It's another day of sideways action in the Comex PMs...which is both good and bad, I suppose. However and as we keep repeating, every day that Comex Digital Gold remains above $1550 is another step toward $1600 and, above there, things will get pretty interesting.

And why is that? Because you know all about the significance of $1550 and closing above there on a weekly basis. We've now done this three weeks in a row but the last two have come with slightly red weekly candles, so any amateur chart-reader can see that there has been a lack of follow-through. What we need is to remain in this $1550 area long enough that it becomes "the new normal," sort of like how we described $1500 late last year. Or think of it this way: any drop now to $1500 will seem like a bargain and not a top. Thus, over time, $1550 soon becomes that way, too. And then eventually the buying momentum appears again and it drives price on its next leg higher and toward $1600.

So, anyway, greetings from Vancouver where I was asked to speak at the annual AME Roundup show. The weather here blows and I likely won't get many new subscribers from my appearance. So why am I here? I knew I was going to be on the west coast last weekend anyway and, more importantly, MrsF wanted to tag along as she's been all over the world but never to Vancouver.

My presentation yesterday was explanation of why prices are headed higher in 2020 and how The Banks are screwing you every step of the way. To a room full of 250 rock-breaking geologists, I might as well have been speaking Latin. But, whatever. The food here is great and it's not snowing like it is back home.

As mentioned in yesterday's podcast, I've promised this day to MrsF so there will not be time for a podcast this afternoon. We fly home tomorrow so there won't be a podcast then, either. Good Lord willing, we'll be back to the regular schedule on Friday.

In the meantime, there's not much news today. The economic datapoints were minor. Existing home sales soared for some reason but "national economic activity" continues to decline. Check the chart below:

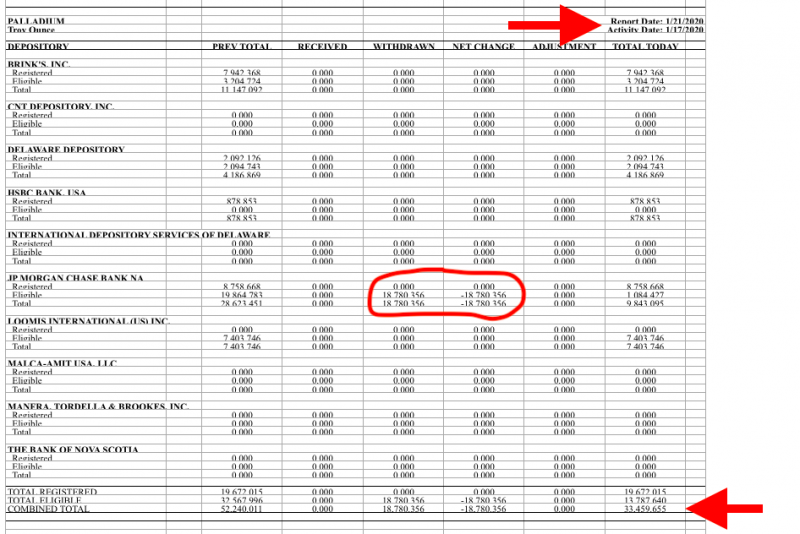

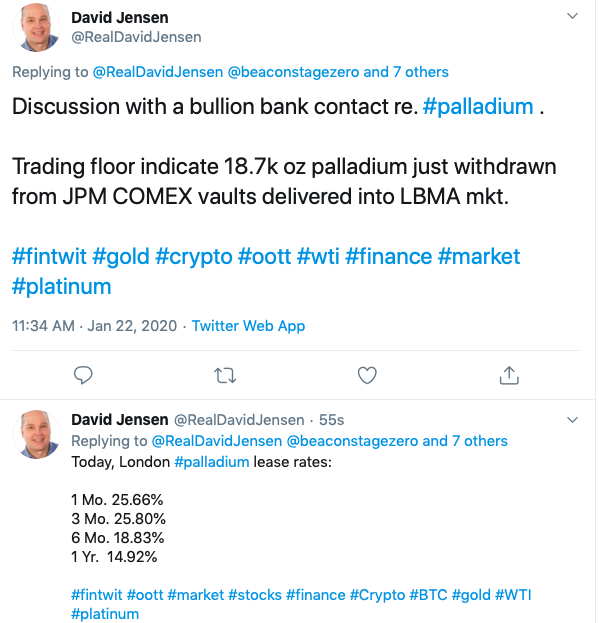

Platinum and palladium are both bouncing back today. I hope that you saw this next bit of info yesterday as I believe it to be significant news. Either JPM or one of their clients has hastily withdrawn over 18,000 ounces of palladium that had been stored in JPM's Comex palladium vault. If you've been following along with me for the past two years, then you know that there have been VERY FEW vault movements in palladium. Nothing like the daily shifts we see in gold and silver.

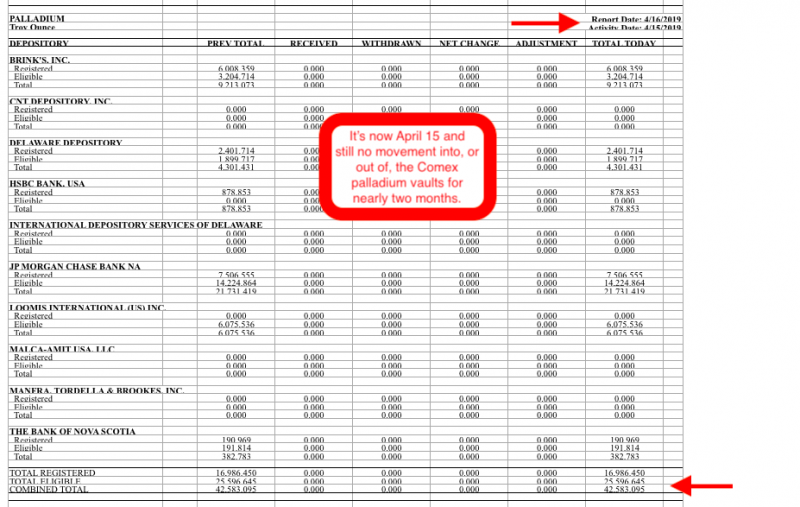

Here's a daily vault stock report from last April where I'd noted that NOTHING had changed in over two months.

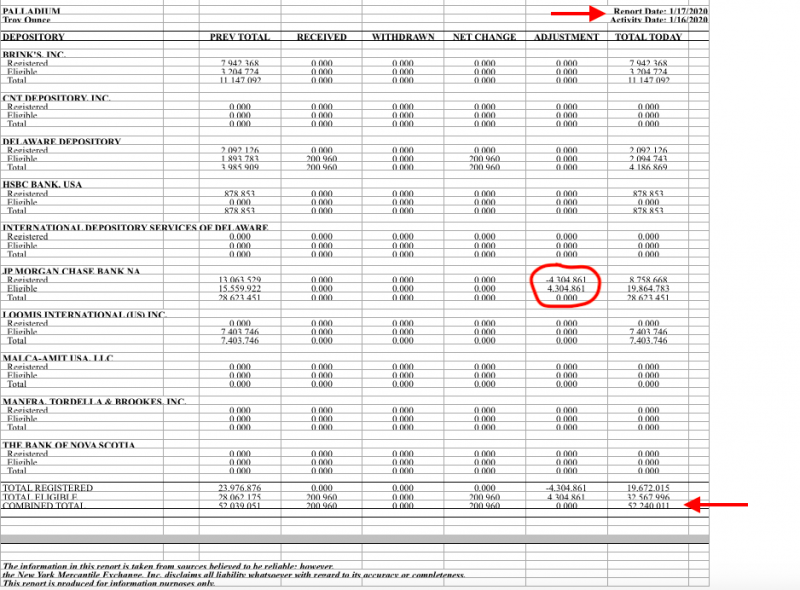

And here's the one from last week where I caught the sudden shift of over 4,000 ounces from registered (readily available for delivery) to eligible.

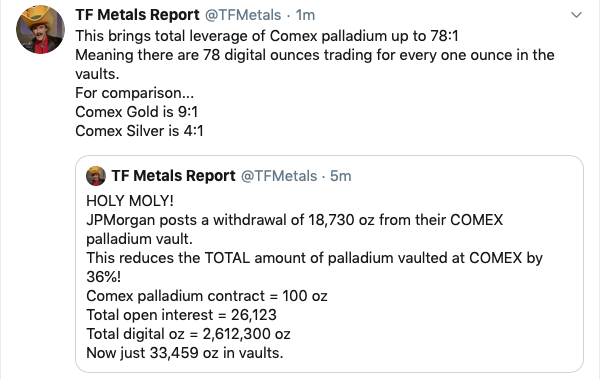

So when the total amount of physical palladium that supposedly backs the exchange falls by 36% in one day, I'd say that's a pretty significant development. Someone – either JPM or a client – did NOT want to take the chance of getting their palladium snatched away in this squeeze. So they first removed the registered tag and then removed the metal. The only question is, will this palladium be used to settle some accounts across the pond where the shortage is? I guess we'll know soon enough by watching the lease rates.

I've not seen the lease rates from David Jensen today but I assume they're back up and remaining extreme as prices have bounced back from yesterday's drop. On the six month chart below, note the frequent and sharp 5-10% corrections that all preceded higher prices. Here we are again.

And just now in checking Twitter, look what I found. David reported the lease rates AND posted that the 18,000 ounces were indeed JPM's and that they were shipped to London as a sort of emergency physical supply. Interesting times, indeed!

So we'll see where this all heads from here. The vault stock reports are released daily at 3:30 ET. If you want to check for yourself later today, you can do so here.

I'll be checking in from time to time today as I make my way around Vancouver. In the meantime, I see that CDG, CDS and the shares are all mostly UNCH so I guess it's a good day to take the afternoon off.