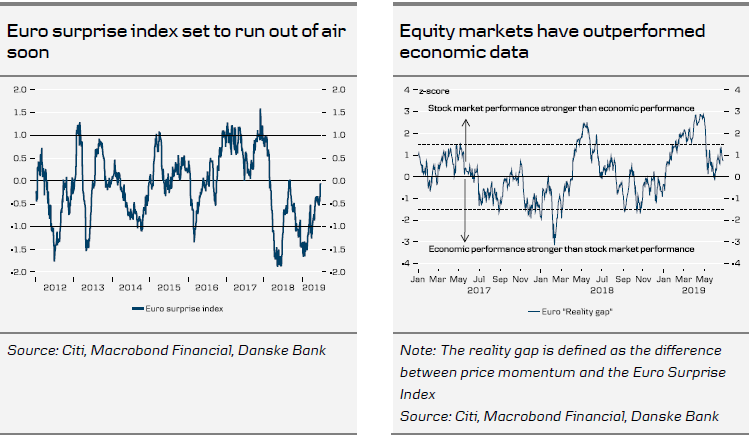

The past few months have seen a steady rise in the euro area surprise index in an environment where expectations were at very depressed levels and central banks stepped into the game by signalling further easing ahead. This begs the question of whether this recent uptrend can be sustained or whether markets are in for an ugly surprise from the hard economic data for Q2.

As the ECB gets ready to prop up the economy with another easing package – possibly in coming weeks (read our take in ECB Research – New ECB call – rate cut and restart of QE, 18 June, here) – economic data shifts back into the limelight as the key determinant of how decisively and timely central bankers will act. Taking stock of the latest euro area macro data signals, we conclude that Q2 will be soft, supporting the ECB’s narrative that further stimulus is warranted.

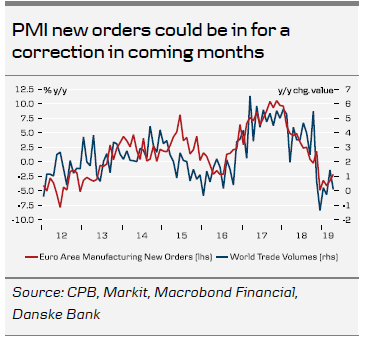

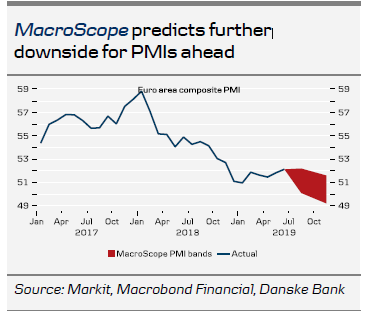

An important factor behind the latest uptick in the euro surprise index has been the seemingly bottoming out of PMIs that has defied analysts’ expectations of a further fall in light of the re-escalating trade war. The latest improvement in the PMI new orders component has coincided with a slight rebound in global trade volumes. As the latter has already started to fall back – and will probably do so even more once the full brunt of the tariff hikes is reflected in the data – we expect manufacturing PMIs to be in for another round of declines in the coming months. This message is also borne out in our quantitative business cycle model MacroScope, which predicts further downside in euro area PMIs ahead.

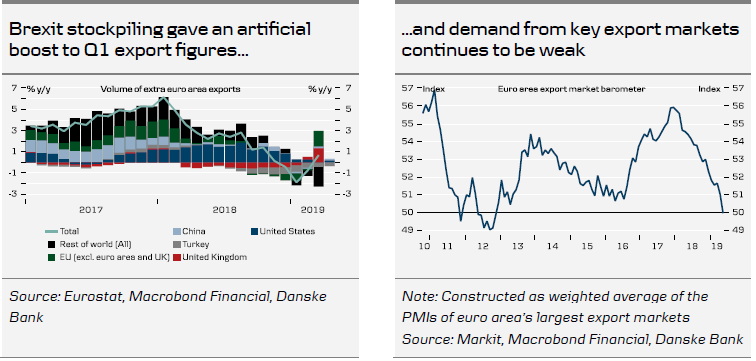

While further declines in PMIs should be one factor driving down the surprise index in coming months, another one looms from the reality gap that has opened up between hard and soft data in Q1. At the start of the year, growth rebounded strongly in the euro area to 0.4% q/q but we doubt that the economy can hold on to its momentum in Q2. Exports and investments, in particular, are likely to be in for a correction. Monthly export data for April already showed a big fall, as the Brexit stockpiling from March reversed and, judging from our export market barometer below, things are not pointing to an improvement anytime soon.

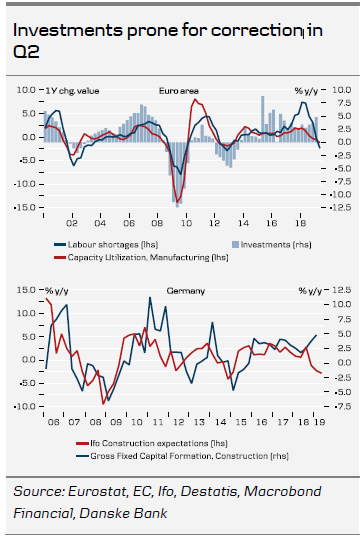

Euro area investments grew strongly in Q1, by 1.1% q/q, but again looking at the decline in manufacturing sentiment and capacity utilisatio, and with issues about labour shortages waning, a correction should be in store for Q2. Buoyant construction investment in Germany has been a key driver and the recent decline in Ifo expectations for the construction sector signals a fall back in Q2.

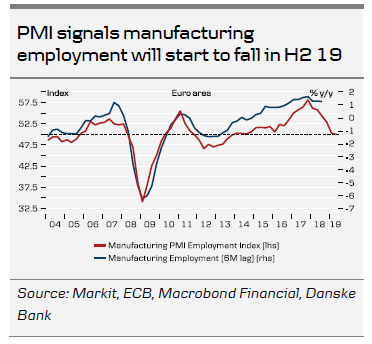

In many ways Germany still holds the key to the near-term euro area outlook and in that light it is concerning that some vulnerabilities have started to show of late, especially in the labour market. Both Ifo and PMI employment expectations have fallen across sectors (though most pronounced in manufacturing) and now signal that manufacturing employment growth will start to go into reverse in H2 19 – a message that also holds for the euro area as a whole.

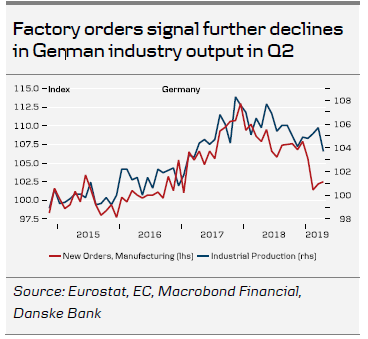

The struggling German manufacturing sector continues to be at the epicentre of the slowdown, as we also discussed in Germany – In the crosswinds of trade war, 14 June. In this light, a surprising divergence between manufacturing order levels and actual production opened up in Q1. It looks as though this will start to correct in Q2 and in April German industrial production fell by 1.9% m/m. Still, there remains a gap to close, so we think markets should brace themselves for further negative surprises from the May and June industrial figures. Indeed, at the current stage it looks likely that industry will return as a drag on euro area growth in Q2.

Overall, not all is doom and gloom yet. Households still find themselves in a benign environment of rising real wage growth, reflected in the still-high willingness to spend expressed in consumer surveys. We do not think the euro area is heading for recession any time soon and expect Q2 growth to tick in at 0.2% q/q (see also Euro Area - At inflection point, 14 June. However, it may be a good time for investors to take a closer look at the data and ask whether a rude awakening is looming in coming weeks and months once real economic data starts to turn the corner.