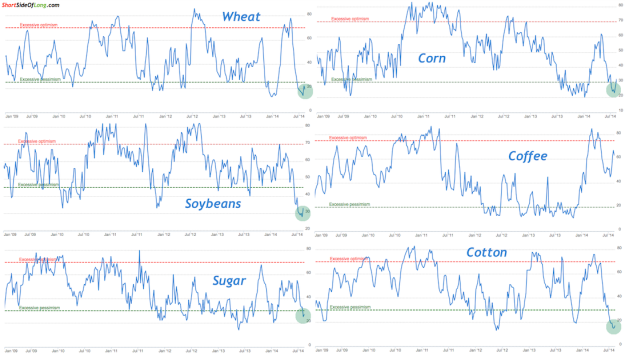

Chart 1: Agricultural Index has become extremely oversold as of late

Source: Short Side of Long

Agricultural prices have been bashed, smashed and trashed very hard over the last several months. It is probably the worst performing sub-sector of the overall macro space. During the last few weeks we have covered these conditions and focused on oversold Grain prices as well as battered Cotton. Now we look at the overall complex as a whole, as it continues to suffer and moves toward new 52 week lows.

Quite a few readers have been asking for a new update in this sector. From the price perspective, there isn’t much to say right now that hasn’t already been said before. The key in buying a bottom is to let the selling pressure exhaust itself. We are definitely coming closer to that point. I have not purchased any new agricultural positions just yet, but I am getting ready to do so soon enough.

As I was reviewing sentiment charts from SentimenTrader, I noticed that 5 out of the 6 major agri-commodities are hated right now. And the one that's not hated, (Coffee) already doubled earlier in the year. Last time we had a majority of ags on pessimistic sentiment was in late December and during January, after which the Rogers International Commodity Agriculture ETF (NYSE:RJA) rallied 16% in three months. However, this time around, instead of an intermediate bottom, there is a possibility that we could be at a final bear market low.